- Whales possess dumped $1.9B in XRP, sparking fears of a 30% tag atomize.

- SEC ruling and ETF recordsdata could maybe well location off a predominant tag reversal.

- XRP must preserve $2.65 or possibility falling toward $2 make stronger.

XRP tag is down 15.7% from its only currently location all-time high, slipping from $3.65 to around $3.07, as heavy whale sell-offs and looming regulatory tendencies ship ripples throughout the market.

Despite keeping above $3, the broader sentiment stays fragile, with analysts warning of a potential 30% drop if make stronger phases give methodology.

As shoppers await a indispensable US SEC decision that also can redefine XRP’s regulatory location, broad holders are quietly exiting the market in volumes not considered for the reason that closing predominant correction earlier this year.

The timing of these outflows, blended with weakening momentum indicators and fading volume, has traders on edge.

Whales offload billions as effort returns

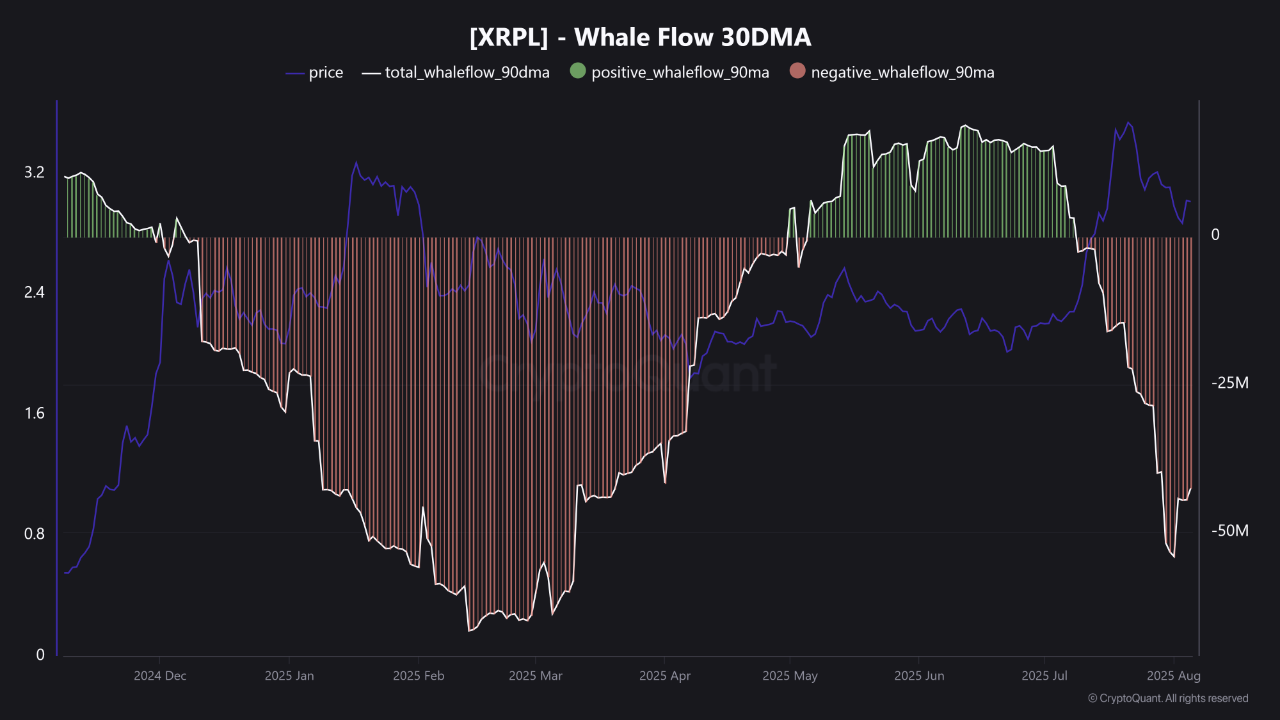

Over the last month, XRP whales possess unloaded extra than 640 million tokens, price roughly $1.91 billion, in accordance to on-chain records analysed by The Enigma Trader on CryptoQuant.

These outflows, most of which came about whereas XRP traded between $2.28 and $3.54, possess raised indispensable concerns among market observers.

Particularly, this pattern of distribution at some stage in tag rallies mirrors earlier exercise in January and February, when an identical sell-off preceded a pointy correction.

This time, on the opposite hand, there is a broader structural weak point all the contrivance in which through altcoins, with XRP extra and extra showing indicators of fatigue.

Santiment records also reveals $6 billion in XRP was once dumped by whales for the reason that July 18 prime.

Even Ripple co-founder Chris Larsen reportedly provided $26 million price of XRP in July, at the side of to concerns that insiders and early holders are taking earnings earlier than potential downside.

XRP momentum stalls, make stronger phases below stress

While the XRP tag only currently managed to push above the $3 tag, rising from $2.91 to $3.08 forward of closing at $3.07 at press time on August 7, technical momentum stays flat.

Making an are attempting to search out stress came largely from Korean exchanges, especially Upbit, which processed over $95 million in XRP trades internal in some unspecified time in the future.

Nonetheless, regardless of the rapid-interval of time surge, the token failed to preserve above $3.02, with volume fleet fading.

On the moment, the $2.98 stage serves as immediate make stronger. If this stage fails, the next indispensable ground lies at $2.65.

Analysts warn that a sustained breakdown below this make stronger could maybe well location off a drop to $2.06, a key point out-reversion point aligned with XRP’s 50-week EMA.

Adding to bearish concerns, XRP’s relative strength index (RSI) has been printing lower highs since January, even because the price reached contemporary peaks.

This bearish divergence generally indicators weakening momentum and has traditionally preceded engaging pullbacks.

SEC decision and ETF hopes raise volatility

Great of essentially the most traditional uncertainty also stems from the upcoming SEC decision regarding Ripple’s attraction withdrawal.

The company is anticipated to deliberate on the subject this week, with a broader ruling likely by mid-August.

If the SEC formally recognises XRP as a non-security below US regulation, it could maybe perchance most likely well maybe also keep away with a longstanding regulatory possibility.

Nonetheless, till that ruling is finalised, market contributors remain cautious. A favourable end result could maybe well revive bullish momentum, but any delay or ambiguity could maybe well intensify most traditional selling stress.

Meanwhile, global tendencies provide a glimmer of hope. Japan’s SBI Holdings only currently filed for a Bitcoin-XRP ETF, signalling renewed institutional pastime.

Reviews counsel corporates are exploring as much as $1 billion in XRP allocations for treasury diversification, which could maybe well add indispensable ask if market prerequisites stabilise.

Eyes on $3.05 as key XRP tag breakout stage

Despite the bearish overhang, derivatives records uncover traders are positioning for a potential breakout.

Per Coinglass, bullish bets on XRP perpetual contracts within the point out time outnumber shorts virtually 2-to-1, some distance extra aggressive than positioning considered in Bitcoin or Ethereum markets.

Alternatives traders, too, are centered on the $3.20 strike for contracts expiring in late August, suggesting expectations of a rebound if key phases preserve.

Nonetheless, without renewed accumulation from whales — at the least 5 million XRP per day, in accordance to analysts — the market could maybe well continue to fight.

Till then, the $3.05 stage stays the next take a look at. A realizing rupture above it could maybe perchance most likely well maybe also commence a course to $3.14 and $3.25, especially if the SEC decision or ETF momentum breaks in XRP’s favour.