BNB has been regarded as one of many most efficient-performing layer-1 altcoins on the market all the device in which thru the last year. Thanks to its ecosystem, which is carefully tied to the super person nefarious of the area’s main crypto exchange, BNB might per chance perhaps proceed to defend this performance.

Plenty of on-chain indicators and shopping and selling knowledge counsel that even all the device in which thru market corrections, BNB is unlikely to journey a pointy decline.

Three Stable Request Drivers Supporting BNB’s Mark in 2026

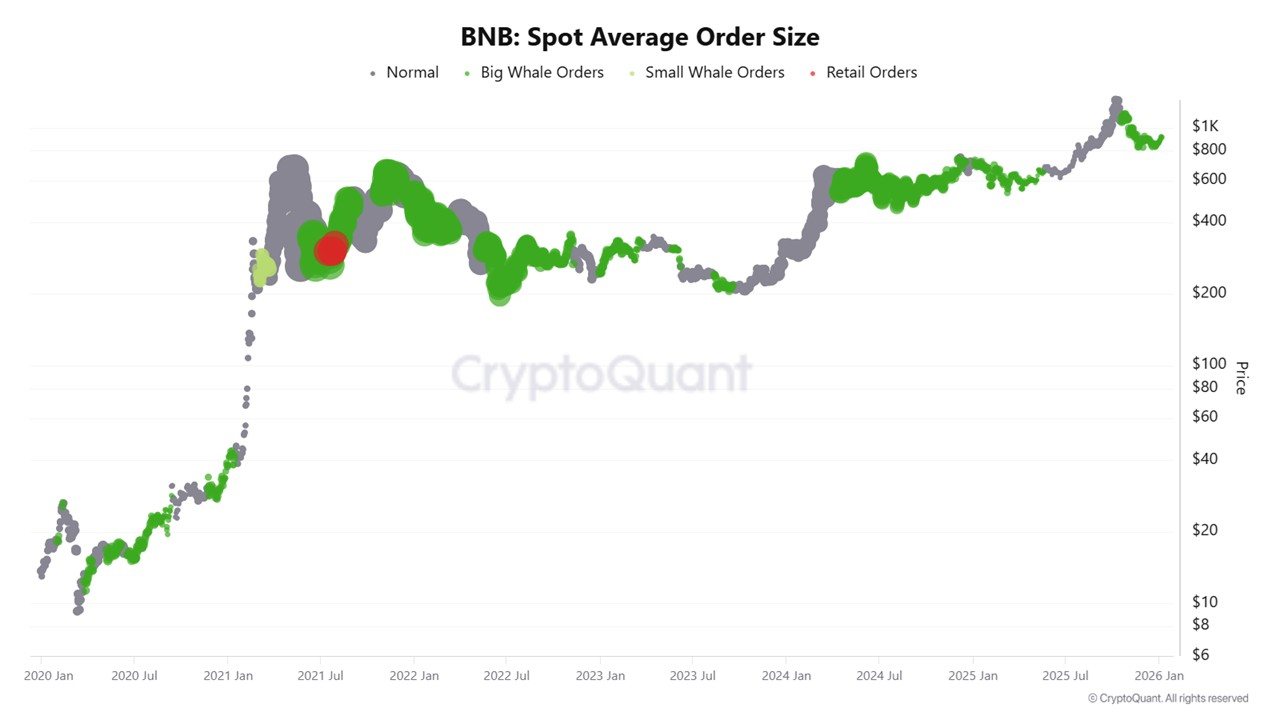

First, regarded as one of many biggest indicators demonstrating BNB’s designate stability is the neatly-liked space tell measurement.

Primarily based on knowledge from CryptoQuant, the neatly-liked tell measurement has remained somewhat super.

The chart reveals that for loads of the time, designate zones are marked by orders starting from odd to whale measurement. This reflects consistent participation from super traders.

“Reasonable space tell sizes remain somewhat super, indicating regular participation by utility-pushed or bigger holders reasonably than speculative retail flows,” analyst XWIN Learn Japan at CryptoQuant said.

With this stage of liquidity, BNB advantages from stable downside toughen supplied by whale orders all the device in which thru designate declines. Consequently, BNB has a higher capability to defend its value under fearful market prerequisites.

