As of Feb. 9, 2025, XRP hovered at $2.41, commanding a market valuation of $138 billion—trailing at the lend a hand of USDT’s $141 billion valuation in fourth self-discipline—whereas posting a 24-hour turnover of $3.2 billion and an intraday dance between $2.39 and $2.50.

XRP

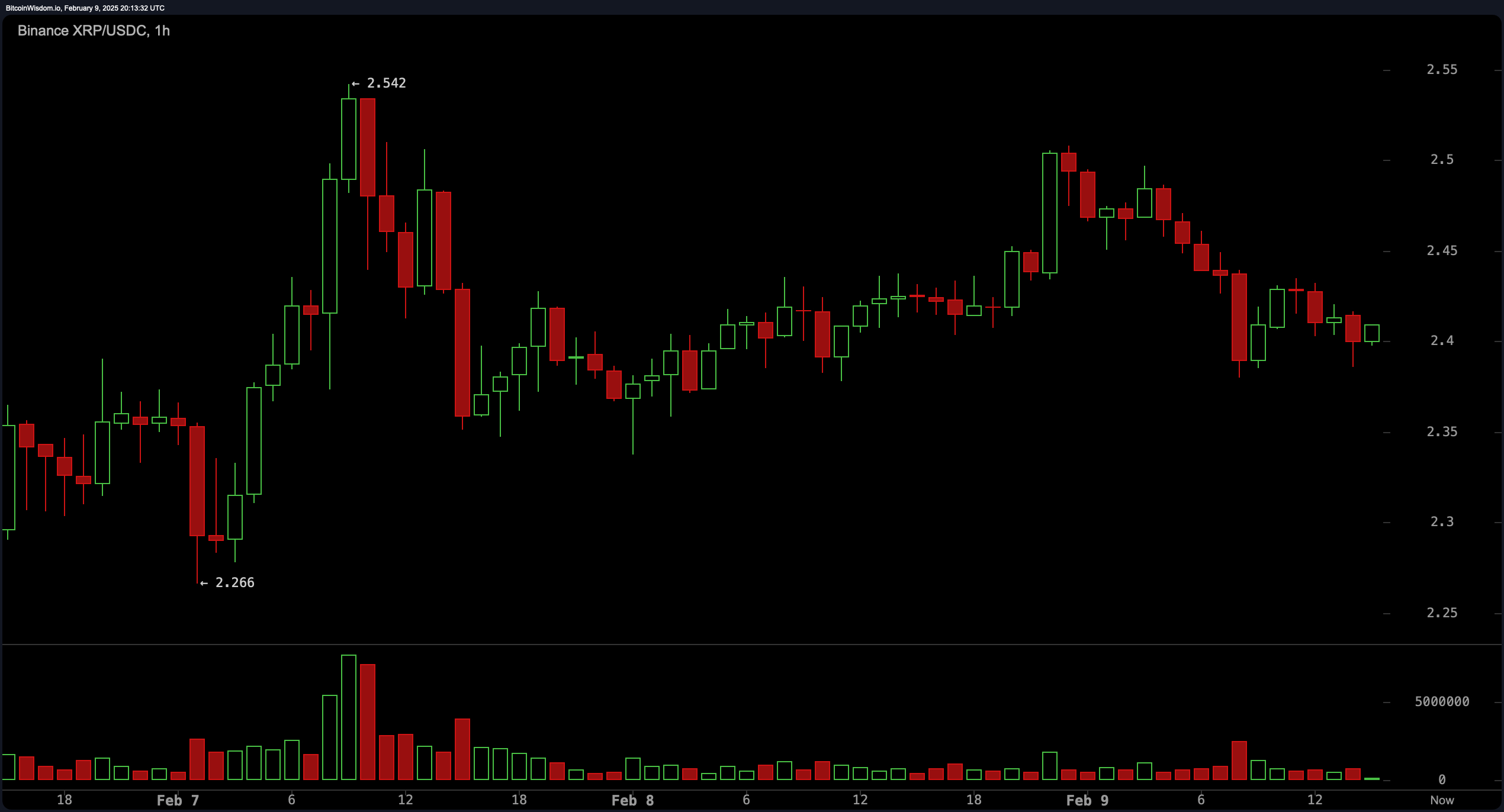

XRP’s 1-hour chart exhibits a part of lateral equilibrium, with prices oscillating between $2.35 and $2.Forty five. A defensive position has emerged reach $2.30, the effect purchasing whisper has materialized, whereas the $2.5 threshold acts as a ceiling for bullish advances. Trading whisper has tapered off, hinting at muted participation; a definitive breakout keep is mandatory earlier than directional commitments. A optimistic sample reach $2.35-$2.40—similar to higher lows or a reversal candlestick—can also simply converse a strategic entry, with income-taking horizons at $2.50 and $2.60.

