XRP traded at $3.24 as of Aug. 13, 2025, reflecting a 1.8% intraday extend. The asset maintained a day by day differ between $3.20 and $3.32, with a 24-hour trading volume of $9.64 billion and a total market capitalization of $193.41 billion.

XRP

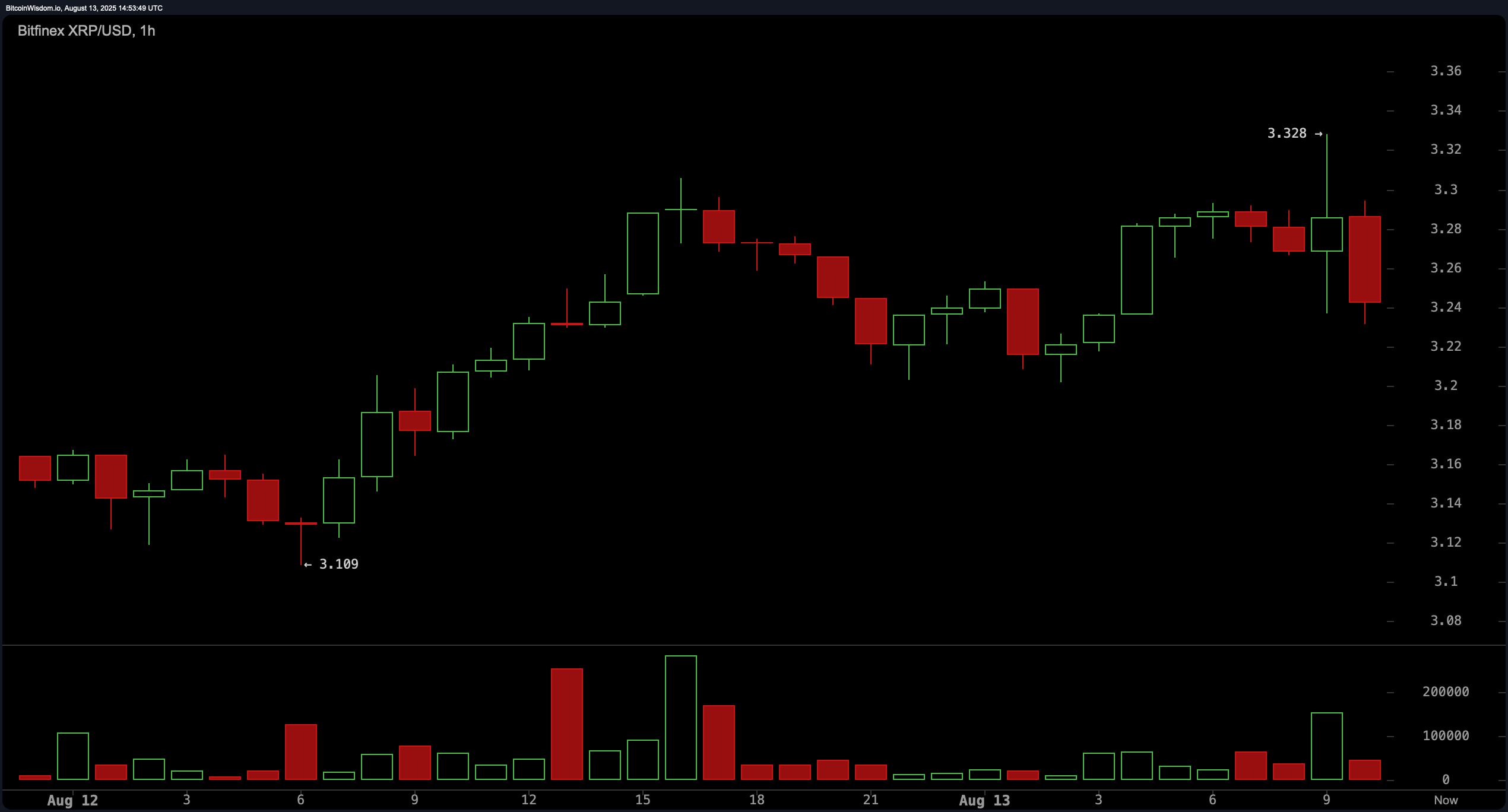

On the 1-hour chart, XRP skilled a modest retracement following a top at $3.32. The tantalizing greater wick on the hourly candle at this level, paired with a corresponding spike in crimson volume, indicated instant promoting force. Give a boost to changed into known at $3.22, with capability for further retracement toward $3.18. Whereas momentum looks posthaste exhausted, bullish continuation is seemingly ultimate if XRP convincingly breaks above the $3.32 resistance.