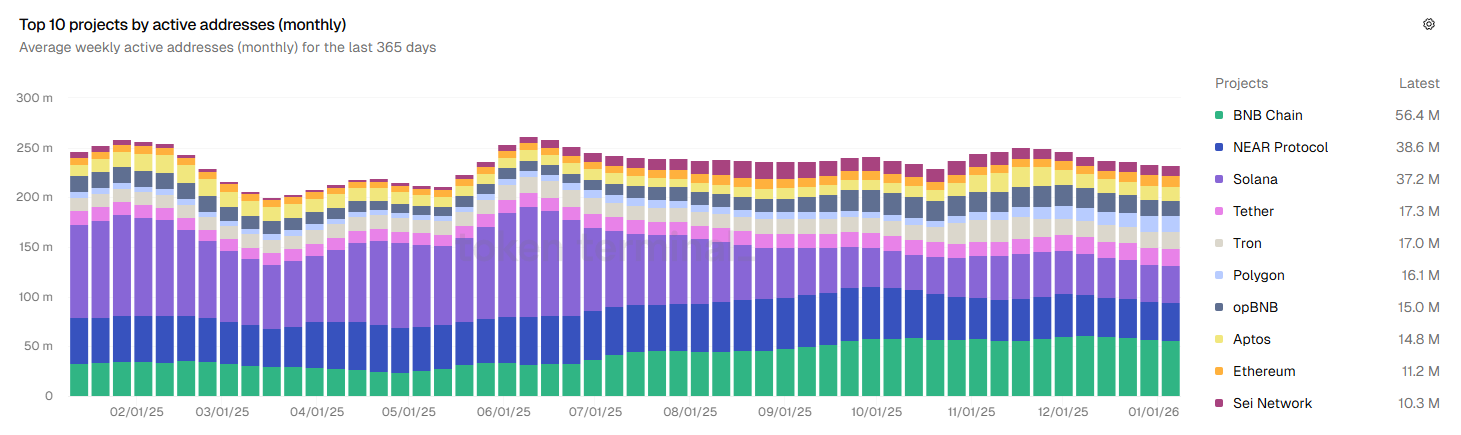

Retail traders seem much less visible in space market knowledge. On the other hand, they proceed to be actively engaged within the BNB Chain ecosystem. This command has helped BNB Chain defend its lead in weekly full of life users.

Primarily based on Token Terminal, in early 2026, BNB Chain recorded a imply of 56.4 million weekly full of life addresses. This figure critically exceeds those of competitors comparable to NEAR Protocol (38.6 million), Solana (37.2 million), and Ethereum (11.2 million).

The chart reveals an on a approved basis upward fashion since closing year, highlighted in inexperienced. This fashion means that retail traders are an increasing selection of searching for opportunities within the ecosystem. This dynamic contributes to BNB’s designate stability and boundaries the risk of a deep decline.

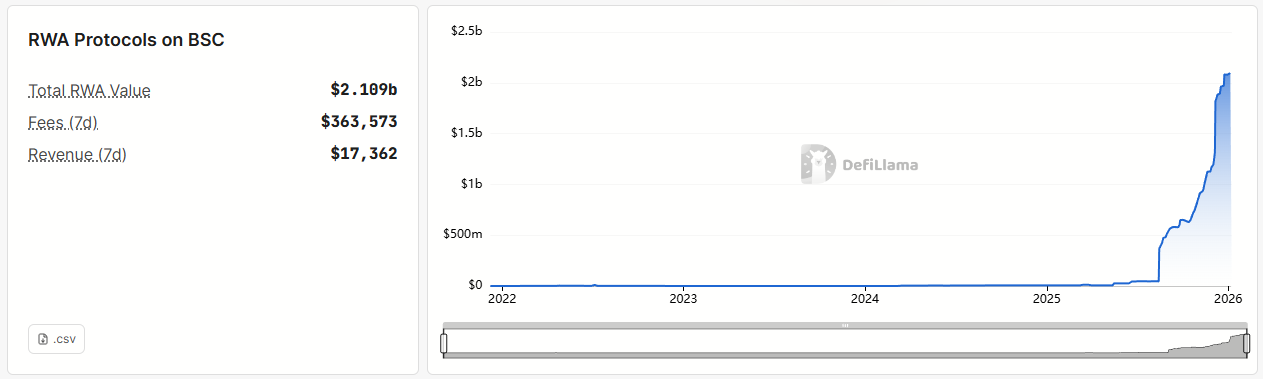

Furthermore, the development of Exact World Asset (RWA) protocols on Binance Trim Chain (BSC) has reached unusual highs in phrases of total value locked (TVL). This fashion reflects rising institutional inquire.

Primarily based on DeFiLlama, RWA TVL on BSC has surpassed $2.1 billion. The chart reveals a stable expansion from mid-closing year to the most well liked. Tokenized US Treasury resources from Hashnote, BlackRock, and VanEck myth for the majority of this value.

With inquire supported by whale shopping and selling command, retail participation within BNB Chain, and institutional RWA adoption, many analysts depend on BNB to reclaim the $1,000 stage within the shut to future.

The put up Why Is BNB Now not going to Survey a Deep Decline in 2026? seemed first on BeInCrypto.