Ethereum developers enjoy officially situation December 3, 2025, as the date for the lengthy-awaited Fusaka upgrade. Merchants are already staring at carefully to search if Fusaka can gas the next indispensable rally.

The trading approach that follows change into generated by AI the use of proper-time market context, the historical impression of Pectra, and structured prompts designed to filter human bias.

The tip result is a pragmatic, step-by-step diagram aimed at helping recent traders enter Ethereum sooner than Fusaka without chasing the market or taking on pointless threat.

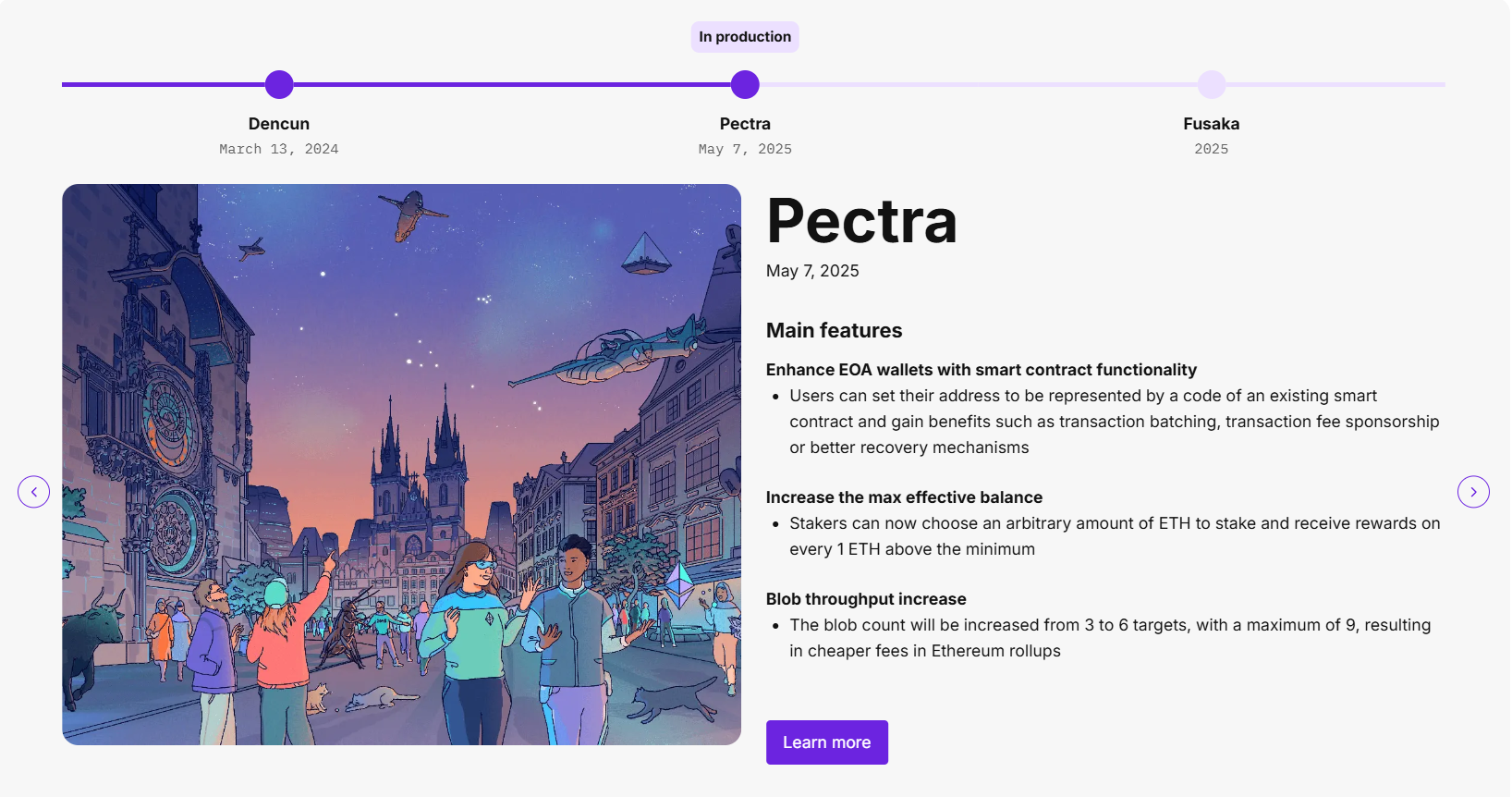

What Is The Ethereum Fusaka Give a boost to?

The Fusaka upgrade is Ethereum’s next indispensable community update. Its major diagram is to provide a boost to scalability and lower prices for customers and developers.

