Earlier this day, Jonathan Wu, an investor at Asylum Ventures, a $55 million early-stage enterprise fund based entirely in Brooklyn, Unusual York, posted on the social media platform a thread on the cryptocurrency market’s ongoing rupture.

Wu began his explanation by addressing the basics of lift trading, a approach where traders borrow money at low-passion rates in one currency to invest in higher-yielding sources in one other.

Raise alternate is a monetary approach in which traders borrow money at low passion rates in one currency and utilize it to invest in higher-yielding sources in one other currency. The distinguished aim is to capitalize on the differential between the low borrowing prices and the upper returns on the investments. In most cases, traders goal currencies from countries with lower passion rates for borrowing, such because the Jap Yen or Swiss Franc, and convert these into currencies from countries with higher passion rates, deal with the US Buck or Australian Buck, to invest in sources that provide higher returns, equivalent to bonds, stocks, or even higher passion charge deposits.

This approach will also be extremely profitable when exchange rates and keenness charge differentials remain trusty or switch in favorable instructions. However, it also carries vital risks. If the currency borrowed strengthens in opposition to the currency in which the investments are made, the worth of repaying the mortgage will enhance, potentially wiping out the profits from the investments or even resulting in losses. Furthermore, changes in passion rates or financial stipulations can residence off sudden and nice shifts in exchange rates, which is able to consequence in posthaste unwinding of lift trades and consequence in vital market volatility.

Consistent with Wu, three serious stipulations are vital for this approach to be triumphant in success: low borrowing rates, considerable collateral, and profitable investments. However, Wu illustrious that every and every body these stipulations are currently deteriorating for lift traders, surroundings the stage for vital market disruptions.

A vital prick of Wu’s diagnosis focuses on the Bank of Japan (BOJ) and its present monetary protection adjustments. Wu defined that the BOJ has been compelled to tighten its monetary protection to defend Jap citizens from the impacts of inflation, drawing parallels to the Federal Reserve’s historic charge hikes between 2022 and 2023. Wu illustrious that an already weakened Yen exacerbated the misfortune, making it sturdy for Japan, a resource-unfortunate nation reliant on imports, to manage its foreign alternate successfully.

Wu says that based entirely on inflationary pressures, the BOJ raised passion rates. Wu clarified that increasing passion rates, that are in actuality the worth of borrowing money, reduces the money provide by making loans more expensive. This switch aimed to curb inflation nonetheless had some distance-reaching consequences for lift traders.

Wu elaborated on the predicament of lift traders who had borrowed in Yen to own foreign sources. The upward thrust in passion rates elevated the Yen’s payment, posing a excessive venture for these traders. Wu defined that higher passion rates elevate the quiz for Yen attributable to higher yields, thereby strengthening the currency. Consequently, the worth of borrowing in Yen also surged, resulting in a discount within the money provide and additional riding up the Yen’s payment.

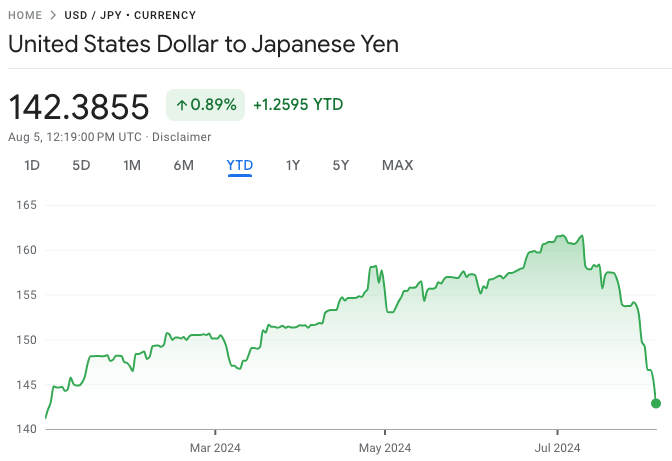

Wu identified that the Yen’s payment spiked seriously, with the USD/JPY exchange charge dropping from a high of 162 to 145 (at the time of writing, the charge is 142.38).

