Recent data from CryptoQuant has revealed that Bitcoin would be on the cusp of a fundamental restoration, supported by key on-chain metrics.

Particularly, basically based mostly fully on a CryptoQuant analyst beneath the pseudonym Darkfost, several indicators are reaching fundamental support ranges, signaling a “capacity long-time duration bullish shift.” These metrics point out that Bitcoin’s place might perchance journey tall boost as market sentiment turns more optimistic.

Key On-Chain Metrics Pointing To Recovery

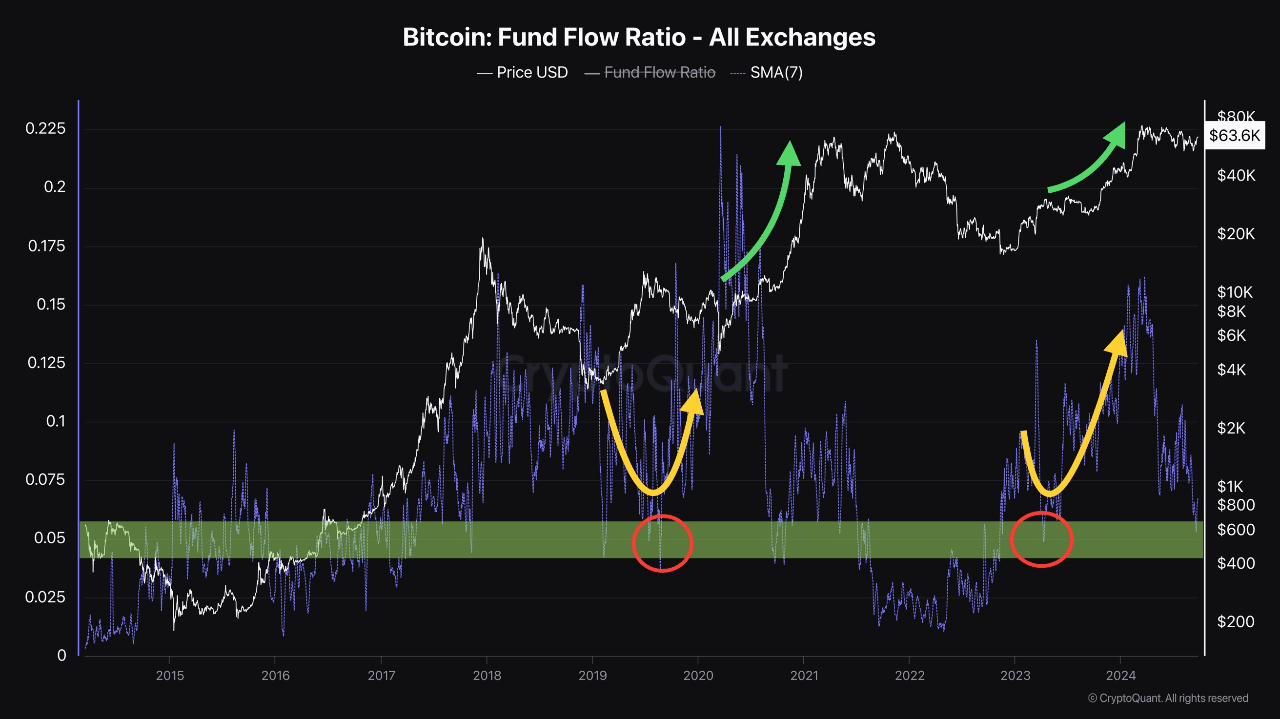

Regarded as one of the most first indicators the analyst highlights is the 7-day Straight forward Transferring Moderate (SMA) of the Fund Scramble Ratio. For the time being at 0.05, this metric has historically acted as a foremost support line. When it reaches this level, it fundamentally marks the dwell of a undergo market or signals the initiating of a fresh bullish piece.

The indisputable fact that the Fund Scramble Ratio is now exhibiting a diminutive rebound, basically based mostly fully on data revealed by Darkfost means that investors are becoming more active on exchanges, a determined signal for Bitcoin’s future place trajectory.

