Post the Establish Ethereum ETFs launch, the ETH mark has persevered to wrestle at this time, proving that the launch of the Establish ETFs had been a ‘promote the info’ occasion. To this level, the 2nd-biggest cryptocurrency by market cap has misplaced spherical 10% of its cost for the reason that Establish Ethereum ETFs procuring and selling began on Tuesday, July 23, and may perhaps well look for added decline from right here, essentially based on an analysis from Matrixport.

Establish Ethereum ETFs Triggers Selling

Following the launch of the Establish Ethereum ETFs, there used to be rather about a excitement available in the market, in particular across the incontrovertible reality that merchants may perhaps well now carry out exposure to ETH without having to straight purchase the underlying token. Nonetheless, this excitement has been short-lived as days after the launch, the ETH mark continues to wrestle.

In a file released on Thursday, Markus Thielen, Head of Research at Matrixport, outlined a range of reasons why the ETH mark used to be declining. As Thielen explains, whereas the inflows crossed $100 million on the first day, the Grayscale Ethereum fund had been suffering outflows.

Simply like with the Establish Bitcoin ETFs launch, the Grayscale ETH fund, which holds spherical $9 billion in ETH, began recording outflows. Right here is thanks to the incontrovertible reality that Grayscale’s management expenses remain high with opponents offering expenses as low as 0.19%. On the first day alone, $481 million flowed out of the fund, and $326 million adopted tomorrow to come.

To boot to this, the Mt. Gox distributions began across the time of the Establish Ethereum ETFs launch, so this even moreover effect extra selling stress on the crypto market. Simply because the Bitcoin mark did with the Establish Bitcoin ETFs, the ETH mark has responded negatively to those outflows, main to a mark decline beneath $4,200.

Will The ETH Designate Bag better From Right here?

Outflows from the Grayscale ETH fund for the reason that launch of the Establish Ethereum ETFs had been one among the most most important factors utilizing the ETH mark decline. Nonetheless, it is no longer the finest bearish construction that has emerged for the cryptocurrency.

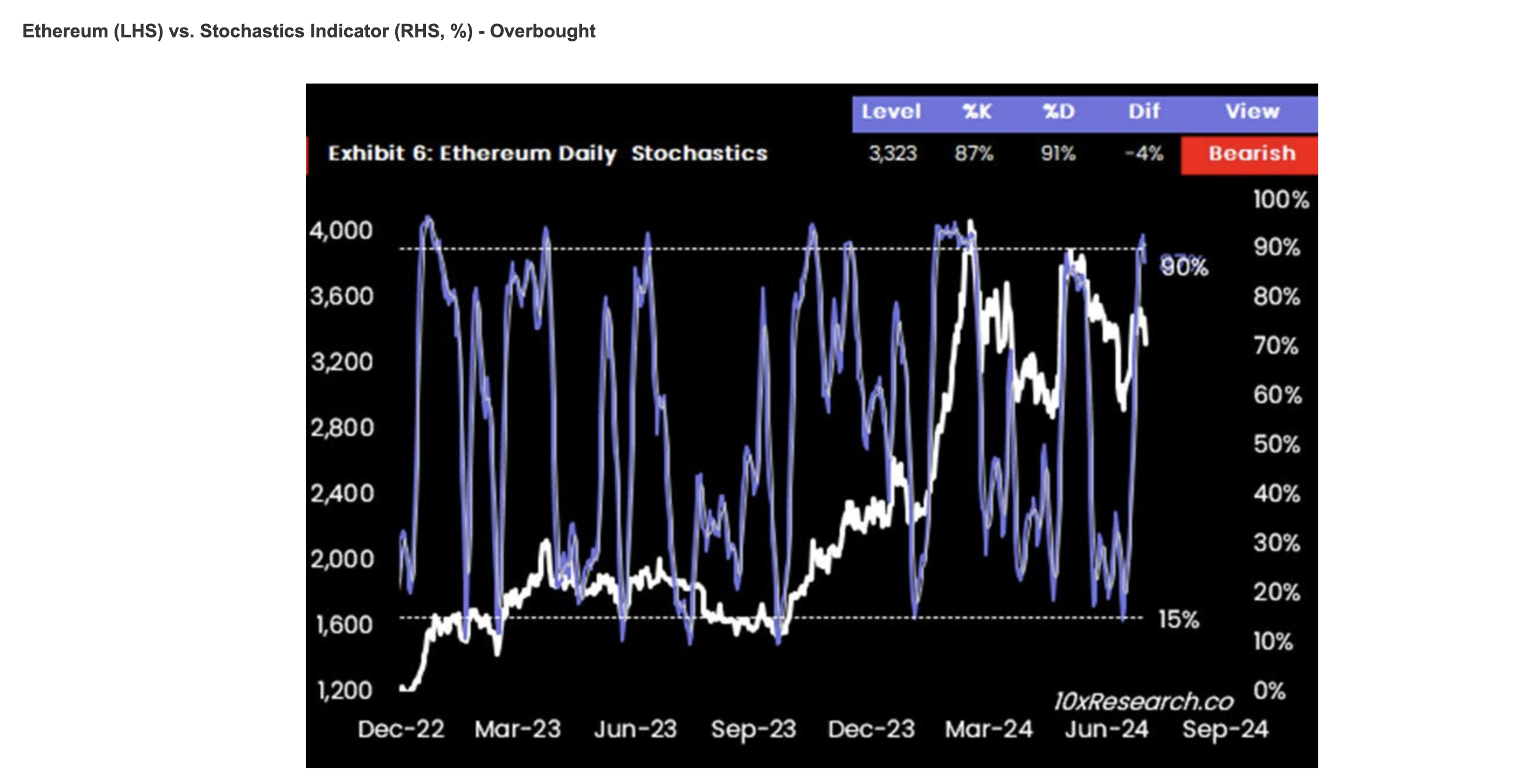

Thielen aspects out that the ETH mark will have reached the end, utilizing the day-to-day stochastics indicator as a handbook. Now, when the mark of this indicator is low, it continuously potential a procuring opportunity and the mark is hitting a low. Meanwhile, the associated fee being high suggests that the ETH mark will have hit its top.

In step with the file, the ETH mark had hit a rating of 92% in the days main as much as the Establish Ethereum ETFs launch. Most regularly, a rating above 90% is bearish for the mark as it potential the cryptocurrency is currently in overbought territory. Due to this reality, the mark of the stochastic indicator is anticipated to articulate no as merchants offload their holdings.

To this level, there had been a 5% decline from 92% to 87%, suggesting that there may perhaps be soundless a actually perfect distance to transfer sooner than the ETH mark stops bleeding. “Taking into account the unique rally and the likely overhang from Mt. Gox, the US earnings season, and the light seasonals for August and September, it should always also glean sense to press the Ethereum short a piece of longer,” Markus Thielen acknowledged in closing.