Major choices were made on nowadays’s Ethereum developer call, ACDC #165. Developers confirmed the public testnet schedule and BPO laborious fork schedule for Fusaka.

Let’s glean into it. pic.twitter.com/mNrYMYyDj2

— Christine D. Kim (@christine_dkim) September 18, 2025

Particularly, a key feature is PeerDAS (Discover Files Availability Sampling). This lets in validators to verify handiest aspects of broad knowledge blobs in desire to downloading them in fleshy.

So, the upgrade will decrease the burden on hardware and have the Ethereum community more efficient.

Also, Fusaka will extend blob potential. This can enable rollups and Layer-2 options to post more knowledge at lower prices.

Together, these changes converse Ethereum closer to its lengthy-term scaling roadmap identified as “the Surge.”

Ethereum Investment Technique Earlier than Fusaka

1. Realize the Context

- Ethereum trades in the $4,400–$4,600 fluctuate in September 2025.

- Traditionally, Ethereum upgrades (Shanghai, Pectra) created non everlasting rallies, adopted by revenue-taking.

- Fusaka specializes in scalability (PeerDAS, more blobs), which correct now benefits Layer-2 rollups and reduces transaction prices. That’s a bullish lengthy-term catalyst, however upgrades can also additionally situation off “sell the suggestions” occasions.

Takeaway: Recent investors may perchance well perchance restful enter with structured, phased exposure in desire to going all in.

2. Entry Technique: Phased Shopping (Greenback-Price Averaging)

Since ETH is “costly” now, recent investors may perchance well perchance restful plod entries.

Instance: $1,000 fund size (adjustable to any amount):

- 40% ($400): Aquire step by step correct thru September–October (sooner than testnet outcomes). Unfold into weekly buys to moderate entry ~ $4,400–4,600.

- 30% ($300): Attend for November. That is when Fusaka hype veritably builds. Allocate buys on dips (if ETH retests $4,200–4,300).

- 20% ($200): Attend as dry powder in case ETH dips laborious post-Fed meetings or into December.

- 10% ($100): Optionally accessible — allocate to a excessive-conviction Layer-2 token (Arbitrum, Optimism, or Inappropriate ecosystem initiatives), that may perchance well perchance rally more sturdy from Fusaka benefits.

Outcome: You unfold threat, accumulate dips, and slit back feel sorry about from chasing tops.

3. Trading Technique: Core + Swing Draw

- Core put: Attend at the least 50–60% of total ETH sold untouched unless Q1 2026. This ensures exposure to longer-term upside ($5,500+ if Fusaka adoption account performs out).

- Swing put: With the closing 40–50%, exchange around resistance ranges.

Instance (persevering with with $1,000 diagram):

- Core conserving: $600 ETH, correct stake or take care of in chilly storage.

- Swing trading: $400 ETH.

- If ETH breaks $4,700 and pushes $5,000, sell 25% ($100) to lock revenue.

- If ETH retraces to $4,300, re-deploy that $100 support in.

- Repeat the cycle.

This arrangement, you glean ETH over time whereas restful taking advantage of rallies.

4. Staking Technique (Optionally accessible for Prolonged-Termers)

- If planning to take care of ETH beyond Fusaka, take care of in thoughts staking ETH (by potential of Lido, Rocket Pool, or correct now).

- Most popular annualized staking yield: ~3–4%.

- For a $1,000 example, staking $600 core ETH generates ~$18–24/365 days. Puny, nonetheless it compounds over the years and offers exposure to staking incentives.

5. Risk Management

- Never dash 100% in one entry. Despite the incontrovertible truth that ETH rallies, searching for staggered reduces downside threat.

- Residing exit ranges:

- Take partial revenue attain $5,000–$5,200.

- Reload if ETH dips to $4,200–$4,300.

- Macro see: Fed coverage shifts, ETF flows, or Bitcoin tag corrections may perchance well perchance slither ETH. Continually take care of 10–20% money buffer.

6. Psychological Edge

- Don’t waddle green candles — better to miss the tip 5% of good points than glean trapped in a 20% correction.

- Treat Fusaka as a multi-month catalyst (Oct → Jan). Patience matters more than attempting to time one single rally.

Abstract Plan for First-Time Investors

- Allocate in phases: 40% now, 30% next month, 20% pre-Fusaka, 10% for non-compulsory L2 bets.

- Attend a core earn (50–60%) unless post-Fusaka, exchange swings with the the relaxation.

- Exhaust dips around $4,200–4,300 to scale in, rob earnings attain $5,000+.

- Stake lengthy-term ETH if conserving beyond the upgrade.

The post AI Finds Most efficient Ethereum Trading Plan Sooner than Fusaka Give a boost to regarded first on BeInCrypto.