What are Bollinger Bands?

Bollinger Bands are a technical analysis tool feeble to gauge the volatility of resources like stocks. They reduction traders to identify overbought and oversold prerequisites essentially based on mean reversion principles.

Bollinger Bands encompass three strains: a heart line that represents the asset’s fascinating reasonable and two outer bands which would maybe maybe well well be positioned a obvious distance a ways from the center line, typically essentially based on fashioned deviations. The bands enlarge and contract essentially based on the asset’s volatility.

This tool modified into developed by legendary dealer John Bollinger in the Eighties. Bollinger Bands present insights into market prerequisites by combining the concepts of a fascinating reasonable and a volatility measure in a single indicator.

As volatility tends to revert to its mean over time, the contraction of the bands typically precedes a variety and a probably worth breakout. By monitoring the expanding and contracting bands, traders can live up for market shifts and make stronger their procuring and selling outcomes.

How assemble they work?

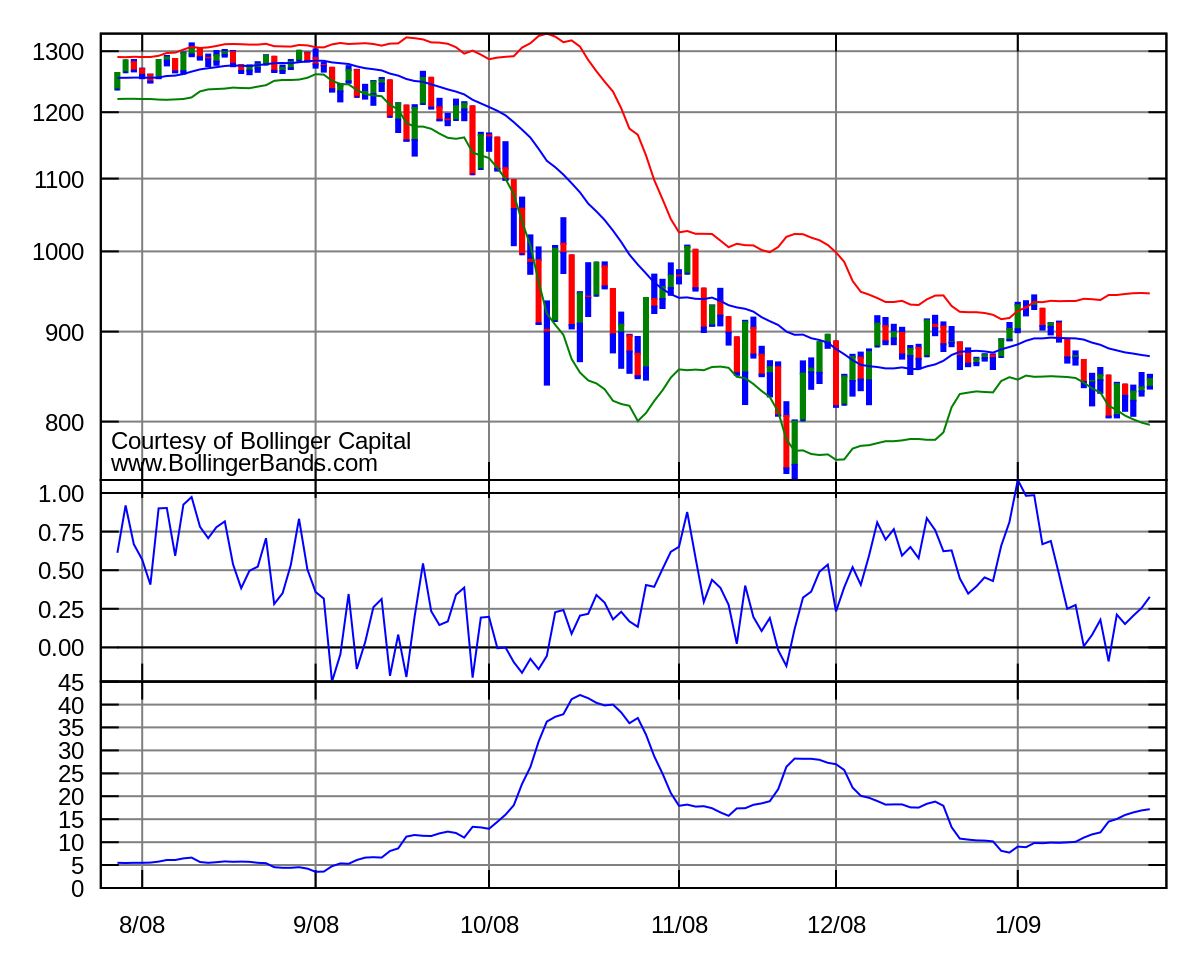

Bollinger Bands monitor market volatility, expanding for the interval of high volatility and contracting for the interval of low volatility. This helps traders identify probably aquire or sell alerts, such as when the price of the asset moves shut to or beyond the outer bands. For occasion, right here’s Bitcoin Ancient Volatility Index chart for 2024:

As volatility typically reverts to its mean, bands are inclined to enlarge, doubtlessly causing necessary worth actions. Monitoring these band actions helps traders live up for breakouts and reversals for extra profitable trades.

