On Monday at 9 a.m. Eastern time, XRP is trading at $2.ninety 9 to $3.00, up 3.9% within the past 24 hours, with a market capitalization of $177.31 billion. The cryptocurrency has posted a 24-hour trading volume of $4.85 billion and traded within an intraday fluctuate of $2.86 to $3.02, displaying indicators of consolidation after most as much as date volatility.

XRP

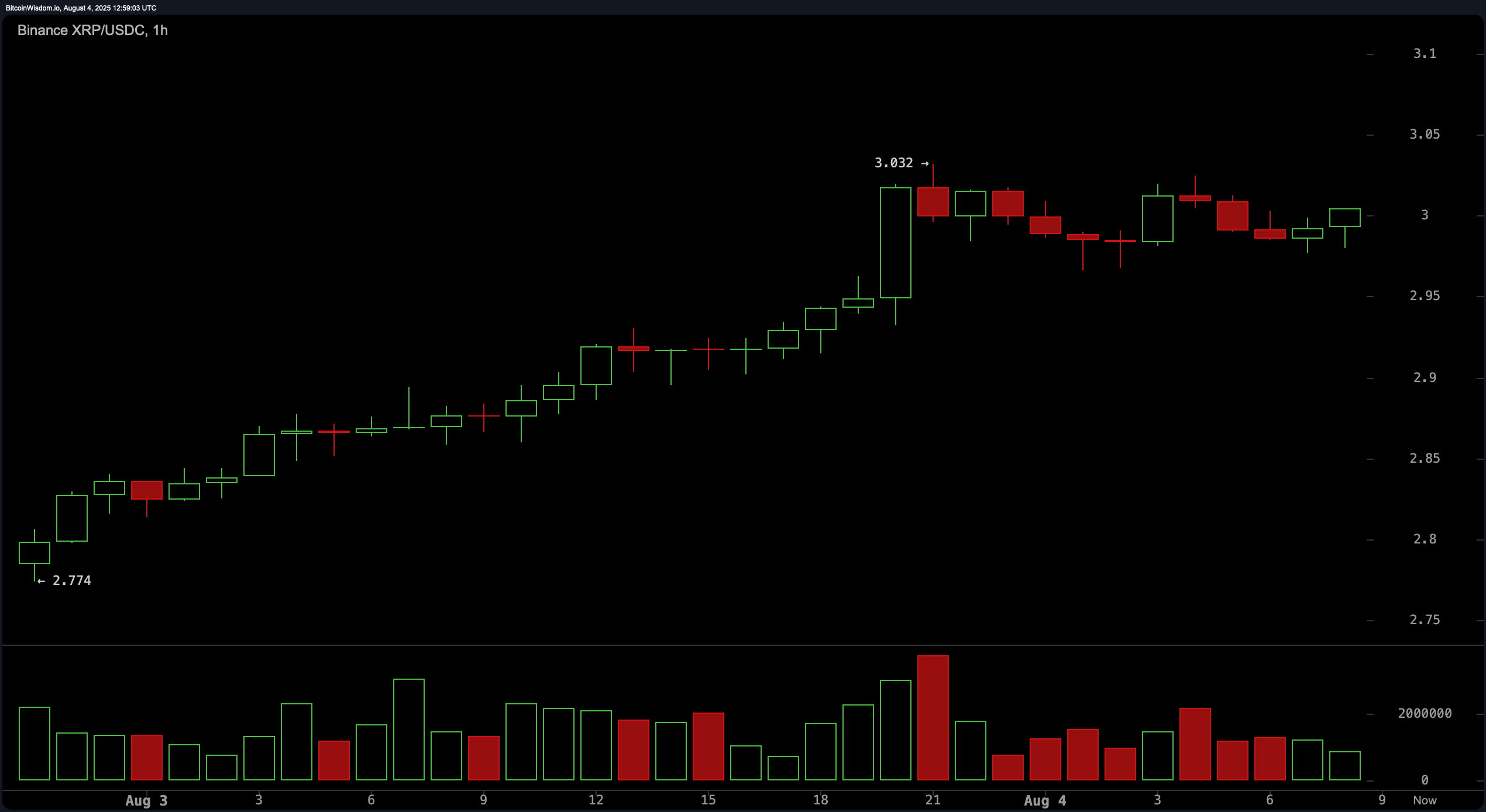

On the 1-hour chart, XRP has been on an actual climb from $2.77 to $3.03, for the time being consolidating stunning below the $3.05 resistance stage. A volume spike at $3.03 ended in rejection, confirming this place as a key momentary hurdle. Instantaneous reinforce is infamous at $2.98, making it a principal stage for bulls to defend. A breakout above $3.05 with adequate volume also can originate the door for a push toward $3.10–$3.15, while a breakdown below $2.98 also can shift momentum toward $2.93–$2.90.

