XRP is trading moral below the serious $2 heed, a level that served because the local prime in some unspecified time in the future of the 2021 bull cycle. The cost has been step by step mountain climbing, fueled by bullish momentum, and seems poised to push increased. Traders and analysts intently video display the charts for a definitive signal to verify a breakout above this indispensable resistance.

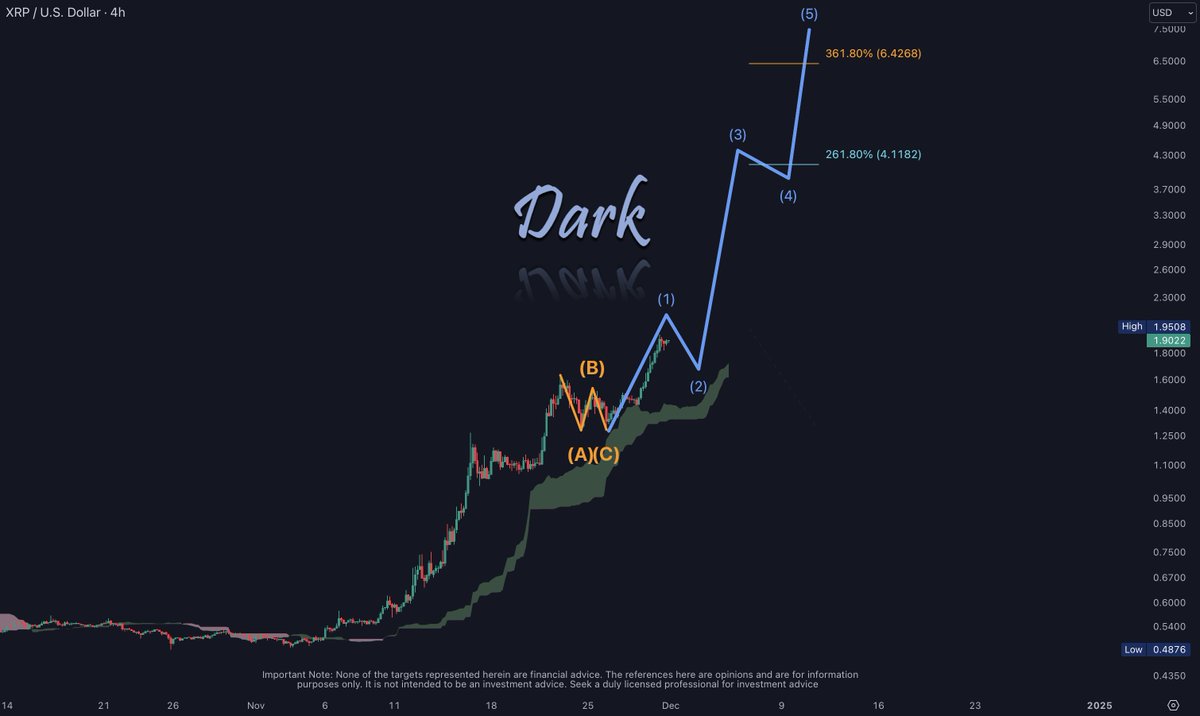

This psychological trace level is a level of interest for market contributors, with a winning breach potentially marking the origin of a sustained rally. High analyst and investor Darkish Defender has weighed in on XRP’s outlook, sharing a detailed technical diagnosis on X. Per his insights, XRP is predicted to reach $2.13 within the coming days earlier than experiencing a fleet correction. Darkish Defender also anticipates additional trace gains following this pullback as XRP continues to attract bullish sentiment.

A confirmed breakout above $2 can also pave the come for trace spanking sleek multi-yr highs, whereas a failure to surpass this level can also consequence in quick volatility. With its historical significance and unique market dynamics, the $2 heed represents each an quite loads of and a self-discipline for XRP. All eyes are now on whether the token can reclaim this milestone and chart a route increased.

XRP Attracts New Set a query to of

XRP has surged over 50% this week, using a wave of sleek search files from that continues to propel its trace in direction of sleek provide ranges. The bullish momentum has sparked indispensable hobby among investors and analysts, with many speculating on the token’s next cross.

High analyst and investor Darkish Defender shared a detailed technical diagnosis on X, highlighting XRP’s evolving market building on the 4-hour chart. Per his insights, XRP is more doubtless to contact $2.13 soon earlier than facing a doable correction.

Darkish Defender’s diagnosis also identifies key resistance ranges on the 4-hour timeframe. Critically, resistances at $4.11 and $6.42 align with his secondary trace target of $5.85, which follows a give a enhance to retest at $1.88. These ranges point out a roadmap for XRP’s trace motion if the unique rally sustains its momentum.

As XRP approaches these serious trace zones, the coming weeks will most doubtless be pivotal in figuring out its trajectory. Whereas the bullish sentiment dominates, the assorted of corrections or consolidations remains. A decisive damage above $2.13 can also birth the door to sleek highs, nonetheless failure to care for key ranges can also invite quick volatility.

For now, XRP’s spectacular efficiency and emerging search files from set it as one amongst basically the most intently watched property within the crypto market.

Reaching Multi-Year Highs

XRP is at point out trading at $1.88 following a resounding speed since November 5, marking a staggering 285% amplify in lower than 30 days. The cost now no longer too long ago tagged $1.95, a indispensable level, and has since entered a consolidation section because it gathers momentum to push previous the pivotal $2 heed. This consolidation means that XRP is building the needed gas for a doable breakout.

The cost motion remains decisively bullish, supported by solid market sentiment and rising search files from. Analysts are intently staring at the cycle’s prime at $1.97, as breaking above this level would doubtless signal the launch up of a brand sleek leg increased. A confirmed breakout previous $1.97 would now no longer handiest toughen the bullish building nonetheless can also additionally propel XRP to uncharted highs, aligning with predictions of a parabolic rally.

Nonetheless, consolidation shut to those ranges signifies that XRP is facing quick resistance. Market contributors are now eyeing key give a enhance to zones to make certain that the unique bullish momentum remains intact. If the upward stress continues, XRP’s next targets can also rapid surpass historical ranges, solidifying its set as one amongst the leading property within the crypto set. For now, XRP remains a level of interest for merchants and investors because it inches nearer to the $2 threshold.

Featured image from Dall-E, chart from TradingView