This dramatic appreciation intended that anybody with Yen-denominated loans now faced a higher debt burden in USD phrases. Wu highlighted that the elevated debt load and better passion rates compelled some traders to sell their sources to repay their loans, which added additional upward pressure on the Yen, increasing a vicious cycle of compelled liquidations and currency appreciation.

Drawing parallels to the crypto market, Wu described how reflexive dynamics—where market actions prolong themselves—play a vital position. Wu likened the present misfortune to the unwinding of Terra, emphasizing that whereas issues may also work smoothly when stipulations are favorable (i.e., a more inexpensive Yen), they will turn out to be disastrous when the misfortune reverses. Wu urged that many traders underestimated the chance of passion rates rising from zero, resulting in overly optimistic bets on the ongoing devaluation of the Yen and the BOJ’s willingness to endure home financial anxiousness.

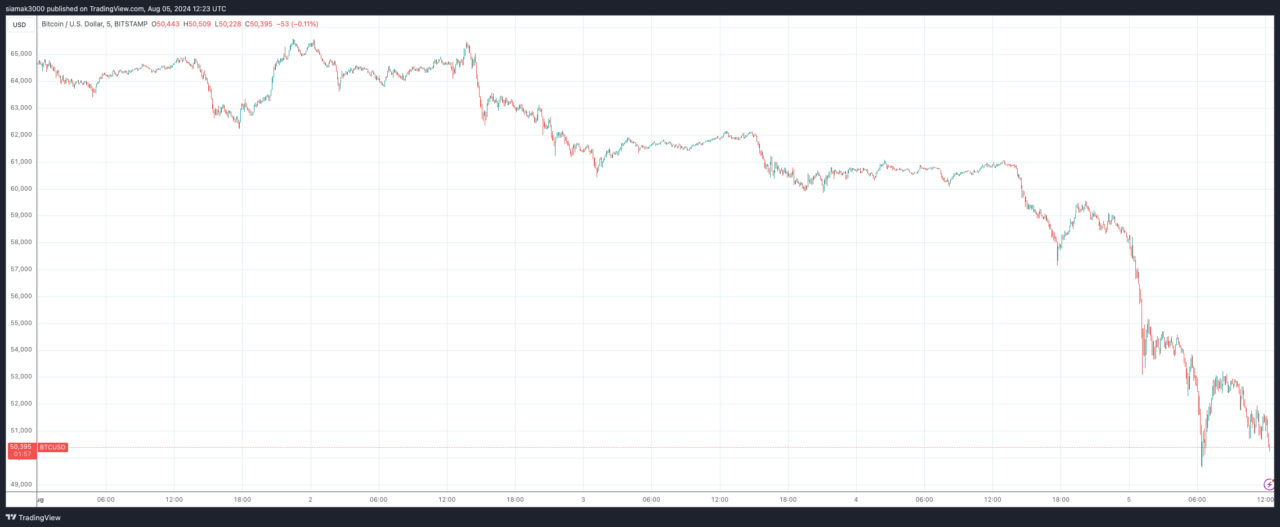

Wu concluded that the hidden leverage within the monetary system, facilitated by Japan’s monetary protection, had been a vital driver of trouble asset valuations. With the BOJ tightening its protection, Wu illustrious that this leverage is being unwound, inflicting a ripple attain all the map thru assorted markets, including cryptocurrencies. Wu emphasized that the closure of what he termed because the “limitless money glitch” of Japan’s monetary protection has resulted in a gargantuan sell-off, impacting these with unfortunate trouble management first and potentially resulting in a more intensive liquidation cascade.

On the time of writing, Bitcoin is trading at around $50,453, down 17.7% within the past 24-hour duration.

Featured Characterize by the utilize of Pixabay