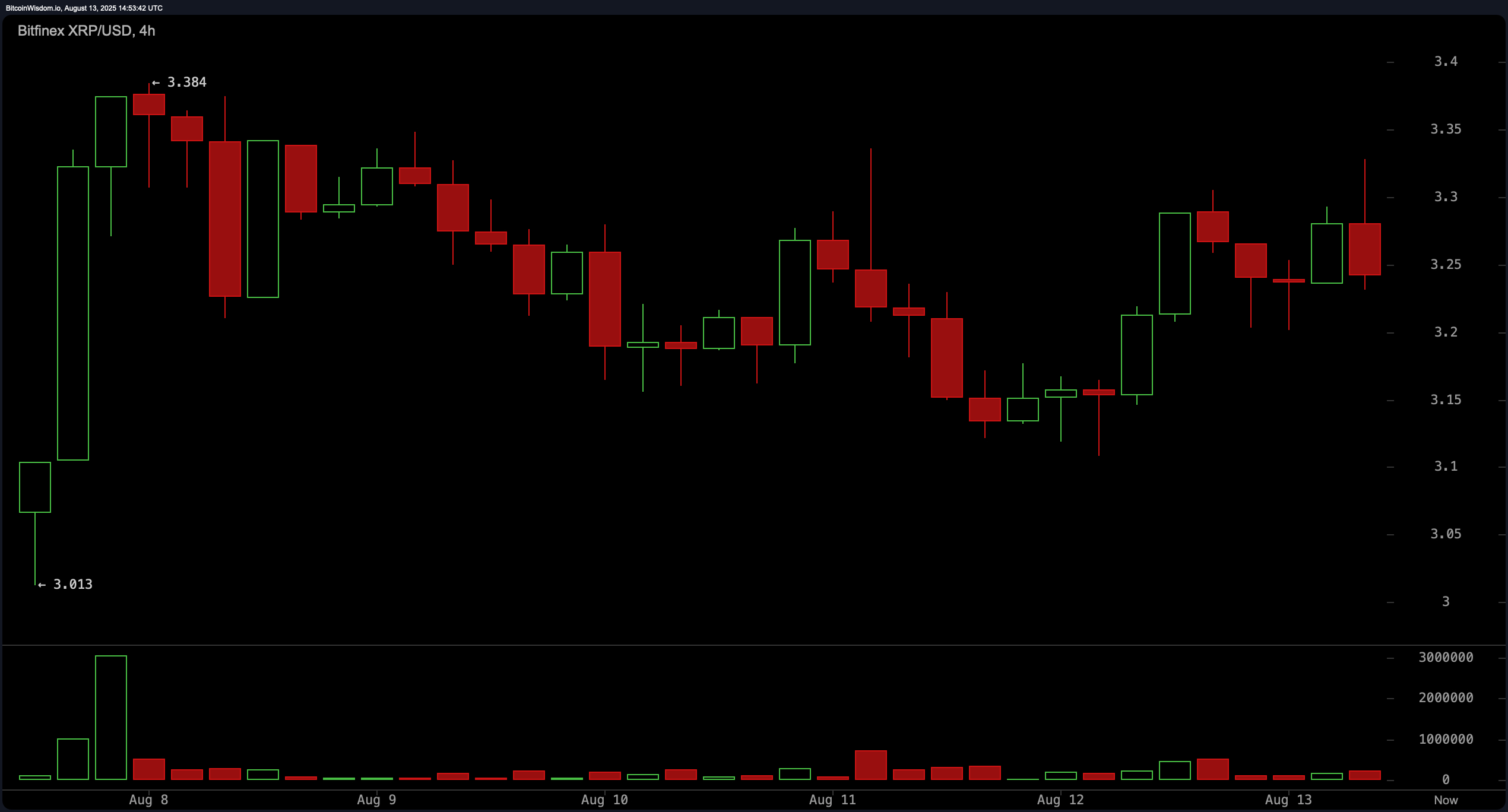

Zooming out to the 4-hour chart, XRP’s non permanent label action shows a pattern of recovery from a fresh downtrend. A bounce from the $3.01 apartment changed into adopted by the formation of an ascending triangle pattern, bounded between $3.15 and $3.30. Extra than one attempts to surpass the $3.30 level have failed, indicating a key resistance zone. A confirmed breakout above this threshold would likely signal bullish continuation, whereas a breakdown beneath $3.15 could per chance counsel one more test of the $3.00 reinforce.

