- Bitcoin breaks $64K, supported by exact market trends and technical indicators.

- Severe Fibonacci levels counsel the different of additional gains if resistance is breached.

- MACD crossover and RSI signal energy, but traders could well furthermore quiet peep for that you just can well per chance furthermore believe downside dangers.

BTC continues its upward trajectory, breaking the $64,000 impress with a trace of $64,321.86, representing a 5.33% magnify internal the final 24 hours. This onwards momentum comes after the coin skilled a upward push in swap, which ended up pushing its market capitalisation to $1.27 trillion. This has secured Bitcoin because the main cryptocurrency globally by market capitalisation.

Furthermore, the 24-hour trading quantity has also followed the track of the coin’s magnify by 67.08%, main to its label of 43.95. This has, in turn, indicated the sturdy trading exercise witnessed available in the market.

Source : coinmarketcap

The coin’s exact market engagement has also contributed to its high circulating present, which is at display conceal at 19,744,443 BTC, or 94.02% of the total maximum present capped at 21 million BTC. Inviting to the price charts, a exact climb from $61,040 at final passed $65,000 sooner than it went on to stabilise across the $64,000 vary. This sustained boost suggests exact shopping for force and market self belief in Bitcoin’s persisted efficiency.

Bitcoin Value Motion

The token has proven resilience in the face of high market volatility, main to its latest trace of $64,198 with a modest 0.18% day-to-day magnify.

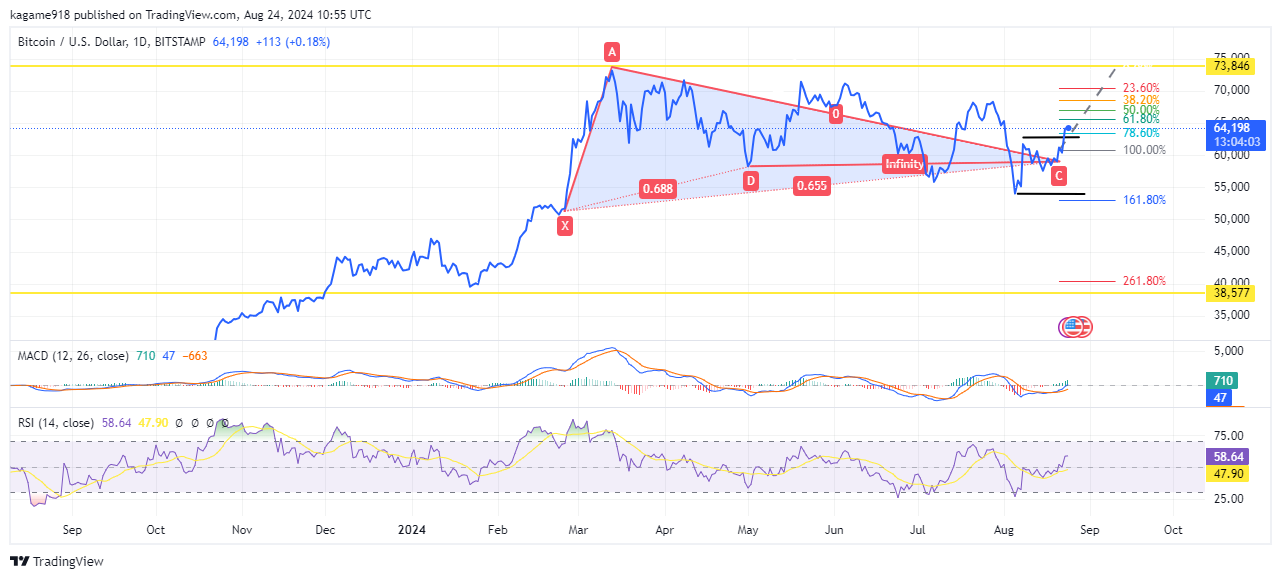

Inviting on with the coin’s trace walk, the chart pattern showcases an prolonged XABCD structure, which overall means that Bitcoin could well furthermore be poised for any other upward toddle. After reaching the height of level A earlier this year, Bitcoin retraced to level D, indicating the doable completion of the pattern.

Source : Tradingview

Notably, the Fibonacci levels highlight key areas of resistance and purple meat up. The 23.60% retracement at roughly $67,188 and the 38.20% level around $65,208 are well-known zones where Bitcoin could well furthermore face predominant promoting force. If these levels are breached , the following aim could well furthermore be the 50.80% retracement level at $61,808, aligning with basically the latest upward momentum.

The Inviting Moderate Convergence Divergence indicator reveals a promising crossover, evident with the MACD line (710) crossing above the signal line (47) signalling a doable reversal. Here could be backed by the Relative Strength Index, which at display conceal stands at 58.64, which means that Bitcoin is gaining energy without being overbought.

Merchants ought to preserve terminate caution available in the market, because the chart also signifies a doable downside possibility. The 161.80% Fibonacci extension level at $38,557 serves as a serious purple meat up level. Must Bitcoin fail to preserve its latest trajectory, a breach could well per chance happen and assign off additional downward walk.