Bitcoin has experienced a huge rally correct via the last month, marking a unique all-time high (ATH) at $111,980. This crucial stamp surge has raised questions referring to the sustainability of Bitcoin’s momentum entering June.

Whereas some traders are optimistic about additional gains, others are wondering if the associated price will icy down or if Bitcoin holders will take a extra cautious route.

Bitcoin Patrons Assemble Heavily

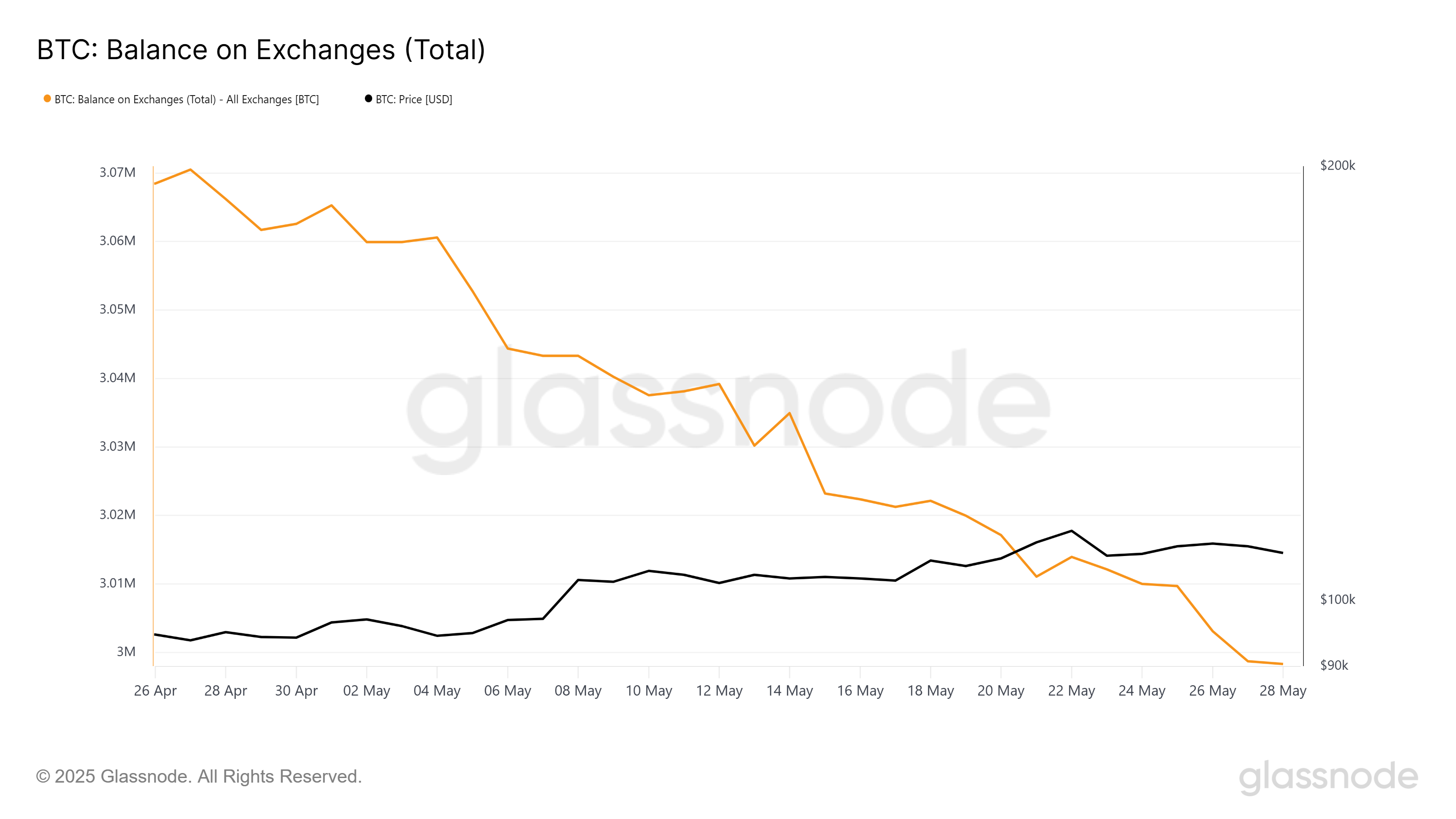

Bitcoin’s market sentiment is within the period in-between driven by stable accumulation. The stability on exchanges has dropped by 66,975 BTC, price over $7.2 billion, indicating that traders are interesting their holdings off exchanges and into internal most wallets. This crucial decline in on hand Bitcoin on exchanges suggests growing belief within the asset and perception in additional stamp will increase.

