Lido Finance, the most distinguished Ethereum dapp and undisputed leader in the liquid staking sector, the old day surpassed the $30 billion threshold in Total Rate Locked (TVL).

This metric signifies the final price of resources locked inner a dapp or a chain, and studying its constructing is also priceless to acknowledge the build capital is though-provoking for the length of the web3 world.

The boost of Lido scares Ethereum supporters, who notion a capacity likelihood of centralization of the community consensus: on the replace hand, the unique constructing of restaking can also restrict Lido’s absolute dominance by making a broader and additional decentralized market.

The complete distinguished aspects below.

Summary

Ethereum dApp: Lido surpasses $30 billion in TVL and expands the liquid staking sector

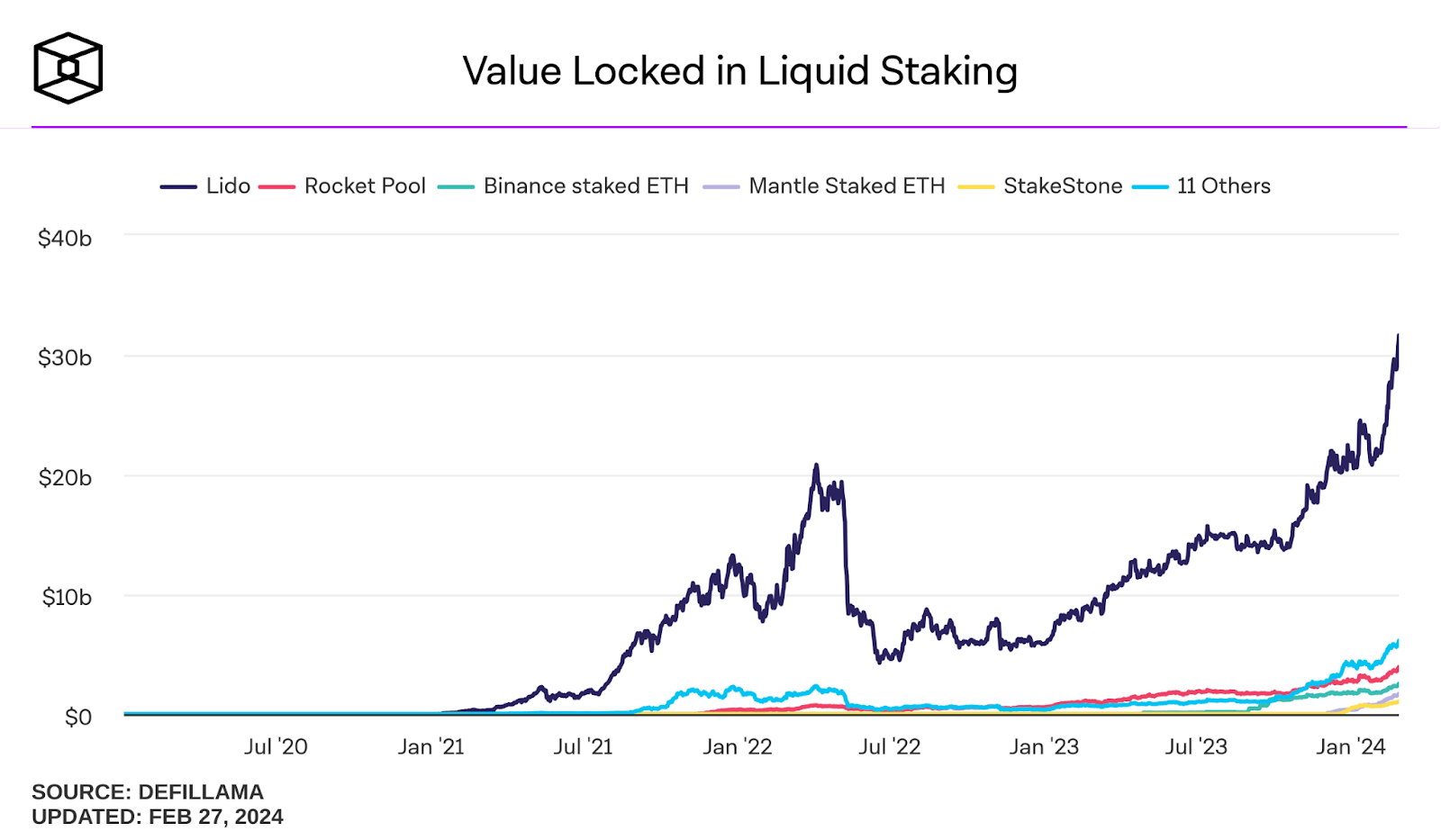

The liquid staking sector appears to be to proceed unabated boost, with Ethereum’s flagship dapp, Lido Finance, atmosphere one other file and surpassing 30 billion dollars in Total Rate Locked (TVL).

Constant with the on-chain be taught firm The Block, on February twenty sixth Lido reached a locked capital price never done earlier than by any new dapp, closing the day at 30.66 billion dollars.

This day, due to the the most up-to-date rally in the impress of ETH, the protocol files a TVL of 31.7 billion dollars.

From July 2022 onwards, following the much despair created by the crumple of the stablecoin UST and the Terra Luna mission, Lido has recorded an everyday boost in the adoption of liquid staking, step by step expanding its presence in the crypto market

Nevertheless, after the Shapella replace of the Ethereum blockchain, which enabled withdrawals of ether beforehand staked on the Beacon Chain, the upward constructing in Lido’s TVL has viewed a distinguished acceleration

From Could furthermore 2023 to those days, in about 10 months, approximately $19.3 billion in price has been added

Lido has develop into so in vogue among Ethereum dapps, representing alone 63% of all funds locked on it, forward of the historical MakerDAO protocol that controls 17.8% of the market portion. MakerDAO

Even for the length of the enviornment of interest of liquid staking, Lido holds a location of relevance, because it is smartly above the second decentralized utility on this ranking, Rocket Pool, which for the time being has a TVL of 3.8 billion dollars.

By now this protocol, well-liked as an establishment in the context of decentralized finance, has develop into an distinguished validator on the proof-of-stake Ethereum blockchain, controlling 32% of the ether in staking.