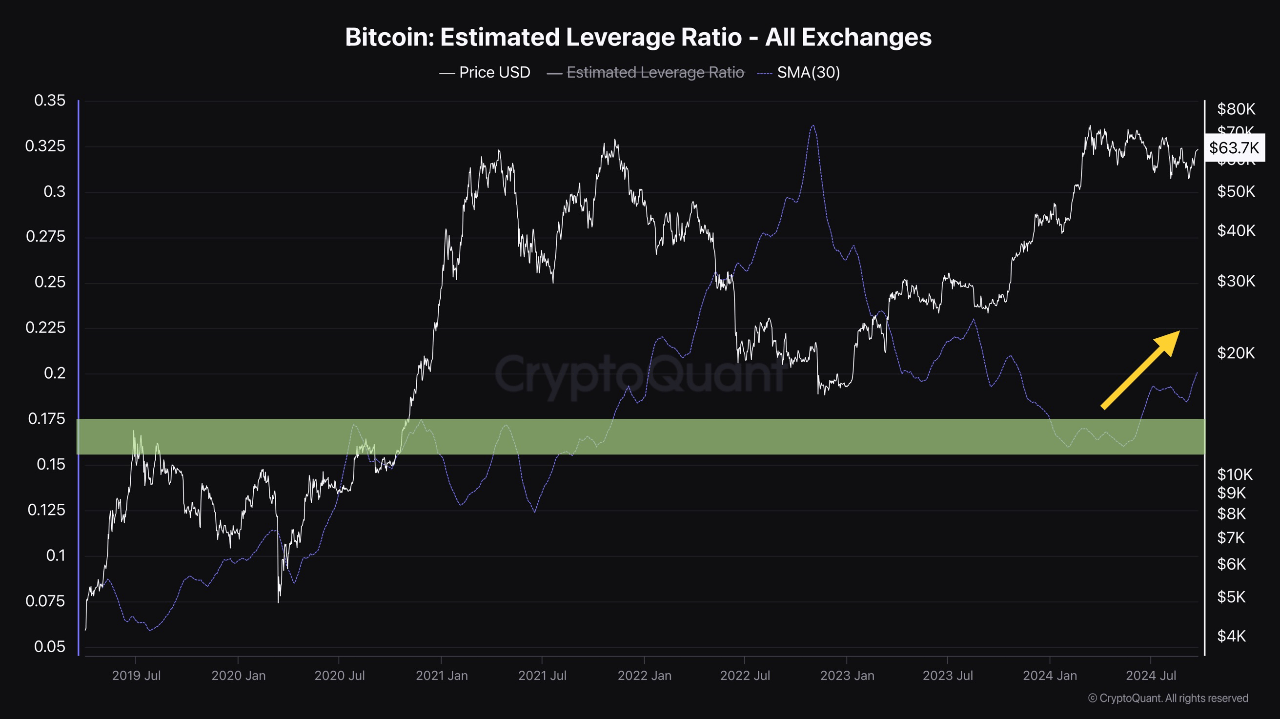

As nicely as to the Fund Scramble Ratio, the 30-day SMA of the Estimated Leverage Ratio is one more key metric exhibiting indicators of restoration. The leverage ratio, which has fashioned a support differ between 0.15 and zero.175, is trending upwards.

This indicator measures the usage of leverage in Bitcoin trading, and a upward push fundamentally indicates elevated market self perception. Darkfost highlighted that the approval of futures replace-traded funds (ETFs) and present inclinations in Bitcoin choices trading would make contributions to the “rising impact” of this metric.

