XRP is at the moment trading at $2.35 with a market capitalization of $138.14 billion and a 24-hour trading volume of $58.62 billion. The digital asset skilled an intraday mark differ between $2.33 and $2.43, reflecting vital intraday volatility amid blended technical signals.

XRP

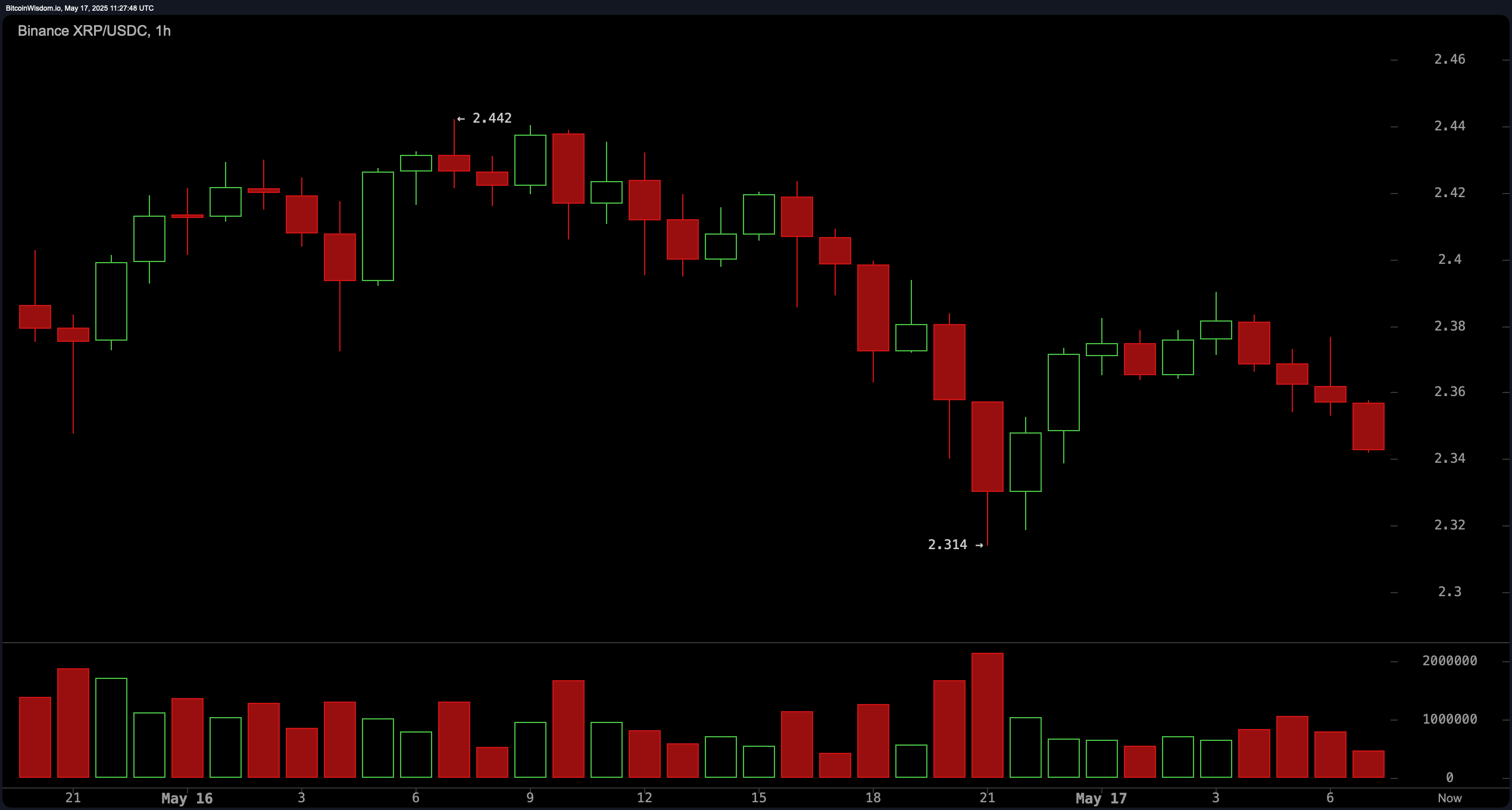

On the 1-hour chart, XRP reveals indicators of a determined pullback, with the cost structure forming lower highs and lower lows. This short-duration of time bearish pattern indicates a weakening in bullish momentum, in particular because the $2.31 strengthen stage has been many situations tested. If this stage fails to encourage, XRP would maybe maybe maybe drop towards the $2.20 zone. The amount profile supports this cautionary outlook, with crimson volume bars outweighing inexperienced in most up-to-date sessions, suggesting that sellers are dominating the most up-to-date momentum.

