No subject definite traits, XRP Set is tranquil combating value factors, which has caused some analysts to evaluation it to Bitcoin in its early stages.

XRP changed into as soon as procuring and selling at $0.574 on August 29 after Bitcoin pulled encourage from the most trendy high of $65,000. The token’s efficiency has been reasonably glum, with a 6% drop in the month to this level, which has been reasonably disappointing to many traders.

XRP Set Underperforms Amid Market Volatility

No subject the high expectations for the token, it has underperformed other major coins equivalent to Solana (SOL) and Bitcoin.

SOL has increased by 565% in the year, whereas Bitcoin has obtained 119% of its charge since the beginning of the year. Equally, XRP has increased by solely 5% in the year to this level, which demonstrates its endured glum efficiency.

This efficiency has improved particularly after certain events passed off, as an example, the end of Ripple’s four-year lawsuit and Ripple stablecoin open. However, even though the inquire of of for XRP has increased, and more companies are integrating the asset into their charge merchandise, the cost of XRP has now no longer followed swimsuit, as would be anticipated.

Market Analysts Plot Parallels with Bitcoin’s Early Days

To this end, some market analysts like sought to console the traders by evaluating the most trendy reveal of XRP to the early days of Bitcoin. MOLT MEDIA analyst identified that Bitcoin changed into as soon as as soon as laughed at when its value changed into as soon as below $1. On the time, folks doubted the cost of Bitcoin, but now it is miles procuring and selling at round $60,000.

This comparison implies that XRP would be overemphasized and underestimated in a a connected manner as Bitcoin changed into as soon as greater than ten years previously. Ripple’s proponents bear in mind that XRP is smartly positioned for future speak given the strategy of the global funds market, which is value a total lot of trillion dollars. Whereas Bitcoin changed into as soon as essentially idea to be as as a digital currency, XRP is touted as a charge protocol for unsuitable-border transactions which is a immense market.

The lawsuit ended correct two days previously, and the XRP community is already reacting impatiently. It is astonishing how snappy XRP holders put a question to good points, they’re potentially the most impatient traders in crypto. Be conscious, nothing goes up in a straight line. Bitcoiners waited 15 years for…

— Mr. Huber🔥🦅🔥 (@Leerzeit) August 9, 2024

One other XRP suggest Mr. Huber every so often called for tranquil amongst the traders regarding the fact that Bitcoin has taken 15 years to envision its most trendy charge. He identified that XRP has been round for nearly the connected time and can preserve conclude a connected time to develop.

Analysts Predict Intrepid Set Targets for XRP Set

However, there are tranquil some analysts who like placed high value targets on XRP and put a question to it to rally substantially. Prolonged-length of time technical evaluation equipped by Analyst Javon Marks urged that XRP might well also perchance hit $150. He identified a descending triangle sample which signifies a imaginable breakout and can result to giant value fluctuation.