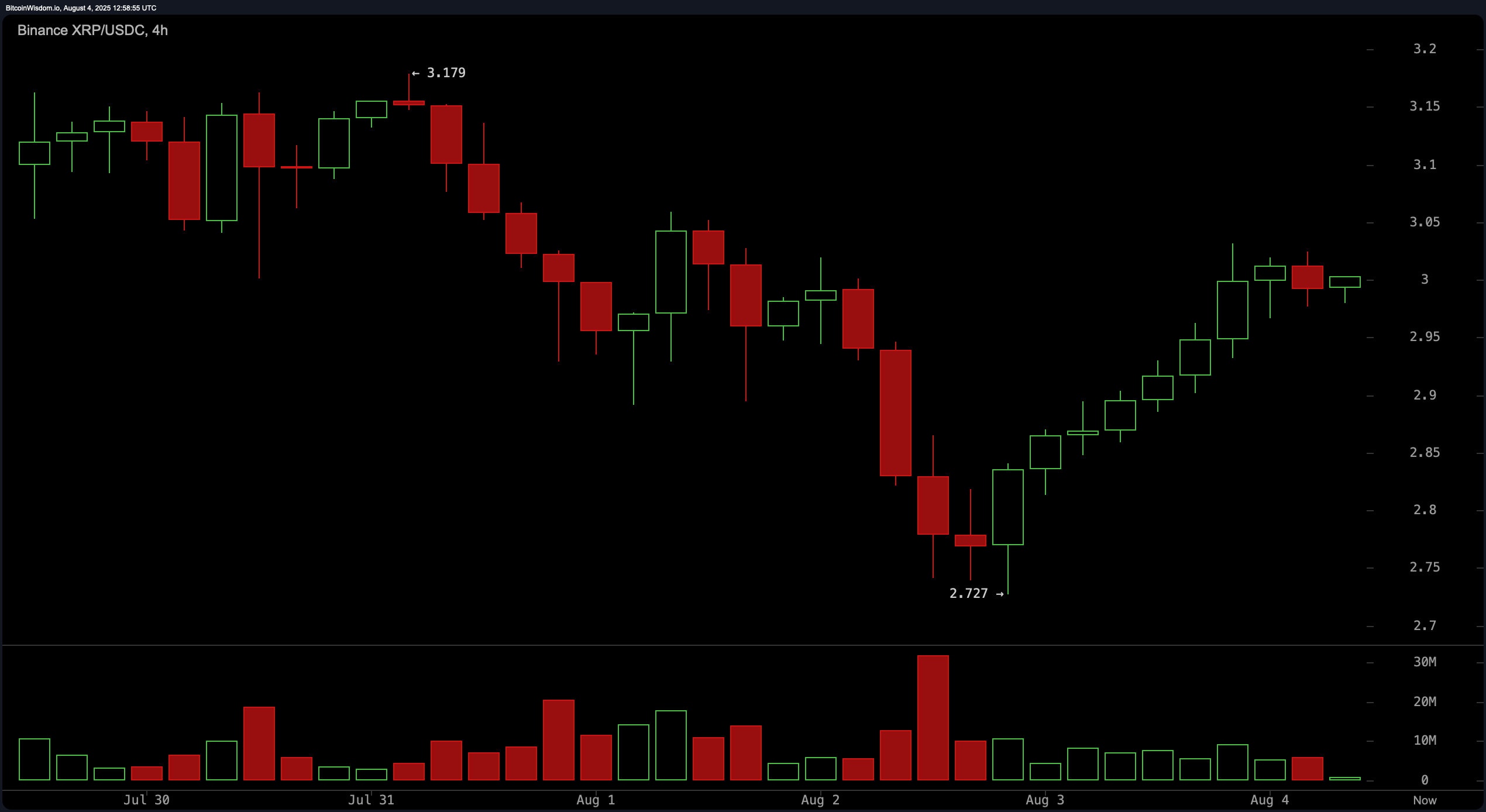

The 4-hour chart depicts a restoration from the $2.72 low again to the $3.00 impart after a preceding downtrend from $3.17. The pattern now reveals bigger highs and bigger lows, reflecting a tentative bullish building. Brief-term resistance lies at $3.05, while reinforce at $2.90 is important for affirming upward momentum. Purchasing volume throughout the restoration is noticeable nonetheless remains weaker than the selling surge seen on August 2, signaling caution for traders.