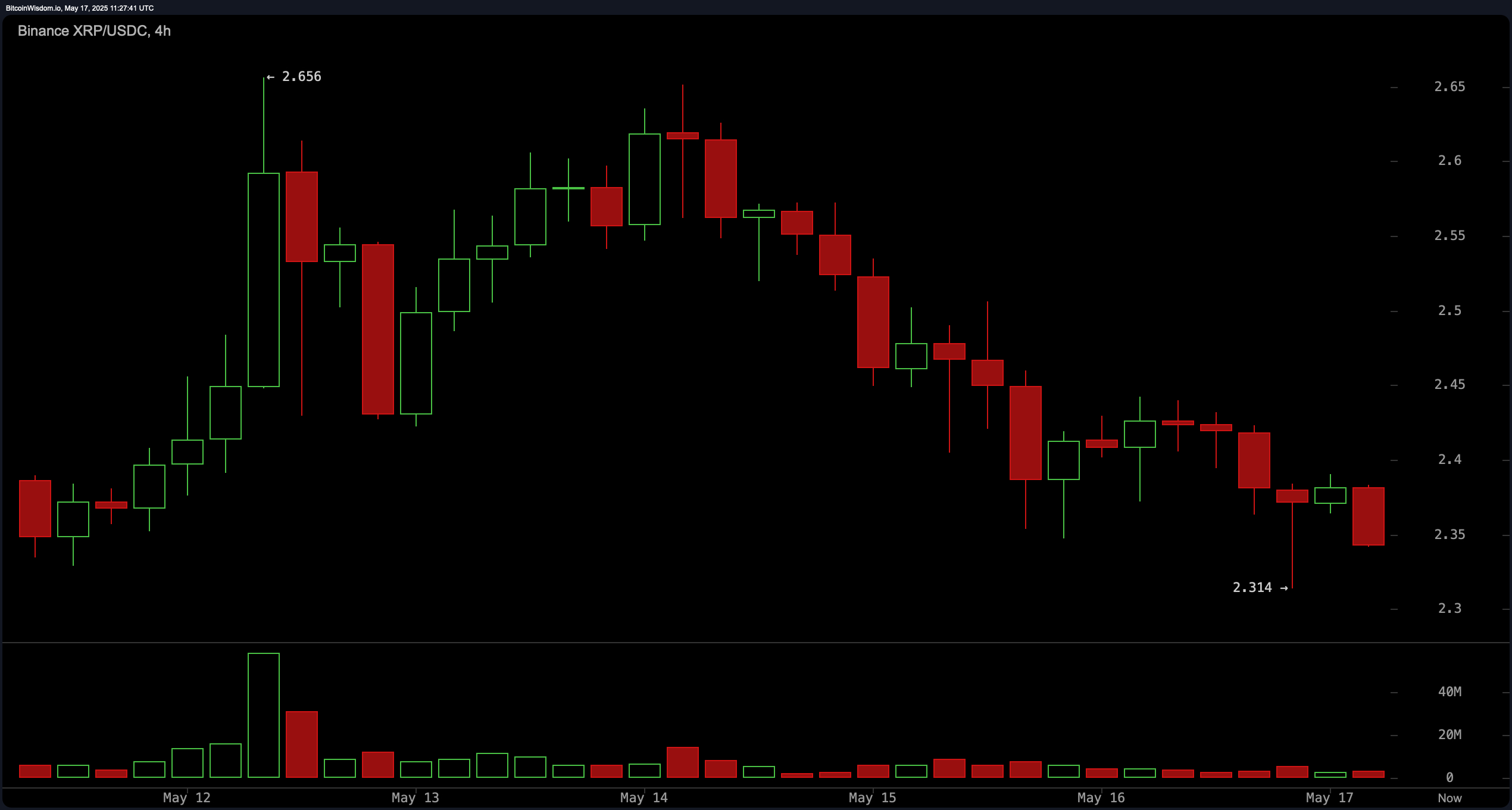

The 4-hour chart equally paints a bearish record, with XRP striking forward a downtrend underneath a main resistance level of $2.44. This time body exhibits a capacity lower high formation, underscoring persisted short-duration of time weak point. The pair beforehand peaked terminate to $2.656 sooner than coming into a corrective portion. Though large inexperienced volume spikes preceded the drop—suggesting preliminary institutional pastime—word-by technique of has been ancient, with sellers pressing prices lower. If the cost closes underneath $2.30, the following strengthen to quiz lies nearer to $2.20.

The day-to-day chart, on the opposite hand, maintains a extra structurally bullish outlook no topic most up-to-date downward stress. XRP has fashioned better highs and better lows over a broader time horizon, in step with a weakening uptrend. A day-to-day terminate above the $2.40–$2.Forty five resistance zone on main volume would reinstate bullish self belief and commence the door for a switch towards old highs terminate to $2.60. Key to this scenario is the skill of investors to encourage the $2.30 strengthen stage, which stays a pivotal predicament for future mark circulate.

Oscillators are exhibiting a largely just stance, underscoring the most up-to-date market indecision. The relative energy index (RSI) reads 52.73389, the Stochastic stands at 50.66967, and the commodity channel index (CCI) is at 22.90536—all indicating a balanced momentum profile. The favored directional index (ADX) at 20.27480 suggests a ancient pattern energy. The Awesome oscillator registers 0.22143, additionally in just territory. The momentum, on the opposite hand, signals negativity, while the transferring practical convergence divergence (MACD) stage at 0.07107 gifts a bullish signal, hinting at a doable divergence between momentum and pattern-following indicators.