The buildup is partly driven by FOMO (pains of lacking out), as unique traders bustle in, but it will likely be backed by a growing conviction in Bitcoin’s long-timeframe likely. Nonetheless, Juan Pellicer, VP of Research at Sentora, not too long ago talked about with BeInCrypto how elements beyond straightforward accumulation like influenced Bitcoin’s stamp surge.

“Patrons’ willingness to attain for pain this spring has been fashioned by a tight save of macro currents which can also very effectively be all interesting in a “looser-financial-stipulations” route correct now. Inflation is gliding down, central-financial institution easing is relieve on the desk, exact yields and the dollar are slipping, world liquidity is growing, and financial spigots live huge launch. Those forces like lifted all pain assets, Bitcoin integrated, they customarily also existing why BTC’s stamp has been strongly correlated to the S&P 500 via Might possibly merely,” Pellicer worthy.

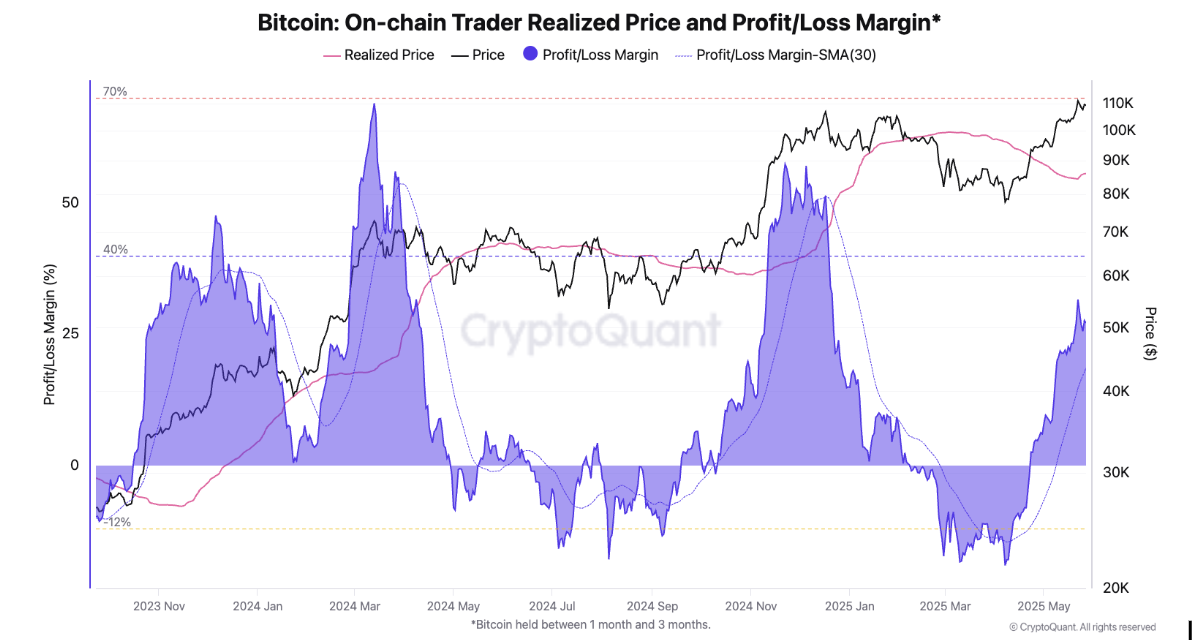

On-chain files unearths key indicators that counsel Bitcoin’s macro momentum stays stable. The On-chain Supplier Realized Mark and Earnings/Loss Margin had been spiking, signaling that Bitcoin traders, particularly those that bought 1 to a few months ago, are sitting on considerable unrealized earnings. This files helps gauge investor behavior and indicates that many are still preserving, trying forward to additional stamp rises.

Julio Moreno, Head of Research at CryptoQuant, talked about with BeInCrypto how the rising earnings amongst these short-timeframe holders can also threaten Bitcoin.

“Within the short timeframe, there’ll likely be some profit taking from traders as their unrealized profit margins are drawing halt overheated ranges around 40%. Tag the chart where we estimate the On-chain profit margin of Bitcoin traders reaching 31% within the past few days (crimson say),” Moreno talked about.

