U.S.-listed characteristic XRP$2.0042 substitute-traded funds (ETFs) non-public recorded 30 consecutive trading days of uncover inflows since their debut on Nov. 13, setting them other than bitcoin and ether ETFs that skilled multiple days of outflows over the the same duration.

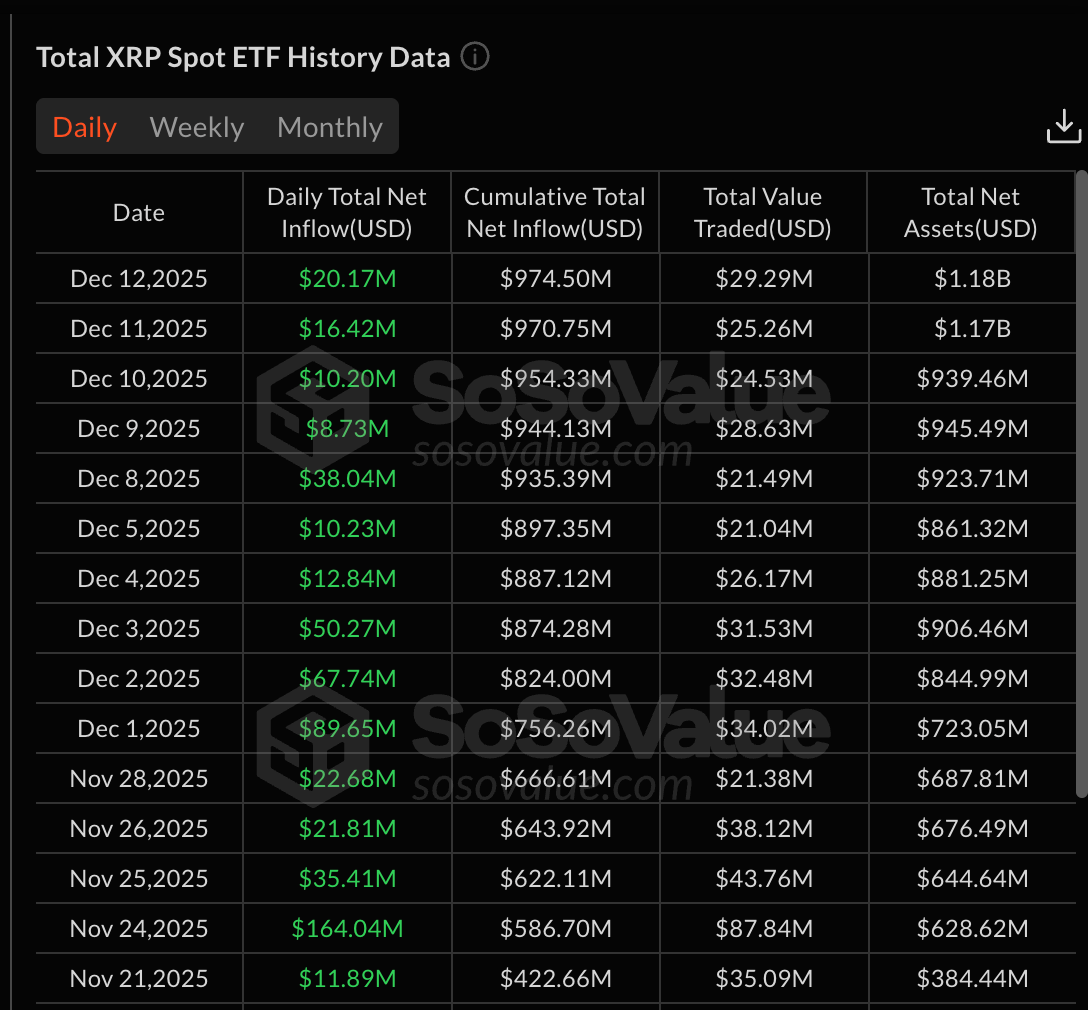

Recordsdata from SoSoValue reveals XRP characteristic ETFs non-public attracted contemporary capital every trading day since open, lifting cumulative uncover inflows to about $975 million as of Dec. 12. Complete uncover assets all the scheme in which during the merchandise non-public climbed to roughly $1.18 billion, with out a single session of uncover redemptions recorded.

The uninterrupted hotfoot contrasts sharply with accelerate patterns in extra established crypto ETFs. U.S. characteristic bitcoin and ether funds — which collectively account for the majority of crypto ETF assets — both noticed pause-birth flows in most modern weeks as traders reacted to transferring passion-payment expectations, equity-market volatility and concerns round abilities-sector valuations.

XRP-linked merchandise, by comparison, drew precise (albeit critical smaller) allocations during the the same ambiance, suggesting search recordsdata from pushed less by non everlasting macro positioning and more by asset-specific concerns.

The consistency could maybe possibly contemporary XRP ETFs being primitive as a structural allocation in would like to a tactical trading instrument. Whereas bitcoin ETFs on the total act as a proxy for broader liquidity stipulations, XRP funds seem like taking pictures passion from traders seeking differentiated crypto publicity internal regulated autos.

The accelerate profile additionally reflects a broader evolution within the crypto ETF market. Reasonably than concentrating capital entirely in bitcoin and ether, traders are increasingly more spreading publicity all the scheme in which through quite so a lot of assets with clearer employ cases in payments and settlement infrastructure.