With the Arbitrum (ARB) token liberate suppose for April 16, the cryptocurrency community is closely monitoring the aptitude impacts on the token’s market dynamics. This event marks a main milestone in Arbitrum’s roadmap, with a big volume of ARB tokens, approximately 92.65 million, slated for distribution to advisers, crew members, and merchants. This follows a series of transfers and unlocks that dangle influenced ARB’s market performance in most modern months.

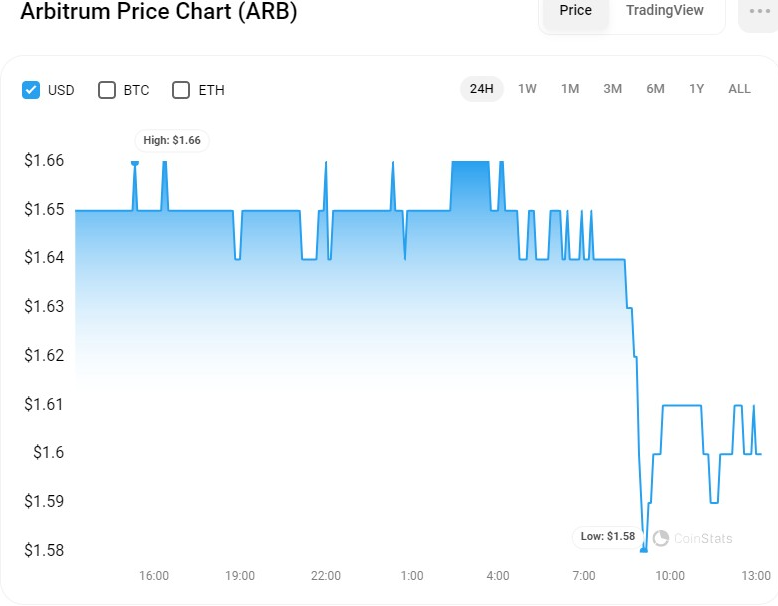

Similtaneously, the ARB heed has been in a bearish vogue within the final 24 hours after failing to breach the $1.66 resistance. Bear’s, for that reason, dipped the ARB heed to an intra-day low of $1.57, the put improve used to be established. At press time, ARB used to be procuring and selling at $1.60, a 3.07% decline from the day’s high.

ARB/USD 24-hour heed chart (source: CoinStats)

All around the upsurge, ARB’s market capitalization fell 3.06% to $4,249,904,411, whereas 24-hour procuring and selling volume elevated 26% to $326,845,231, respectively. This pattern signifies that merchants are amassing the tumble in ARB heed, which can perhaps seemingly expose a bullish mood available within the market.

Most popular Whale Actions and Market Reactions

Within the lead-up to the upcoming liberate, there used to be famous negate amongst Arbitrum token holders. Most popular reports from blockchain analytics platforms dangle highlighted main actions of ARB tokens to exchanges, particularly within the wake of a main liberate in March, the put $2.32 billion fee of tokens were released.

Following this event, transactions amounting to $18.5 million in ARB tokens were recorded as being transferred to Binance, indicating a doable preparation for liquidity events or income-taking by substantial holders.

4 extra whale wallets deposited 11.34M $ARB($18.5M) into #Binance ~20 hours within the past.https://t.co/hp1hIJgelihttps://t.co/ew0ysvXTgGhttps://t.co/3qyK8bjxEdhttps://t.co/E7423NzAi8https://t.co/pVNUsGxdMz pic.twitter.com/qDXIRconY8

— Lookonchain (@lookonchain) March 23, 2024

This pattern of behavior has had a noticeable function on the ARB market, with the token experiencing fluctuations in heed. Following the March liberate, ARB’s cost noticed a downward vogue, deviating from its peak prices earlier within the yr. These actions dangle sparked a combination of reactions all around the community, with some viewing the transfers as a conventional market negate. In contrast, others utter concerns over doable heed pressures attributable to these substantial-scale unlocks.

Upcoming Free up and Market Hypothesis

The April 16 token liberate is anticipated with fervent hobby by both merchants and the broader crypto community. The liberate of 92.65 million ARB tokens adds a brand fresh layer to the market’s dynamics, doubtlessly increasing the available provide and influencing heed actions.

In consequence, market members speculate on how this event might possibly seemingly impression ARB’s heed, thinking about the historic precedents suppose by previous unlocks and whale actions.

Arbitrum’s Initiatives

In parallel with these market events, Arbitrum continues to push ahead with initiatives geared towards bolstering its ecosystem and utility. The Arbitrum Basis recently announced the third fragment of its funding thought, concentrated on dApp projects across diverse domains. This stir underscores Arbitrum’s commitment to fostering innovation and growth within its network, doubtlessly enhancing the intrinsic cost of ARB tokens in some unspecified time in the future.

What’s fresh?

Grant Tracks.

– Segment 3 will proceed to level of curiosity on dApps but introduce a extra standardized manner to awarding grants: grant tracks.

– Initiatives will descend under a genuine grant note in accordance with the stage, growth projection & form.

– Each grant note can dangle…— Arbitrum (💙,🧡) (@arbitrum) March 29, 2024

Furthermore, the collaboration with entities love the NFT mark Azuki for the introduction of AnimeChain extra exemplifies Arbitrum’s efforts to develop its attain and utility within the Web3 space. These initiatives, coupled with the network’s rising Total Fee Locked (TVL) and user adoption, most modern a counterbalance to the instant market reactions to token unlocks, suggesting a sturdy long-period of time outlook for the Arbitrum ecosystem.

ARB/USD Technical Prognosis

On the ARBUSD 4-hour heed chart, the stochastic RSI vogue south with a ranking of 8.93 signifies that there might be seemingly to be extra negative motion within the short speed. This pattern means that there might be seemingly to be a procuring opportunity for merchants in quest of to enter the market at a more cost effective heed level. Since it’s oversold, merchants can also imagine placing aquire orders at key improve levels to steal advantage of future heed recoveries.

ARB/USD 4-hour heed chart (source: TradingView)

In addition, the Rate of Alternate (ROC) ranking of -2.90 signifies that the fee is currently decreasing at a common tempo, extra supporting the premise of a doable procuring opportunity. If the ROC shifts to the sure plot, it can perhaps seemingly ticket a reversal within the downward vogue, making it a good extra dazzling entry level for merchants.

Disclaimer: The knowledge presented in this article is for informational and tutorial functions handiest. The article would no longer constitute financial advice or advice of any form. Coin Model is now no longer liable for any losses incurred as a outcomes of the utilization of vow material, products, or companies mentioned. Readers are informed to negate caution sooner than taking any action connected to the company.