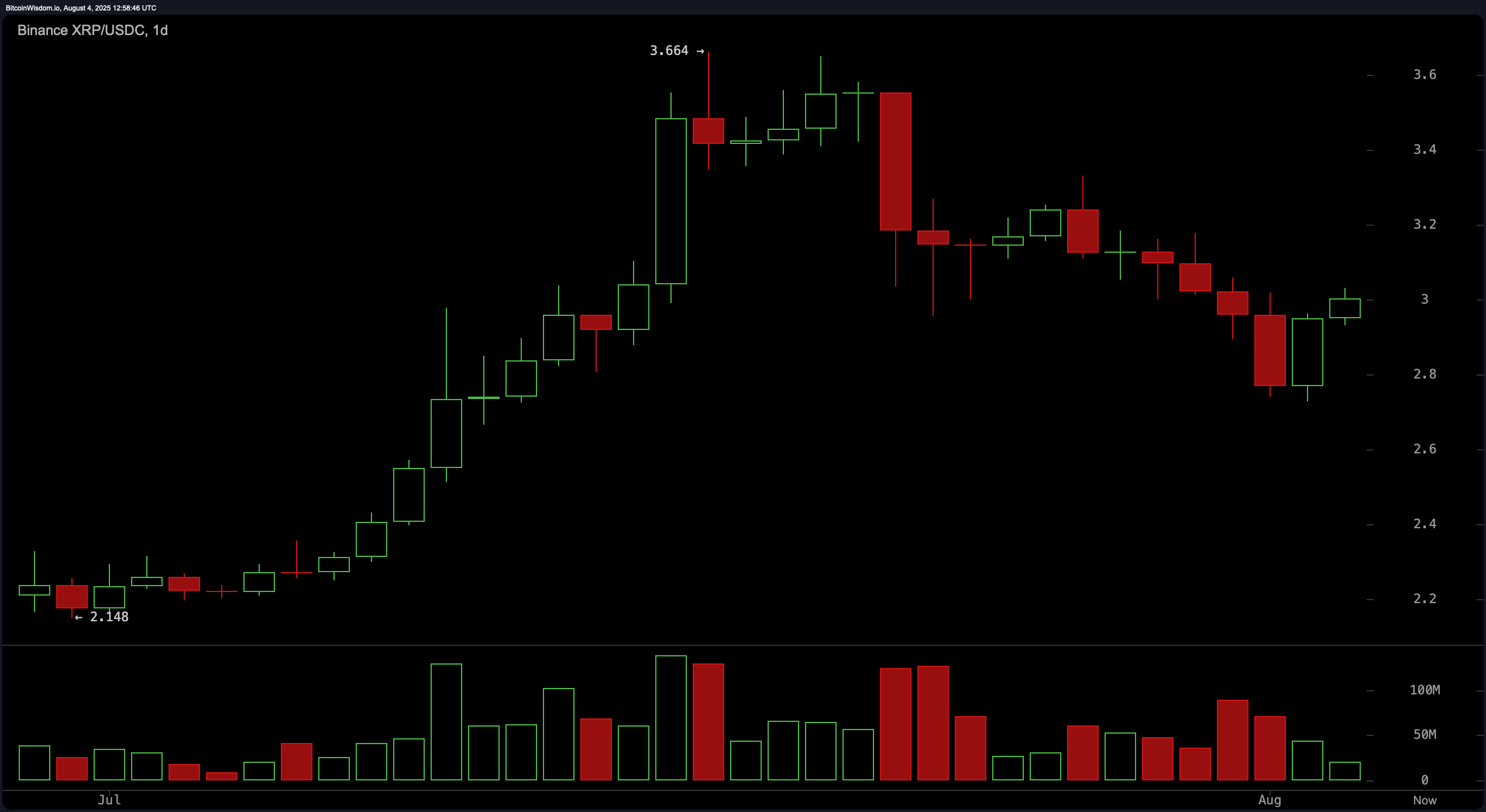

From the day-to-day chart standpoint, XRP remains in a macro uptrend that began with a surge from $2.15 to $3.66 forward of coming into a corrective section. The worth is for the time being consolidating between $2.80 and $3.05 after a pullback from most as much as date highs. Precise selling volume accompanied the fall from $3.66, while reinforce at $2.80 continues to succor. A breakout above $3.20 with sturdy volume also can reignite the uptrend toward $3.40–$3.66, nonetheless a fall below $2.80 also can trigger declines toward $2.60.

Oscillator readings repeat a largely honest market stance. The relative strength index (RSI) at 51.37 is honest, as are the Stochastic oscillator at 19.Fifty three, the commodity channel index (CCI) at −77.91, the average directional index (ADX) at 34.20, and the Awesome oscillator (AO) at 0.05791. Momentum at −0.14546 suggests a particular signal on the day-to-day chart, while the transferring average convergence divergence (MACD) stage at 0.05962 aspects to bearish sentiment. This blended oscillator profile implies a market in equilibrium, awaiting a catalyst for directional clarity.