Inspiring averages (MAs) most up-to-date a blended yet mildly bullish outlook. Both the exponential transferring practical (EMA) and straight forward transferring practical (SMA) for the ten-duration body masks sell signals, with values at $2.39179 and $2.43053, respectively, indicating terminate to-duration of time weak point. Conversely, all other EMAs and SMAs from the 20-duration to the 200-duration provide aquire signals. This alignment suggests that while short-duration of time stress is evident, the broader pattern stays sure, offered key supports are maintained. The exponential transferring practical (200) at $2.03875 and straight forward transferring practical (200) at $2.17692 are in particular supportive of the longer-duration of time bullish bias.

Bull Verdict:

XRP stays structurally bullish on the day-to-day chart, with better lows and institutional buying pastime offering a foundation for restoration. If the asset holds the $2.30 strengthen and reclaims the $2.40–$2.Forty five resistance zone on rising volume, it would maybe maybe maybe resume its uptrend towards $2.60 and previous, reinforcing longer-duration of time bullish momentum.

Undergo Verdict:

Despite a broader uptrend, short-duration of time charts masks main weak point, with both the 1-hour and 4-hour timeframes in determined downtrends. Failure to defend the $2.30 strengthen would maybe maybe maybe trigger a deeper retracement towards $2.20 and even $2.10, confirming a bearish short-duration of time scenario pushed by fading momentum and rising sell volume.