Stablecoin payment volumes are projected to exceed $1 trillion yearly by the discontinue of this decade, consistent with a Thursday joint bellow from crypto market maker Keyrock and Latin American alternate Bitso.

That boost will likely be driven by institutional adoption all the contrivance by commerce-to-commerce (B2B), see-to-see (P2P) and card payment rails, sectors which beget already showed indicators of like a flash uptake, the authors acknowledged.

The bellow underscored why stablecoins are gaining floor in funds: they are able to outcompete historical payment programs on both flee and rate. Sending $200 by a bank would per chance maybe elevate payments identical to as a lot as 13% and defend shut days to set up, whereas stablecoins can full the transaction in seconds at a portion of the value, the bellow acknowledged.

International alternate (FX) settlement is at risk of be the supreme untapped change, consistent with the bellow. The $7.5 trillion-a-day FX market detached largely settles on a T+2 foundation by correspondent banks. Meanwhile, on-chain FX utilizing stablecoins would per chance maybe enable atomic swaps with advance-quick settlement and lower counterparty risks, the bellow suggested.

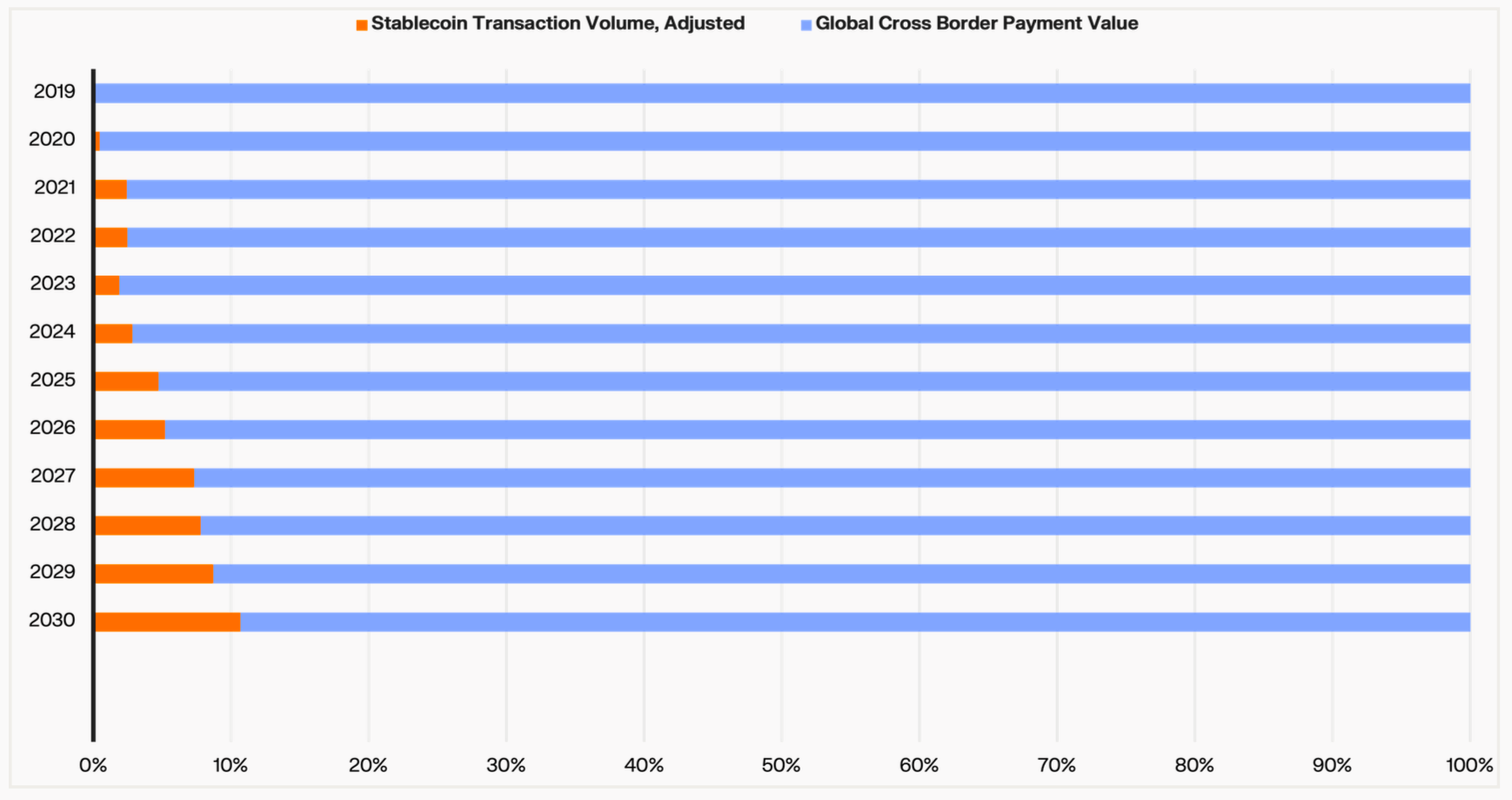

Such efficiencies would per chance maybe additionally transform wicked-border payments. With more regulatory readability, higher liquidity and interoperability, stablecoins would per chance maybe contend with as indispensable as 12% of all wicked-border payment flows by the discontinue of the decade.

Given the opportunities, the authors forecasted that every main fintech companies will eventually combine stablecoin infrastructure over the few next years, sincere as instrument-as-a-service (SaaS) instruments grew to develop into ubiquitous.

In apply, that can mean wallets and payment platforms sharp value on-chain, treasury desks keeping stablecoins and deploying for a yield and merchants settling straight in more than one currencies.

The like a flash boost of stablecoins, which beget a market cap of $260 billion, would per chance maybe additionally beget ripple effects on financial policy. Stablecoin provide would per chance maybe reach 10% of the U.S. M2 money provide in a bull case, up from 1% at the present time, and signify roughly a quarter of the U.S. Treasury invoice market and influence how the Federal Reserve manages non eternal ardour charges.

Read more: JPMorgan Sees Stablecoin Market Hitting $500B by 2028, A long way Underneath Bullish Forecasts