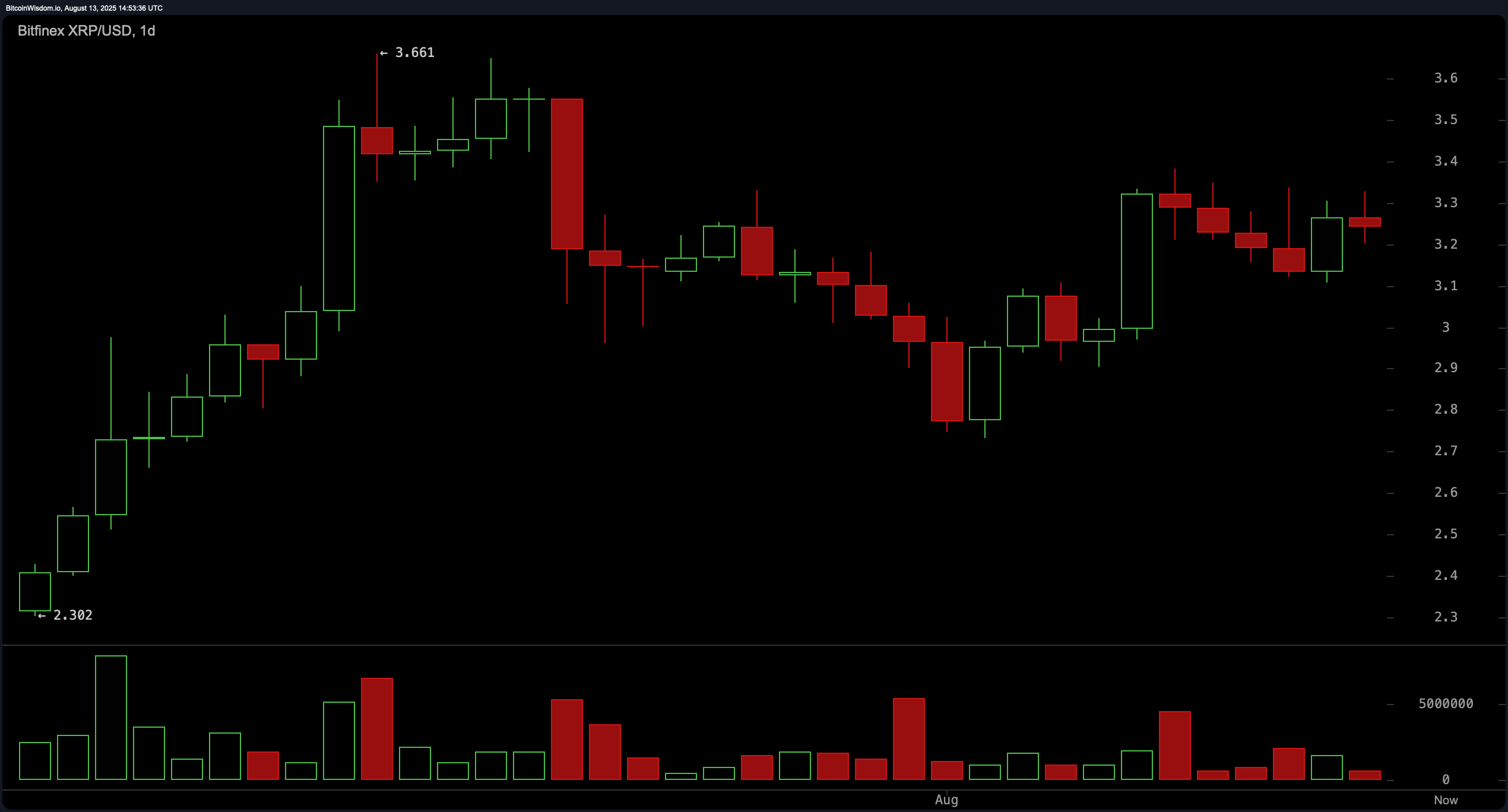

The day by day chart reflects a broader honest to a little bullish pattern. XRP had rallied as high as $3.66 sooner than encountering a correction, adopted by indicators of tiresome accumulation. Currently, the price is organising increased lows, pointing to underlying strength, although fading volume on the rebound cautions in opposition to premature optimism. Severe resistance lies between $3.30 and $3.40, and a breakout with sturdy volume could per chance reignite bullish momentum. A drop beneath $2.90, on the opposite hand, would invalidate the pattern and reintroduce bearish force.

Oscillator readings on Wednesday have been predominantly honest. The relative strength index (RSI) registered at 57.67, the Stochastic oscillator at 74.80, and the commodity channel index (CCI) at 92.70 — all indicating equilibrium. The accepted directional index (ADX) at 30.62 on the day by day chart pointed to a pattern of reasonable strength with out a transparent directional bias. Nonetheless, two key indicators signal a weakness: the momentum oscillator reads 0.30622 and concerns a bearish signal, whereas the transferring reasonable convergence divergence (MACD) level at 0.08283 additionally reveals a negative signal.

All transferring averages equipped sturdy reinforce for the uptrend. The exponential transferring averages (EMA) and easy transferring averages (SMA) all the design in which by 10, 20, 30, 50, 100, and 200 classes — at the side of EMA (10) at $3.18002, SMA (10) at $3.16980, and EMA (200) at $2.41450 — all issued bullish signals. These technical indicators make stronger the uplifting structure, seriously the prolonged-term averages, which expose firm upward alignment. The price final above these key averages supports the broader thesis of persevered strength, contingent on volume confirmation above resistance.

Bull Verdict:

If XRP breaks decisively above the $3.32 resistance with sturdy volume, the technical outlook turns firmly bullish. In that case, the asset could per chance purpose for a breakout toward the $3.40–$3.45 zone, with broader continuation likely given sturdy transferring reasonable reinforce all the design in which by all timeframes.

Dangle Verdict:

Failure to retain above $3.15 or a spoil beneath the $3.10 give up-loss threshold would invalidate the increased-low structure. In this kind of scenario, bearish momentum could per chance push XRP encourage toward $3.00 or decrease, seriously if promote volume accelerates and oscillators continue to deteriorate.