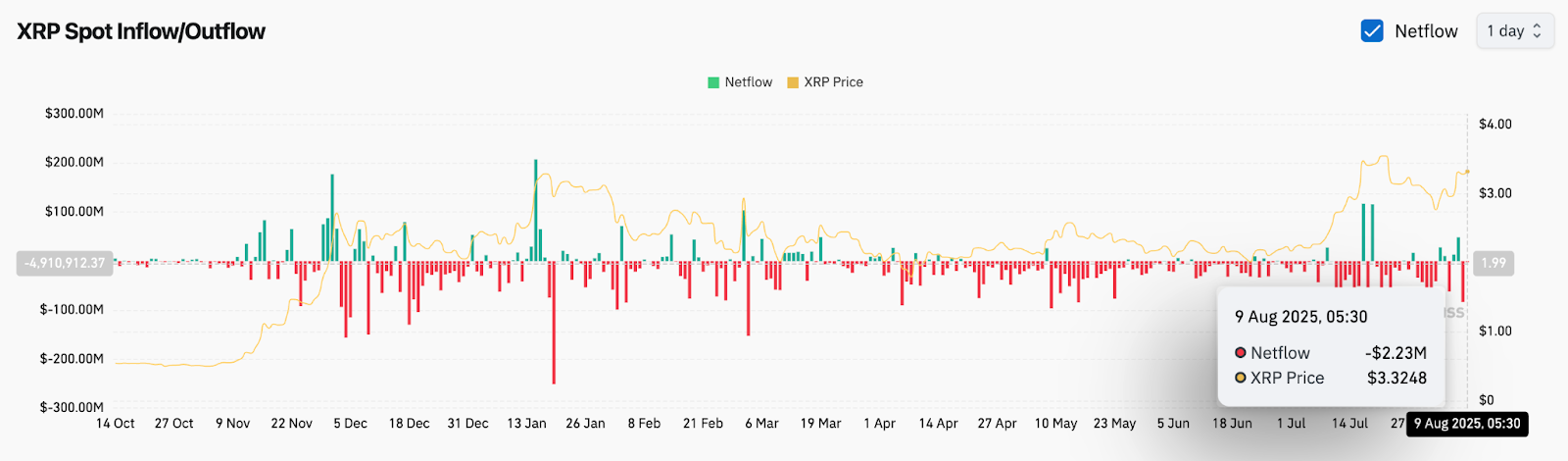

XRP ticket has staged a solid rebound after last week’s pullback, improving from lows shut to $3.09 to retest the $3.34 resistance zone. The tear follows a neat bounce off the day-to-day query house around $3.00–$3.10, with place netflow recordsdata showing $2.23M in outflows on August 9, suggesting accumulation by prolonged-time frame holders. Nonetheless, overhead trendline resistance is conserving ticket capped within the shut to time frame.

What’s Going down With XRP’s Attach?

XRP ticket dynamics (Provide: TradingView)

On the day-to-day chart, XRP ticket this day is consolidating interior a descending triangle pattern that fashioned after the engaging rally toward $3.80 in leisurely July. Attach is now pressing in opposition to the triangle’s better boundary around $3.34–$3.35. A breakout above this stage would possibly possibly maybe maybe originate the door toward $3.55–$3.56, which marks the subsequent provide zone.

XRP ticket dynamics (Provide: TradingView)

The recovery from $3.09 became as soon as supported by a solid bullish engulfing candle on August 8, which flipped non permanent momentum. Request of remains viewed within the $3.00–$3.10 zone, which aligns with prior breakout ranges and the 4-hour Supertrend improve at $3.098.

Why XRP Attach Going Up This day?

XRP Self-discipline Inflow/Outflow Knowledge (Provide: Coinglass)

Essentially the most crucial driver of why XRP ticket going up this day is a combination of technical rebound and solid place query. Netflow recordsdata reveals a $2.23M outflow from exchanges, usually a signal of reduced promote stress. Furthermore, the DMI indicator on the 4-hour chart reveals +DI at 25.09, rather sooner than -DI at 23.76, indicating a bullish edge.

XRP ticket dynamics (Provide: TradingView)

On the 4-hour Bollinger Bands, ticket is preserving above the mid-band at $3.18, conserving the non permanent construction certain. EMAs stay in bullish alignment, with the EMA20 at $3.212 and EMA50 at $3.182 performing as dynamic improve. Nonetheless, the upper Bollinger Band at $3.49 is the subsequent upside reference, that would possibly possibly maybe maybe maybe also act as resistance forward of a doable continuation better.

Attach Indicators Existing Breakout Capacity

XRP ticket dynamics (Provide: TradingView)

Desirable Money Ideas on the day-to-day chart highlight a most up-to-the-minute BOS (Rupture of Structure) from the $2.80 fluctuate, reinforcing the bullish market construction. A neat damage above $3.34 with quantity would possibly possibly maybe maybe behold an prompt tear toward $3.55–$3.56. Beyond that, $3.80 remains the critical upside target from the July highs.

Conversely, failure to interrupt above $3.34 would possibly possibly maybe maybe trigger a retest of $3.18 and $3.09. Losing $3.09 would shift focus toward the $2.87–$2.90 improve zone, which also aligns with the 200 EMA on the 4-hour chart.

Bollinger Band width remains moderately expanded, suggesting volatility is restful packed with life and succesful of fueling a breakout if momentum builds. The Supertrend remains bullish above $3.098, reinforcing that investors at negate devour adjust of the non permanent vogue.

XRP Attach Prediction: Short-Time-frame Outlook (24H)

If XRP ticket this day closes above $3.34, the subsequent 24 hours would possibly possibly maybe maybe behold an impulsive push toward $3.49, followed by $3.55. Breaking previous $3.56 would toughen the case for a retest of $3.80.

On the map back, a rejection from $3.34 would possibly possibly maybe maybe result in a pullback to $3.18, with $3.09 because the critical improve for bulls to defend. A fall below this stage would possibly possibly maybe maybe shift sentiment bearish and target $2.87.

Given the combination of bullish EMA construction, healthy place outflows, and strengthening DMI readings, the non permanent bias remains cautiously bullish, with $3.34 because the breakout trigger stage.

XRP Attach Forecast Table: August 10, 2025

| Indicator/Zone | Stage / Signal |

| XRP ticket this day | $3.325 |

| Resistance 1 | $3.340 |

| Resistance 2 | $3.550 |

| Pork up 1 | $3.180 |

| Pork up 2 | $3.090 |

| EMA20 / EMA50 (4H) | $3.212 / $3.182 (Bullish Stack) |

| 200 EMA (4H) | $2.973 |

| Bollinger Bands (4H) | Mid: $3.182, Upper: $3.492 |

| Supertrend (4H) | Bullish above $3.098 |

| DMI (4H) | +DI 25.09, -DI 23.76, ADX 13.01 |

| Self-discipline Netflow (Aug 9) | -$2.23M (Bullish Bias) |

| Key Request of Zone | $3.00–$3.10 |

Disclaimer: The recordsdata presented listed here is for informational and academic positive aspects most reasonable doubtless. The article does not recount financial advice or advice of any kind. Coin Model is to not blame for any losses incurred because the utilization of protest, products, or companies talked about. Readers are suggested to exercise caution forward of taking any motion connected to the firm.