Transferring averages (MAs) cowl a mix of bearish momentary indicators and bullish longer-term trends. The exponential transferring average (EMA) and uncomplicated transferring average (SMA) over 10 and 20 periods every repeat unfavourable pattern indicators, with EMA (10) at $3.02302 and SMA (10) at $3.04472. Alternatively, the EMA (30) at $2.94150 and SMA (30) at $2.99480 counsel buying stress, as invent the EMA (50) at $2.79232, SMA (50) at $2.66601, EMA (100) at $2.58549, SMA (100) at $2.47274, EMA (200) at $2.34144, and SMA (200) at $2.45413. This divergence aspects to momentary resistance, nonetheless extra highlights sturdy reinforce from medium to long-term holders.

Bull Verdict:

If XRP can succor reinforce above $2.98 on the 1-hour chart and ruin decisively above $3.05 with sturdy volume, the direction toward $3.10–$3.15 within the short term turns into viable. A practice-thru transfer also can location the stage for a test of $3.20, and if that stage is breached on the day-to-day chart, bulls also can aim for $3.40–$3.66 within the upcoming weeks.

Endure Verdict:

Failure to succor $2.98 on the 1-hour chart also can invite selling stress toward $2.93–$2.90, with a deeper fall doubtless toward $2.85. A breakdown below the day-to-day chart reinforce at $2.80 would signal renewed bearish momentum, opening the door for a decline toward $2.60 and invalidating the most as much as date bullish restoration pattern.