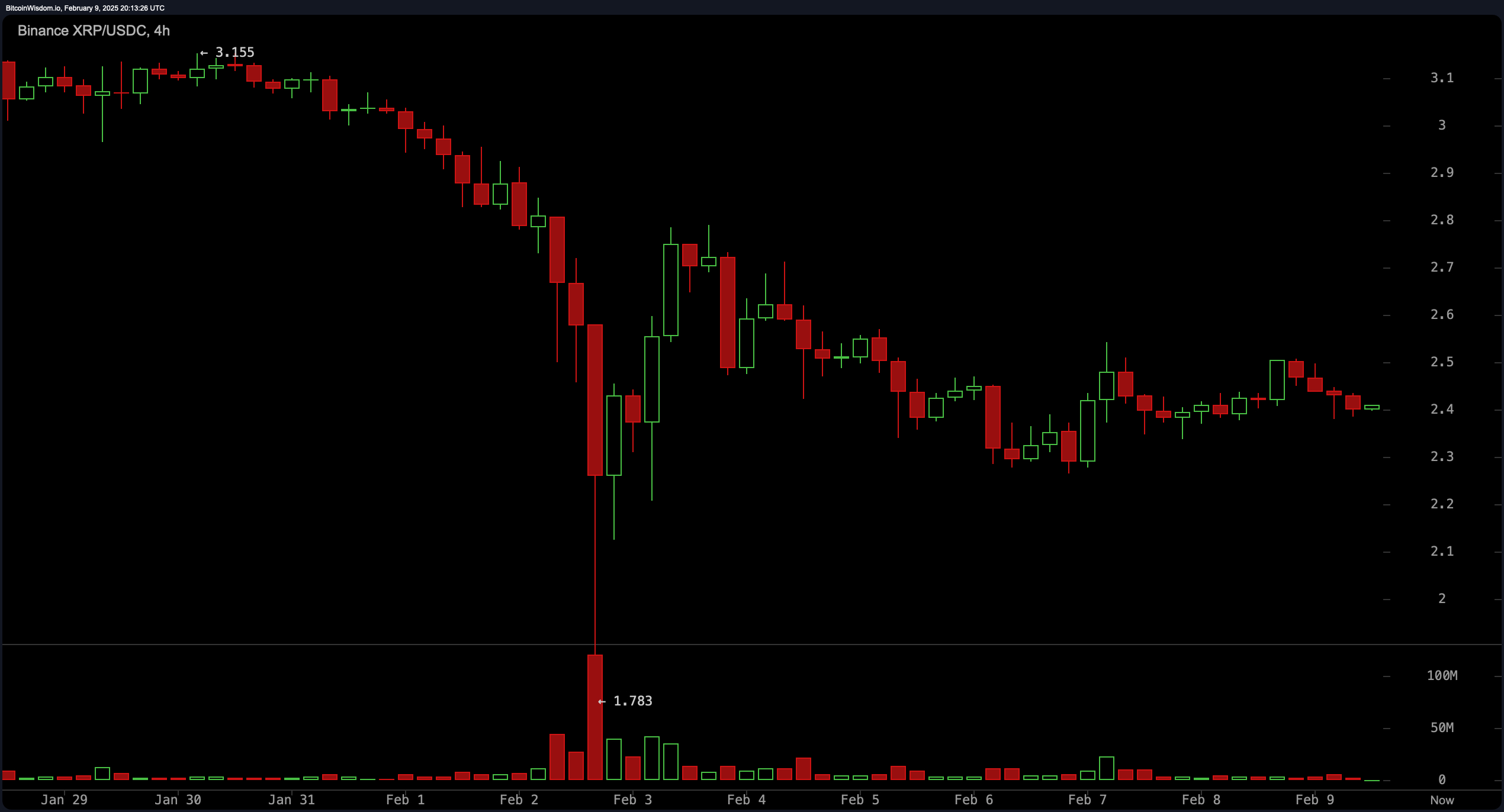

The 4-hour timeframe illustrates a long descent from $3.10 to $2.30, the effect prices safe came upon tentative footing. This hints at a provisional frightful, although distribution dynamics linger. Overhead provide looms at $2.50-$2.60, positioning a basing sample reach $2.30-$2.40 as a tactical entry. Stealth accumulation at XRP’s enhance zones serves as a harbinger of reversal, advising partial exposure reduction at $2.60 and total exits around $2.80 can also simply easy vigor return.

