A pockets reportedly linked to the Ethereum Basis has liquidated $13.3 million in ETH, elevating eyebrows and sparking conversations a pair of that you just may presumably be also possess designate decline.

The Ethereum Basis‘s resolution to liquidate $13 million fee of Ethereum (ETH) has left investors bearing in mind the transaction’s doable impact on the fee of the sphere’s 2nd-finest cryptocurrency by market capitalization.

Traditionally, the muse’s actions are thought of as precursors to market shifts, triggering concerns a pair of seemingly decline. No topic this, Ethereum displays bullish indicators as the charts search for this day.

A pockets linked to the #Ethereum Basis transferred 500 $ETH($13.3M) to #Cumberland Forwarder 10 hours previously.

The pockets got 47,814 $ETH($166M currently) from the #Ethereum Basis on Nov 8, 2015, when the fee used to be $1.02.https://t.co/xTwE67jL6a pic.twitter.com/4KbcbTK7ou

— Lookonchain (@lookonchain) March 4, 2024

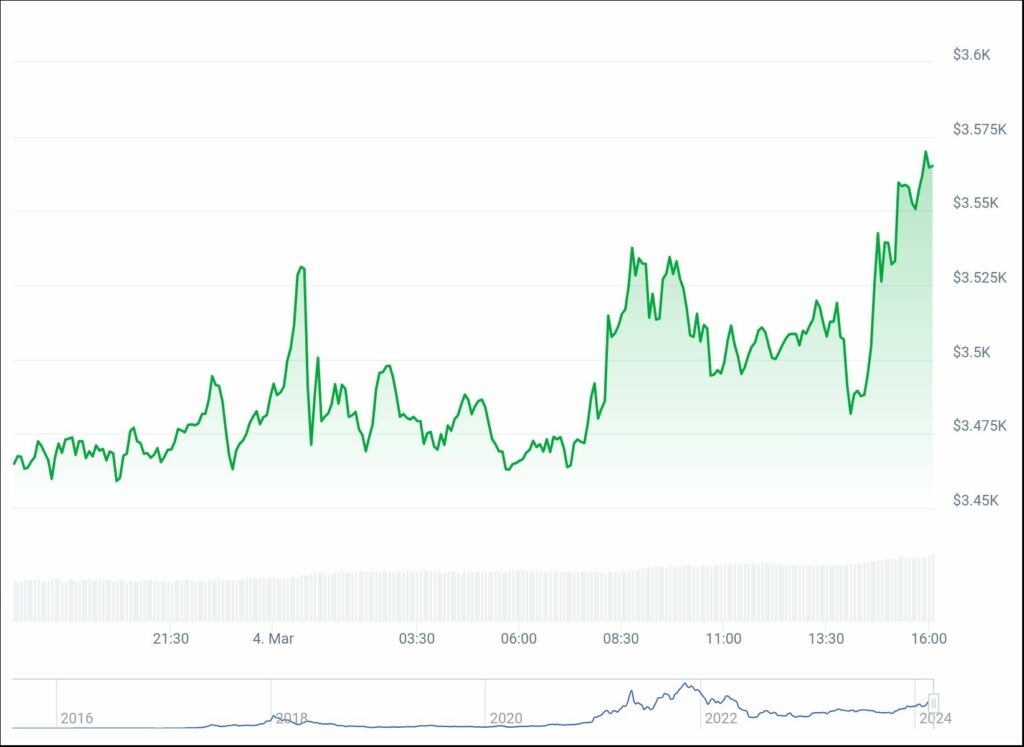

The Ethereum designate chart presents an optimistic search for with a solid uptrend, marked by consistently better highs and lows. For the time being trading at $3,550, Ethereum has experienced a 14.6% map bigger in the closing seven days, commanding a market cap of $420 billion and a crypto market dominance of 17.8%, in accordance with CoinGecko.

Though market pullbacks are pure in an uptrend, they induce investor anticipation as the market awaits its subsequent pass. The weekly Relative Energy Index (RSI) stands at 89.95, drawing near the overbought zone, suggesting a that you just may presumably be also possess correction, which aligns with the Ethereum Basis’s restful sell-off.

You may maybe presumably presumably additionally love: Ethereum designate targets $4k as investors switch $2.1B to prolonged-time interval storage

Within the broader market context, Bitcoin (BTC) has won over 28% in the closing seven days, nearing its all-time excessive of $69,000 in November 2021. On the time of writing, the fee of BTC is hovering around the $67,000 put.

Meanwhile, the Ethereum network is making ready to set off the Dencun replace, combining Cancun and Deneb updates. Scheduled for Mar. 13, this development intends to very much cut layer-2 transaction costs while improving Ethereum’s scalability, efficiency, and security.

On Feb. 27, the Ethereum Basis introduced that it had efficiently activated the increase on take a look at networks.

like a flash notes from the eth dev name this morning, acdc #128:

dencun 🐡

– all consumer groups, excluding lodestar, personal released final tool variations for the dencun increase

– these variations plus the dencun-ready candidate consumer for lodestar are currently being examined on one closing…— Christine Kim (@christine_dkim) February 22, 2024

Final month, Ethereum experienced colossal enhance, attracting 1.8 million novel customers to its network. Santiment’s metric monitoring funded Ether wallets printed a surge, with the overall ETH holders reaching 115.5 million addresses.

In inequity, BTC witnessed a decline of 70,000 pockets addresses in the center of the the same interval, underlining Ethereum’s market dominance.

The rising quiz from novel ETH addresses and a $2.3 billion decrease in alternate present positions Ethereum favorably for a seemingly advance in opposition to $4,000 in March 2024.

Spot Ethereum ETF possibilities

Amidst Ethereum’s certain trajectory, more than one issuers are seeking approval for space Ethereum ETFs, mirroring the success of space BTC merchandise. Nevertheless, SEC delays and commissioner feedback ticket at challenges on the avenue forward.

An upcoming meeting between the U.S. Securities and Alternate Payment (SEC) and space Ethereum ETF candidates later this month, will settle the destiny of Ether-essentially based entirely investment autos. Choices on the merchandise are postponed unless Also can at the earliest, with VanEck’s submitting main the queue. The SEC’s approval or rejection by Also can 23 will influence varied issuers, including BlackRock, Franklin Templeton, Grayscale, and Invesco Galaxy.

The approval of space Bitcoin ETFs in January marked a wide pattern after years of rejections. This resolution, influenced by a Grayscale lawsuit in opposition to the SEC, used to be viewed as a turning level in legitimizing crypto adoption and investment in the US.

You may maybe presumably presumably additionally love: Ethereum designate hits $3k, outperforms Bitcoin no topic $36b ETF inflows