BTC Mark Goals At A Contemporary High

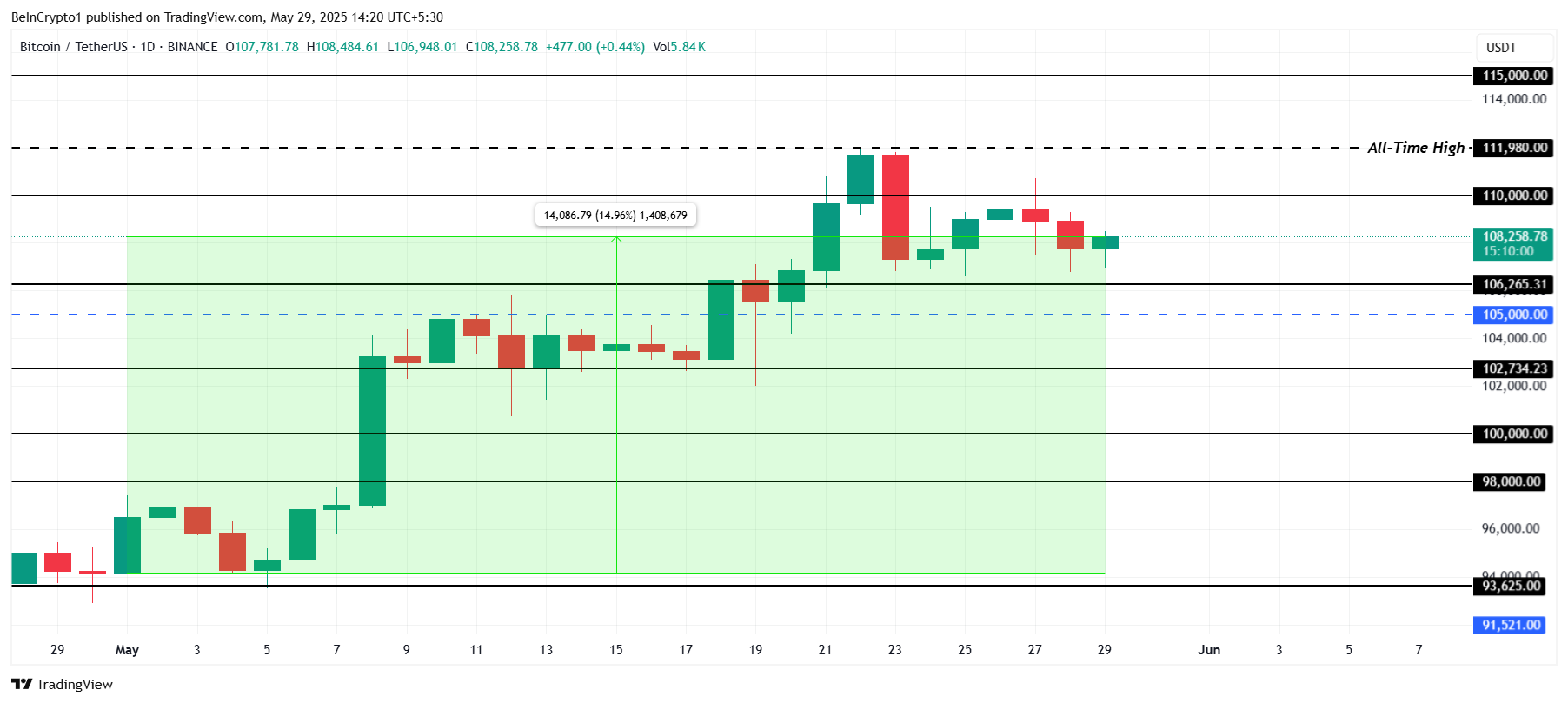

Bitcoin’s stamp surged by 14% all the way via Might possibly merely, reaching a unique all-time high of $111,980. For the time being trading at $108,258, Bitcoin is testing the $110,000 resistance diploma. The following couple of days will likely be necessary in determining if Bitcoin can protect its momentum.

If the accumulation at the hands of institutional and retail holders continues in June, the associated price can also protect its uptrend.

Furthermore, the “Promote in Might possibly merely and race away” formula has proven ineffective for inventory markets correct via the last yr, with markets continuing to rise no matter the seasonal pattern. Bitcoin’s correlation with inventory markets, particularly in mild of macroeconomic stipulations, suggests it will also continue to skills upward momentum via June. Given Bitcoin’s resilience, it’s at pain of push elevated even amid broader market uncertainty.

Bitcoin’s stamp can also ultimately breach $110,000, establishing it as a stable give a boost to diploma sooner than pushing past the ATH to offer attention to $115,000. Nonetheless, if profit-taking intensifies, Bitcoin can also skills a correction. Whereas a appealing downturn looks to be not going, Bitcoin can also face some consolidation sooner than continuing its upward pattern, with give a boost to ranges at $102,734 and $106,265 offering a buffer.