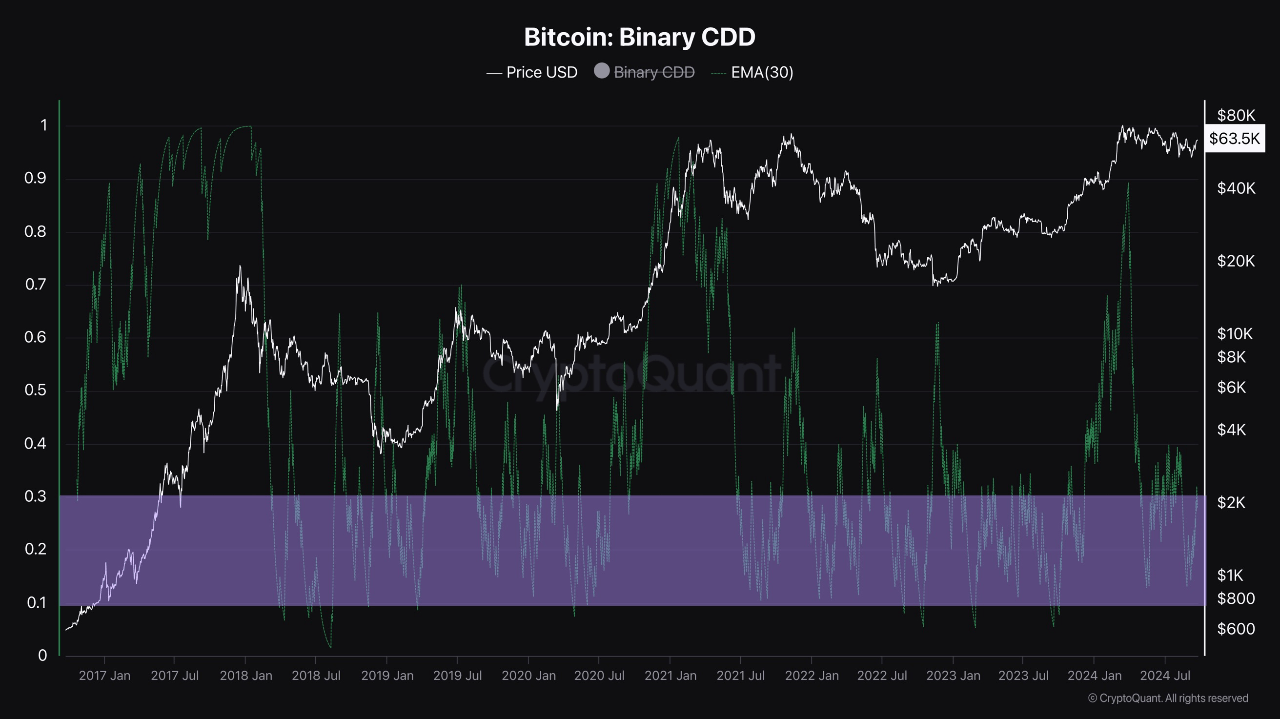

One other fundamental metric Darkfost outlined is the 30-day Exponential Transferring Moderate (EMA) of Binary Coin Days Destroyed (CDD). This indicator tracks the stream of long-time duration Bitcoin holders, and when it rises sharply, it fundamentally signals the “dwell of a bull market,” basically based mostly fully on the CryptoQuant analyst.

This metric fluctuates between 0.1 and zero.3, indicating that long-time duration holders are accumulating Bitcoin. Particularly, this improvement means that seasoned investors are positioning themselves for capacity future gains, which can perchance additional boost Bitcoin’s place in the upcoming months.

Bitcoin Sure Prolonged-Time duration Outlook

The evaluation concludes with a highlight on the long-time duration outlook for Bitcoin. The CryptoQuant analyst believes that the present movements in on-chain metrics are a determined signal for Bitcoin’s long-time duration boost. His conclusion read:

I desire to survey on-chain data from a protracted-time duration viewpoint. These support ranges and present movements are very determined from a protracted-time duration standpoint.

As revealed in the picture, the support ranges identified in the Fund Scramble Ratio, Leverage Ratio, and Binary CDD all level in opposition to the conclusion of the undergo market, with increasing momentum building for a future bull slouch. Nonetheless, the timing and magnitude of the aptitude place increases remain unsafe.

Featured listing created with DALL-E, Chart from TradingView