Gaining momentum

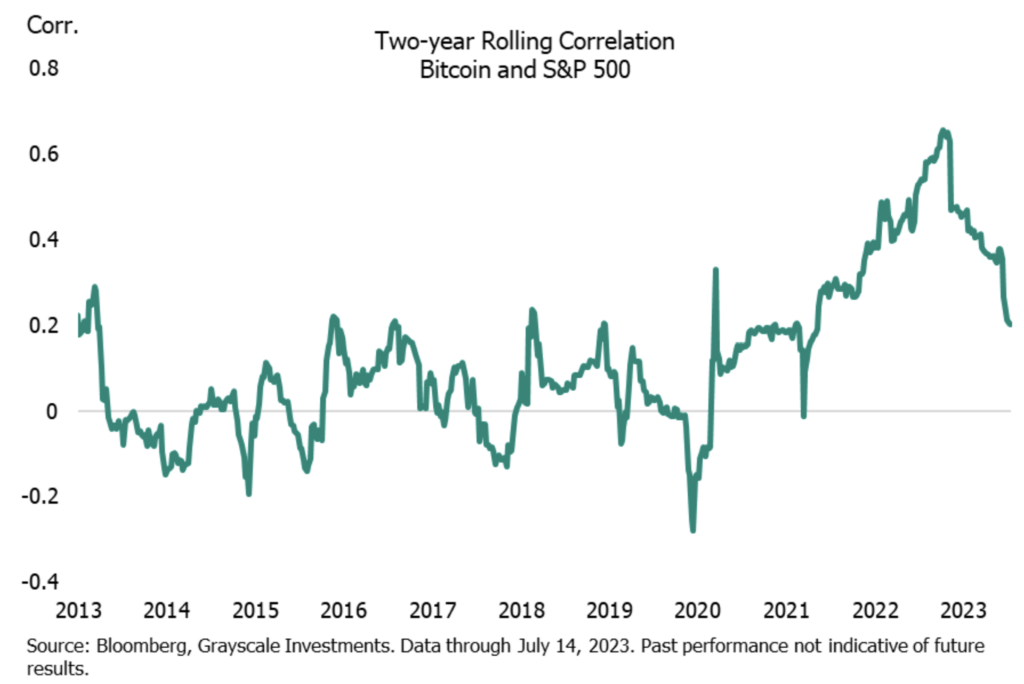

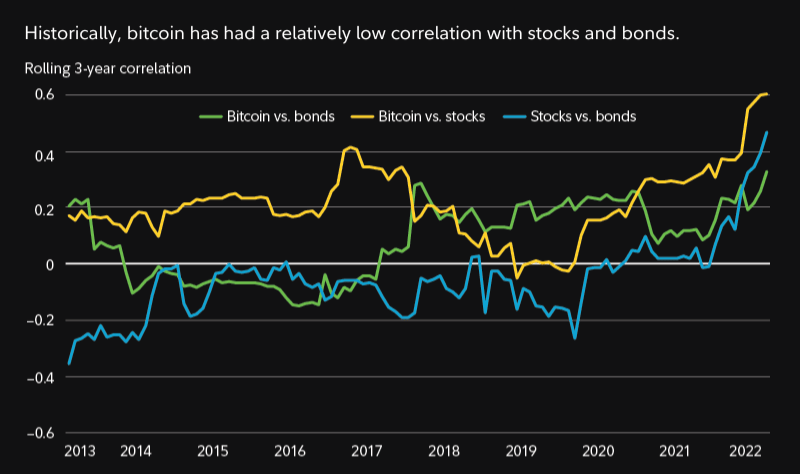

Over the last decade, Bitcoin has confirmed a correlation of 0.17 with the S&P 500, decrease than other different sources like the S&P Goldman Sachs Commodity Index, which has a correlation of 0.42 with the S&P 500 at some level of the similar length.

While Bitcoin’s correlation with the stock market has historically been low, contemporary years hold considered a diminutive expand. Over the last 5 years, the correlation has risen to 0.41.

Bitcoin’s relationship with the S&P 500 saw a unfavourable correlation of -0.76 on November 11, 2023, and then hit a definite correlation of 0.57 in January 2024. This shift from unfavourable to definite correlation aspects to Bitcoin’s changing perception amongst traders.

Comparing stock and Bitcoin

The S&P 500 is a stock market index that shows the efficiency of 500 main firms listed on U.S. stock exchanges. Worthy as a barometer for the U.S. financial system, it is liked by chance-averse traders for its constant historical efficiency and diversification at some level of diverse industries.

Retaining positions in the S&P 500 with a prolonged-timeframe perspective has historically yielded annual positive aspects nearing 10%.

When evaluating Bitcoin and the S&P 500, one significant disagreement is their volatility. Bitcoin’s efficiency is on the full likened to a curler-coaster trip, evident in its drastic swings from plunging over 64% in 2022 to rallying 160% in 2023. This volatility would possibly per chance well per chance even be stressful for crypto traders to navigate.

In distinction, the S&P 500 exhibits relatively stable efficiency, averaging about 9% to 10% annual returns and serving as a benchmark for the U.S. financial system. While the S&P 500 would possibly per chance well per chance honest provide decrease total returns compared with Bitcoin, its consistency and prolonged-timeframe track sage make it a liked desire for chance-averse traders.