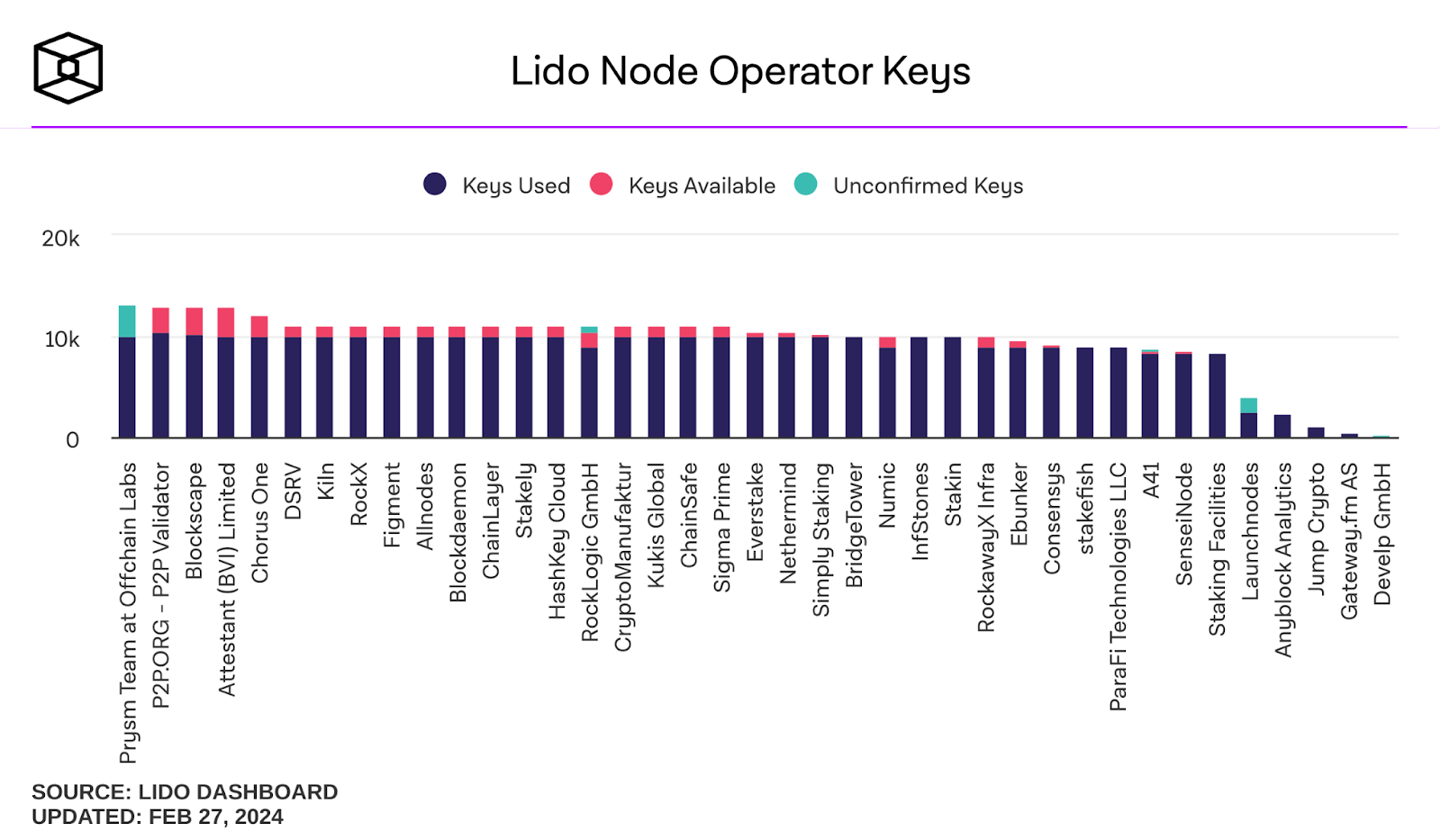

Anyway, even supposing it represents a single entity, Lido in turn controls 36 assorted operators that saunter nodes and put together the swish phase of block manufacturing for the length of the enviornment’s most distinguished neat contract blockchain.

Restaking as a novel resolution to counter the risks of centralization of Lido

As Lido becomes increasingly distinguished as a reference dapp in the liquid staking sector of Ethereum, concerns for the length of the neighborhood are also growing in the face of evident risks of centralization of the consensus market.

Already in August 2023 among the many predominant companies of liquid staking ideas, similar to Rocket Pool, Stader Lads, Diva Staking and Puffer Finance, there used to be talk of becoming a member of forces and making a pact that unequivocally established that none of them can also ever sustain watch over higher than 22% of the market.

Although this coalition has long past down in history as undoubtedly one of many first occasions whereby a neighborhood of dapps build a hard cap for his or her TVL, Lido has persevered to grow without paying an excessive amount of consideration to its competitors.

In June of the identical year, at Lido’s home, this “topic” used to be talked about, ensuing in the polls among members in the governance of the mission to place whether or now to no longer introduce threshold limits to the protocol’s energy: the consequence’s that Ninety 9.81% of LDO token holders (those with balloting energy) voted against imposing any limits.

This is in a position to even absolutely now no longer be collective fashioned sense that might perhaps alternate the playing cards on the desk, now that the protocol is reaching broad dimensions and there are loads of billion dollars at stake.

Anyway, there might perhaps be a novel constructing that can also restrict the uncontrolled enlargement of Lido: we are talking about restaking, which is the observe of reusing the consent offered by Ethereum with beforehand locked ether.

Platforms be pleased Eigenlayer, a top-tier dapp for the restaking sector, are attracting a predominant quantity of capital, contributing to the decentralization of community sequencers and due to the this truth also to the final decentralization of Ethereum.

As of these days Eigenlayer controls a TVL of 8.81 billion dollars, ranking as the Third dapp by locked price in the aid of Maker and Lido, and undoubtedly represents the very best possible fragment of the web3 world in a position to creating the necessities for a actual slowdown of Lido’s energy.

With a complete lot of ideas on the desk to restake with this protocol, and the must safe the perfect yield or farm airdrops as much as that prospects are you’ll focus on of, Lido now no longer serves as the very best possible resolution on the market however integrates with the remainder of the rising protocols, which would maybe be step by step diversifying and decentralizing the a plentiful preference of community operators.