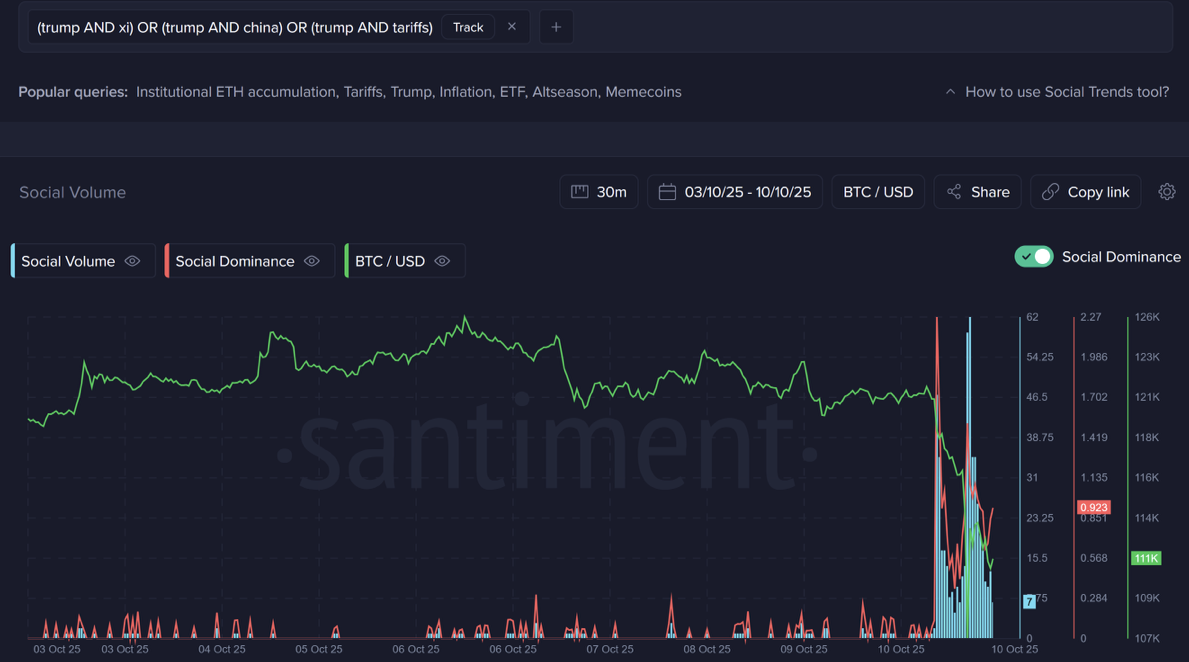

Crypto retail traders were immediate responsible Friday’s broader crypto market decline on US President Donald Trump asserting a 100% tariff on China, as they recurrently seek for for one thing to level the finger at at some level of downturns, per Santiment.

Analysts, on the alternative hand, snarl the motive for the market poke runs deeper than the tariffs on my own.

“That is approved ‘rationalization’ behavior from outlets, who have to show a novel tournament because the motive for a cataclysmic downturn in crypto,” Santiment stated in a order on Saturday.

“After the crash, the crowd immediate jumped to collectively advance to a consensus as to what the flush is likely to be attributed to,” Santiment stated, referring to the elevate in social media discussions connected to both the crypto market and US-China tariff concerns.

US and China tendencies will seemingly be significant for retail traders

Even though the geopolitical tournament used to be a catalyst for the market decline, it wasn’t the completely factor, per analysts from The Kobeissi Letter, who also pointed to “crude leverage and possibility” in the crypto market. The analysts necessary its heavy lengthy bias, with round $16.7 billion in lengthy positions liquidated versus merely $2.5 billion in shorts, a ratio of near to 7-to-1.

The major liquidation tournament got right here as Bitcoin (BTC) fell greater than 10% internal 24 hours, with the BTC/USDT futures pair on Binance falling to as cramped as $102,000 following Trump’s tariff announcement.

Santiment stated that tendencies between the US and China will “be central” in shaping crypto retail customers’ procuring and selling choices, at least in the immediate time duration.

Bitcoin falling beneath $100,000 predictions might perhaps well perchance emerge

Santiment added that if talks between Trump and Xi give a boost to and lead to “definite recordsdata,” retail sentiment toward crypto is likely to enhance.

On the alternative hand, if tensions escalate, traders might perhaps well perchance soundless brace for more pessimistic label forecasts. “Demand for the ‘Bitcoin sub-100K’ prediction floodgates to start out opening up,” Santiment stated, in conjunction with:

“Bitcoin, whether we discover it irresistible or not, is behaving more adore a possibility asset than a safe haven at some level of cases of country tensions.”

Sentiment plunged after the crypto market decline, with the Crypto Inconvenience & Greed Index, which measures overall crypto market sentiment, shedding to a “Inconvenience” level of 27 in Saturday’s substitute.

That represents a intelligent 37-level tumble from Friday’s “Greed” studying of 64, its lowest level in near to six months.