What correlation in total contrivance

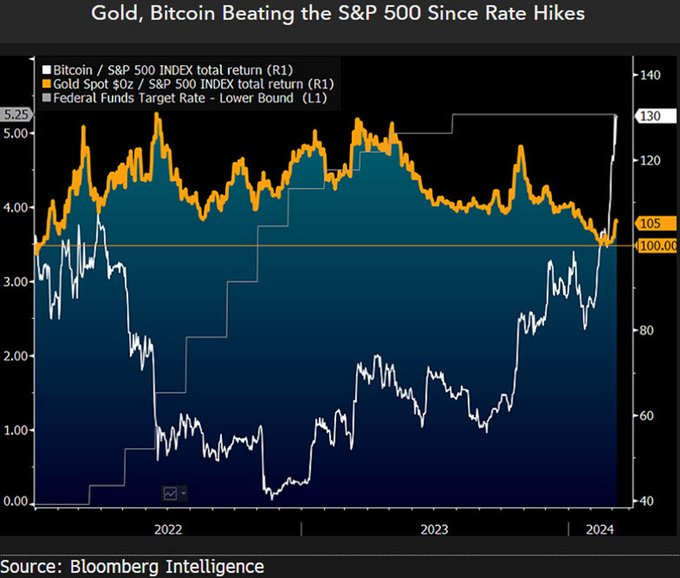

The correlation between Bitcoin and the S&P 500 would possibly per chance well per chance even be attributed to components akin to declining inflation numbers and the U.S. Federal Reserve’s choice to remain hobby charge hikes. This created an ultimate environment for chance-on trading, ensuing in bull rallies for every and every Bitcoin and the S&P 500 index whatever the bearish sentiment following the 2022 correction.

When the correlation between Bitcoin and feeble equity markets like the S&P 500 and Nasdaq increases, while its correlation with Gold decreases, it suggests that Bitcoin is behaving more like a chance-on asset rather than a stable haven. When traders are feeling venturous, they in total swing toward stocks and digital coins for a gamble at juicier earnings.

If institutional and retail traders are more and more fascinated by each and every equity and cryptocurrency markets, their simultaneous buy and promote choices would possibly per chance well per chance trigger the price actions of these sources to align.

Both Bitcoin and the S&P 500 thrive in intervals of loose financial policy, characterized by central banks stimulating the financial system thru measures like hobby charge cuts and quantitative easing.

This environment boosts asset markets by injecting liquidity and reducing borrowing costs. Which capacity that, traders flock to each and every feeble and crypto markets, driving up costs. Nonetheless, when central banks tighten financial policy by elevating hobby charges, as considered honest honest these days, it is going to dampen market enthusiasm and impact asset costs.

BTC beats S&P 500

In 2023, Bitcoin surged by 160%, while the S&P 500 gained 23%. Nonetheless, it is wanted to assign in mind past efficiency, as Bitcoin experienced a indispensable 64% wreck in 2022, compared with the S&P 500’s 19% decline. These contrasting performances highlight the perspective wanted when evaluating Bitcoin’s volatile positive aspects with the more stable returns of the S&P 500 index.

Constancy’s learn implies that Bitcoin has historically equipped necessary returns, averaging 186.7% annually from August 2010 to August 2022. Nonetheless, since the launch of the Bitcoin futures market in 2018, its life like annual returns were spherical 8.8%.

While past efficiency suggests seemingly for high returns, Bitcoin’s indecent volatility would possibly per chance well per chance honest peaceful no longer be misplaced sight of. Traders needs to be conscious that its price can each and every rise and fall dramatically, as evidenced by contemporary fluctuations.

To assess Bitcoin’s chance, Constancy conducted simulations adding diverse quantities of Bitcoin to a feeble 60/40 portfolio. The gaze chanced on that even a minute allocation of Bitcoin enormously elevated portfolio volatility. As an instance, changing 1% of stocks or bonds with Bitcoin contributed about 3% to total portfolio volatility, with dangers rising exponentially as allocation levels rose.

Tech-pushed surge

Bitcoin’s contemporary be conscious surge aligns with optimism in technology stocks on Wall Avenue, mirrored by the rise in the Nasdaq 100 Index relative to the S&P 500 (NDX-SPX ratio). This definite correlation suggests that actions in technology stocks affect Bitcoin’s market. Traders monitoring Bitcoin would possibly per chance well per chance honest track the NDX-SPX ratio for insights.

Despite seemingly fluctuations, optimism prevails in the crypto market due to the components like the upcoming halving-induced supply reduction and elevated ETF attach a question to, fueling predictions of Bitcoin reaching $150,000 and beyond.

Ali Martinez urged that Bitcoin’s be conscious trajectory would possibly per chance well per chance parallel that of the S&P 500 ($SPX), elevating the attach a question to of whether the contemporary fall from $32,000 to $25,000 represented the closing different to amass at a low be conscious.

Imagine if #Bitcoin be conscious motion mirrors the $SPX? Image this: the dip from $32,000 to $25,000 in #BTC became once our handiest chance to amass in low. May possibly also we be on the verge of an unstoppable rise? 🚀 Is it “up handiest” from right here for $BTC? pic.twitter.com/Gc8jQjxrEB

— Ali (@ali_charts) February 28, 2024

He speculated whether this decline would possibly per chance well per chance signal the beginning of an upward pattern, ensuing in a scenario the build Bitcoin handiest moves in a single direction, upward.