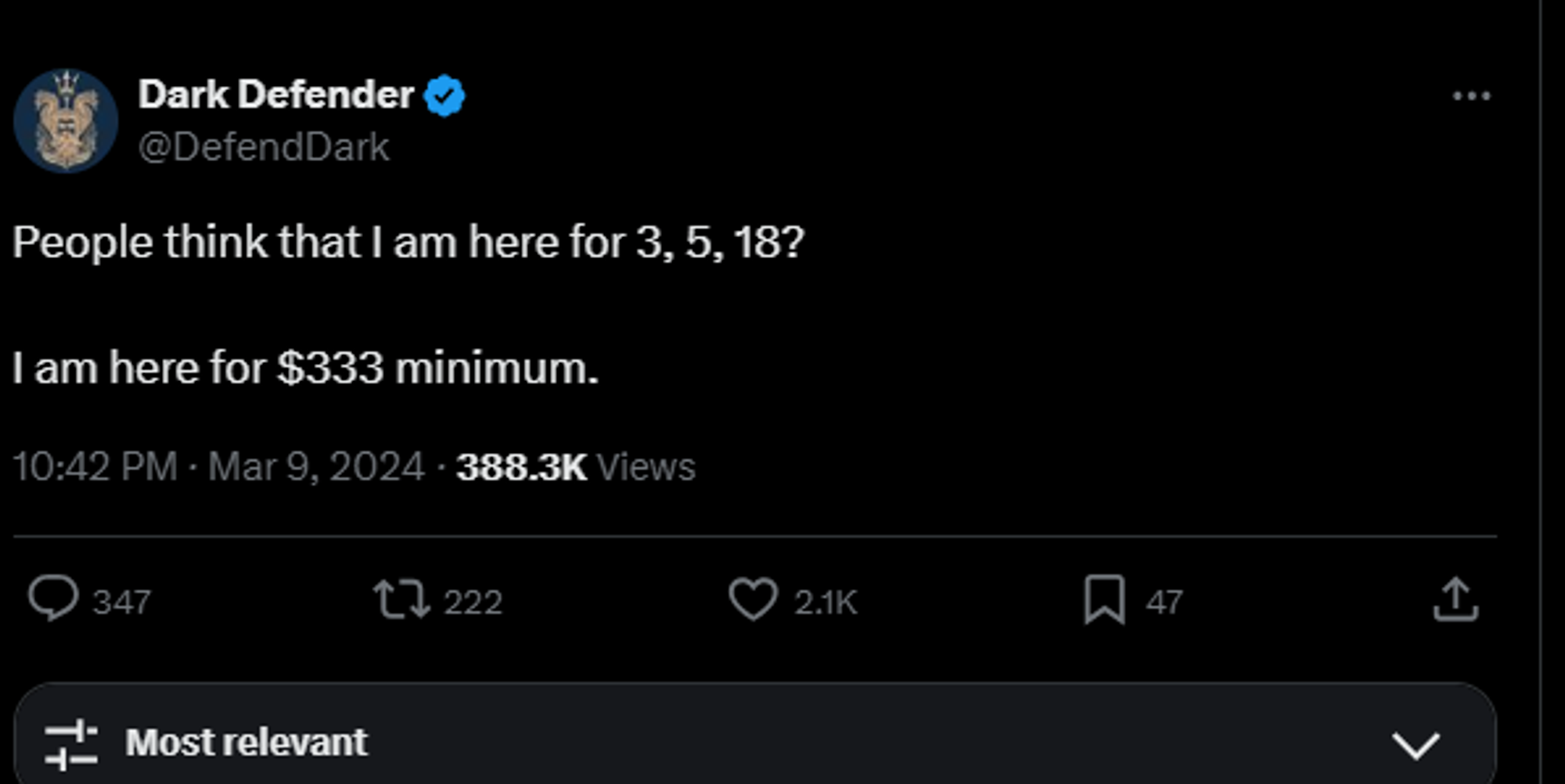

One other analyst, Darkish Defender, has placed a purpose of $333, declaring that XRP might well also spoil by vital resistance phases. In accordance with him, if XRP is able to overcome these hurdles, it’d also lead to a imaginable surge in its value.

A more audacious prediction comes from analyst Flash, who forecasted XRP might well also upward push to $587. His evaluation is in accordance with a symmetrical triangle sample on XRP’s weekly chart, which he believes signals a vital breakout. No subject skepticism from some market members, Flash stays optimistic a few ability 100,000% value magnify.

Seemingly for a Breakout as Merchants Exhibit Self assurance

No subject most trendy setbacks, on-chain recordsdata implies that bullish traders remain eager for a ability breakout. XRP reached a 20-day high of $0.63 earlier than retracting by 8% consequently of earnings-taking. However, XRP’s alternate reserves like fallen below 3 billion coins, suggesting a rising pattern toward long-length of time preserving amongst traders.

This decrease in alternate reserves in most cases reflects investor self perception in an asset’s future possibilities, as fewer tokens are accessible for procuring and selling. On the beginning of August, XRP alternate deposits had been at 3.12 billion coins but dropped to 2.97 billion by August 29. This low cost represents a vital withdrawal, potentially signaling a bullish outlook.

The Keltner Channel and Steadiness of Vitality indicators also recommend that XRP is at a prime juncture. If the cost can leap off the most trendy toughen level of $0.59, a flee in direction of the $0.63 resistance level is possible. Breaching this threshold might well also lead to a rally in direction of the $0.70 designate, potentially triggering extra upward momentum.