XRP is gaining momentum once extra, hiking nearly 6% in the previous week and pushing its market cap back above $130 billion for the first time since March 27.

The altcoin’s RSI has entered overbought territory for the first time in over a month, its Ichimoku Cloud setup stays bullish, and its EMA strains get fashioned consecutive golden crosses. With merchants eyeing each breakout targets and key relieve zones, XRP enters a pivotal second that could well account for its next significant switch.

XRP Enters Overbought Zone for First Time Since March

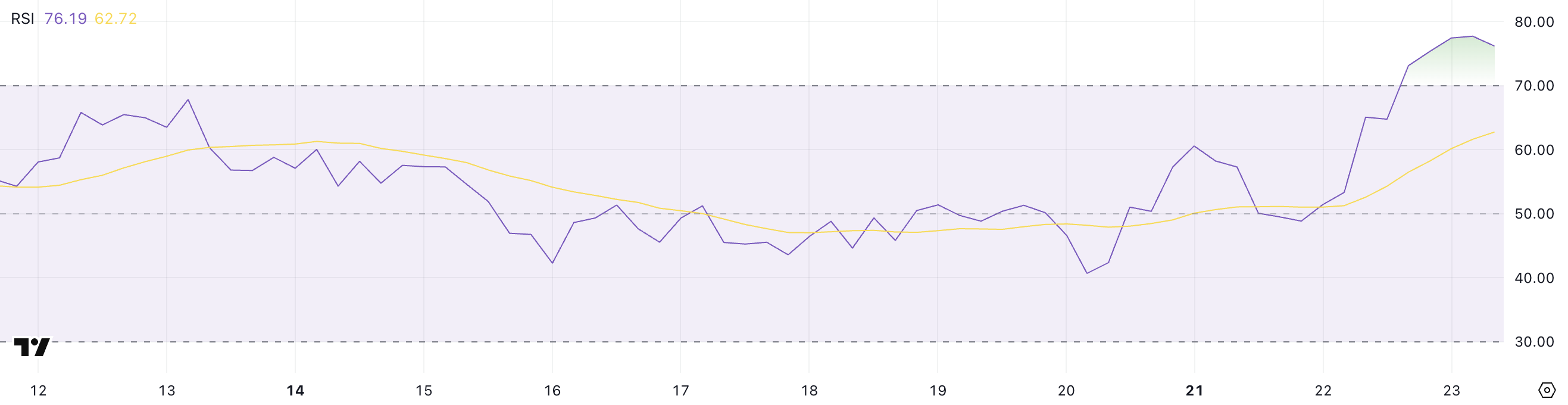

XRP’s Relative Energy Index (RSI) has surged to 76.19, hiking above the 70 threshold for the first time since March 19 — over a month in the past.

Factual the day earlier than at the novel time, its RSI changed into at 51.4, signaling a though-provoking expand in purchasing momentum within a transient period.

This jump means that XRP is entering an overbought zone, a stage the put apart imprint action most frequently begins to tiresome or reverse, reckoning on broader market sentiment.

RSI is a momentum indicator that ranges from 0 to 100 and helps merchants assess whether or not an asset is overbought or oversold. A discovering out above 70 in general indicators overbought prerequisites, suggesting that the asset could well well impartial be due for a pullback.

A discovering out below 30, on the opposite hand, indicators oversold prerequisites and attainable for a jump. With XRP now at 76.19, merchants could well well impartial initiate to see for signs of weakening momentum or consolidation. No topic that, some analysts claim XRP market cap could well quickly surpass Ethereum’s.

On the opposite hand, stable upward RSI strikes can moreover mark the originate of a breakout if supported by volume and broader bullish sentiment.

Ichimoku Signals Align for XRP as Cloud Turns Bullish

XRP’s Ichimoku Cloud stays in a bullish configuration, with the worth clearly positioned above the Kumo (cloud), fashioned by the Senkou Span A (green line) and Senkou Span B (pink line).

This signifies a continuation of upward momentum, though the golf green cloud ahead is narrower than sooner than, suggesting that bullish conviction could well well impartial not be as stable as in earlier phases of the trend.

Serene, being above the cloud in general favors consumers in the short term.

The Tenkan-sen (blue line) is above the Kijun-sen (pink line), signaling non everlasting bullish momentum thru a definite crossover.

In the meantime, the Chikou Span (green lagging line) is nicely above the cloud, confirming that recent momentum is supported by previous imprint energy.

On the opposite hand, the thinner cloud ahead requires some warning — while the trend stays bullish, a weaker cloud can suggest diminished relieve if the worth turns.

For now, XRP has a definite technical structure, however merchants will computer screen for any signs of weak point.

XRP Builds Momentum on Golden Crosses—Reversal or Rally?

XRP’s exponential absorbing moderate (EMA) strains get fashioned consecutive golden crosses since the day earlier than at the novel time, a stable bullish mark that signifies growing upward momentum.

This sample means that non everlasting averages are crossing above longer-term ones, most frequently considered as a mark of a trend reversal or the originate of a silent uptrend.

If this momentum continues, XRP imprint could well climb to take a look at $2.50, with extra resistance ranges at $2.64, $2.74, and $2.83.

Ought to silent the broader bullish sentiment return, XRP could well well impartial even are trying to reclaim the $2.99 stage — and presumably spoil above $3 for the first time in months.

On the opposite hand, if the momentum fades and the trend reverses, XRP could well pull back to take a look at relieve at $2.18. A loss of that stage would initiate the door for a deeper correction toward $2.03.

Persevered shy away pressure could well push XRP below the $2 worth, with the next significant relieve ranges at $1.90 and $1.61.