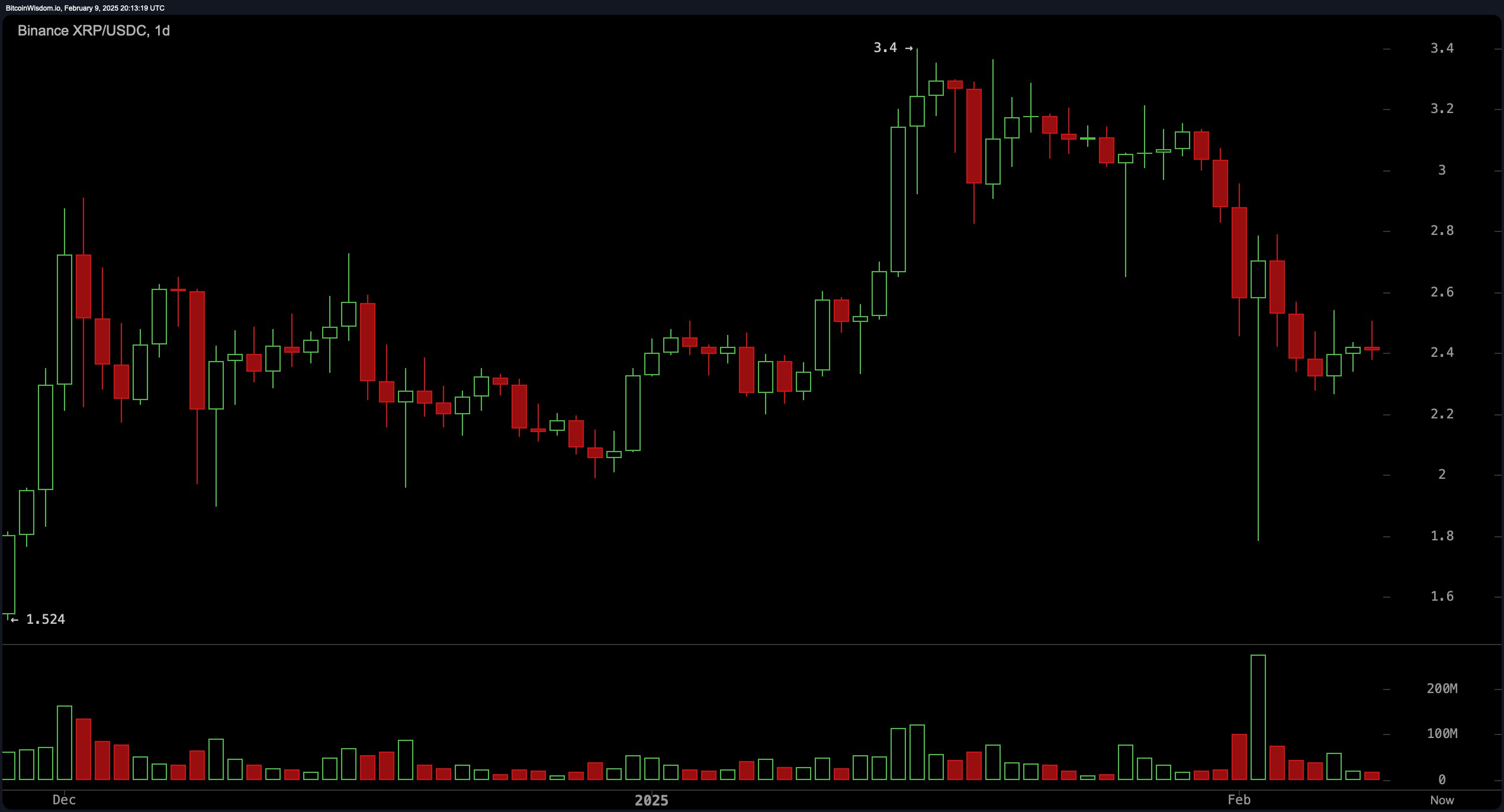

The day-to-day level of view chronicles a precipitous retreat from the $3.40 zenith, with prices probing the $2.20 bastion. Elevated turnover for the length of the fall reflects a distribution crescendo, yet prerequisites flirt with exhaustion. Can even simply easy this foundation back between $2.2-$2.30, a renaissance focusing on $2.80-$3.00 can also simply unfold. A failure right here, on the other hand, invitations extra descent, necessitating disciplined risk protocols.

Momentum gauges paint a mixed tableau: The relative energy index (RSI) sits at 37.86, Stochastic at 44.27, commodity channel index (CCI) at -90.12, and life like directional index (ADX) at 33.85. But the superior oscillator, momentum indicator, and transferring life like convergence divergence (MACD) tilt toward a destructive bias, suggesting prudence for those eyeing mercurial gains.

Trend-following instruments echo the bearish chorus, with exponential and straightforward transferring averages (EMA/SMA) all the procedure by 10-, 20-, and 30-day spans issuing promote directives. The 50-duration EMA and SMA back their downward stance, whereas 100- and 200-duration averages prolong an olive division to optimists. Ichimoku’s baseline stays noncommittal, annoying corroboration earlier than a conclusive model declaration.

Bull Verdict:

No topic momentary bearish pressure, XRP’s ability to back enhance at $2.20 to $2.30 might well per chance per chance trigger a rebound, with a probably push toward $2.80 to $3.00 if merchants step in. Long-term transferring averages dwell bullish, suggesting that a broader uptrend is easy intact. A confirmed breakout above $2.6 would pork up bullish momentum and invalidate the hot downtrend.

Have faith Verdict:

XRP stays below win promoting pressure, with multiple transferring averages signaling a persevered decline. The failure to reclaim key resistance at $2.50 to $2.60 might well per chance per chance consequence in extra shy away, especially if the $2.20 enhance line fails. Bearish momentum indicators, in conjunction with the transferring life like convergence divergence (MACD) and momentum, toughen the danger of a long correction toward decrease phases.