In easy terms, when the price nears the easier band, it is believed about overbought and have to factual, while near the decrease band suggests oversold prerequisites and a probably rebound. In fluctuate-sure markets, traders could maybe well aquire at the decrease band and sell at the easier band.

Upper and decrease bands are created by alongside with and subtracting a a few of fashioned deviations (typically two) from the SMA. This kinds an envelope across the price sequence, representing high and low volatility ranges. No longer fresh deviation measures worth dispersion from the SMA, quantifying volatility. It is a ways regularly calculated the utilize of the same interval as the SMA.

As an illustration, on Feb. 12, Bollinger highlighted in his submit on X the price plug of Bitcoin reaching the easier Bollinger Band, signaling a bullish pattern.

No longer finest has the price surpassed the easier band, but it has also surpassed the $50,000 threshold, a predominant psychological resistance level influenced by human psychology and procuring and selling patterns.

The set aside assemble you initiate?

You initiate by computing the easy fascinating reasonable (SMA), typically employing a 20-day SMA. The 20-day SMA encompasses averaging the closing costs over the preliminary 20 days to place the preliminary records level.

Therefore, the fashioned deviation cost is multiplied by two, with the ensuing product being both added to and subtracted from each and every records level alongside the SMA. This direction of generates the easier and decrease bands, delineating the boundaries of the Bollinger Bands.

Upper band

The upper band within Bollinger Bands marks a worth level that sits two fashioned deviations above the center band, encompassing roughly 95% of the price plug. Acting as a dynamic resistance threshold, it assists traders in pinpointing probably overbought eventualities and figuring out optimal entry or exit functions.

Calculating the easier band entails alongside with two fashioned deviations to the 20-day easy fascinating reasonable (SMA) of the asset’s worth. This better band acts as a flexible resistance level, offering guidance to traders on when to originate long positions or exit short positions available in the market.

Center band

The heart band, typically typically called the fascinating reasonable, is undeniable the utilize of a 20-day time frame and acts as a foundational reference level for both the easier and decrease bands. Serving as an indicator of the safety’s reasonable worth over the specified interval, it facilitates the identification of worth traits and probably reversals.

To compute the easy fascinating reasonable (SMA) for Bollinger Bands, the closing costs across a designated replacement of courses are averaged. This resultant fascinating reasonable functions as the center band within the Bollinger Bands framework, enabling traders to discern prevailing worth traits and probably reversal zones available in the market.

Decrease band

The decrease bandis two fashioned deviations below the center band and helps traders acknowledge consolidation courses and probably breakout or reversal functions. When the easier and decrease bands contract, it suggests low volatility and that possibilities are you’ll maybe well well narrate of breakout opportunities, guiding traders of their seeking out or selling decisions.

BTC worth

As we be taught about at the latest BTC/USD chart, we are able to be taught concerning the bands widening at the live of February.

Bollinger Bands tightening for the interval of low volatility signal an impending fascinating worth pass, maybe initiating a pattern. Here is regularly typically called “the squeeze.”

At some level of gather traits, costs could maybe well over again and over again exceed or hug a band. Divergence with a momentum oscillator could maybe well suggested additional analysis for taking extra earnings. A gather pattern continuation is expected when the price moves beyond the bands. Instantaneous retreat again inner suggests weakening energy.

Currently, the market is sure on the uptrend. Then over again, as Bollinger just as of late identified:

Oh, there have been others. Other folk seem to omit that the bulls are in fee quite quite a bit of the time and thus desire to argue with the market. Never a factual advice.

— John Bollinger (@bbands) February 22, 2024

Conclusion

Bollinger Bands present precious insights into probably worth reversals, overbought/oversold prerequisites and market volatility. Then over again, traders have to complement their utilize with other analytical methods to make effectively-advised decisions.

Past worth actions depicted in charts assemble no longer articulate future outcomes, and technical analysis by myself could maybe well no longer predict market traits precisely. Merchants have to mix a few indicators like RSI for extra advised resolution-making.