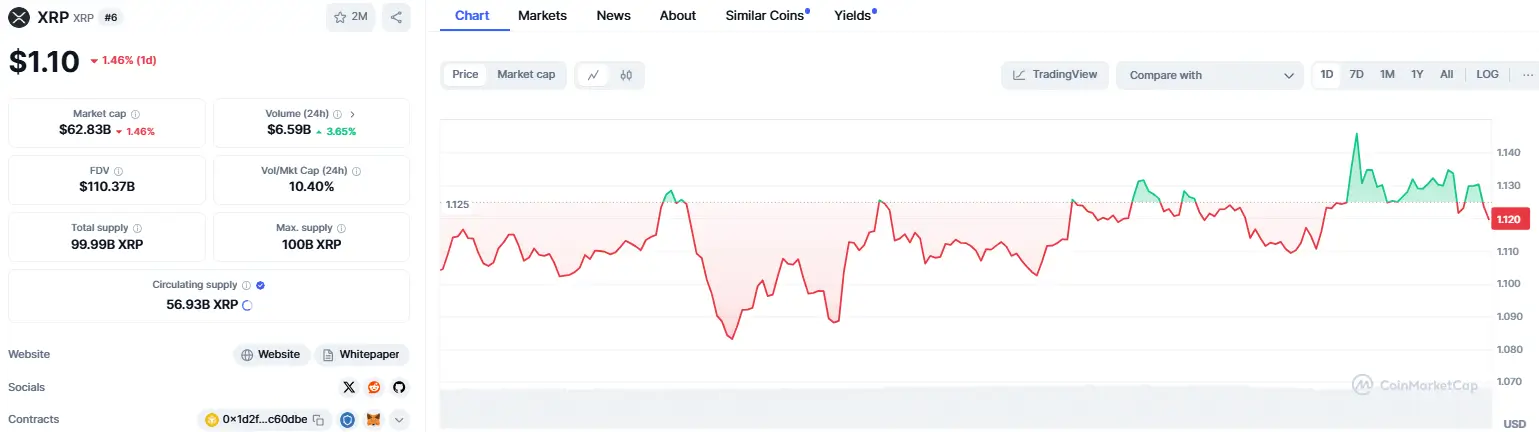

The XRP token has exhibited combined sentiment over the last 24 hours, with a bearish pattern dominating plenty of the purchasing and selling day. In accordance to CoinMarketCap’s recordsdata, the cryptocurrency’s worth action skilled a dinky pullback on its every day chart, recording a 1.46% decline to establish at $1.10. This adverse sentiment implies a cooling-off length following the fleet beneficial properties finished over the rest week. Market contributors might perhaps presumably elaborate this as a momentary consolidation piece, with traders doubtless taking profits after the most recent uptrend. On the other hand, the token’s resilience and the increasing purchasing and selling quantity of $6.59 billion keep at an underlying power that will perhaps presumably aid a future upward pattern.

Zooming out on the lengthy-time length worth action, the XRP’s modest dip contrasts with the broader bullish pattern within the weekly and monthly timeframes, the save the cryptocurrency surged by 55.82% and 107.31%, respectively. With this optimistic outlook in mind, the search recordsdata from lingers: Will the XRP token stem its every day losses and resume its upward climb, or will this dip signal the open of a more extended consolidation length?

XRP Momentum Soars, But RSI Warns of Probably Dip

From a technical standpoint, the MACD indicator at 0.0889 confirms a decisive bullish crossover above the signal line at 0.0261, implying a clear dominance of bullish momentum in XRP’s market. The widening green bars on the MACD histogram further validate this pattern, underscoring sustained purchasing stress that aspects toward persevering with the most recent rally.

Complementing this bullish memoir, the 50-day and 200-day clear-cut transferring averages (SMAs) provide tough aid zones at $0.57 and $0.62, respectively, reinforcing the market’s structural power. On the other hand, the RSI, at 81.08, has entered overbought territory, suggesting the rally shall be overextended within the short time length.

Historically, such RSI levels have a tendency to be adopted by a length of consolidation or a minor pullback as traders stable profits. Within the match of a retracement, the 50-day and 200-day SMAs are expected to behave as key aid levels, presumably serving as a springboard for the next upward leg. This cooling piece would allow the RSI to normalize, putting forward the broader bullish trajectory while reducing momentary overheating dangers.

XRP Worth Forecast: Analyst Eyes $8-$30 Target

In accordance to market analyst Armando Pantoja, the XRP token is on the cusp of a worth rally, doubtless reaching worth targets between $8 and $30. Central to this bullish prediction is the rumor of SEC Chair Gary Gensler’s conceivable resignation, which Pantoja considers a pivotal match for the crypto market—particularly for XRP. Pantoja highlights that Gensler has been perceived as a key driver of the SEC’s aggressive stance in opposition to cryptocurrency.

Gensler’s exit + Elliot Wave patterns signal a big $XRP breakout.

Key spoil aspects: $1.33 & $1.88.

After $1.88, it’s a clear path aid to the ATH of $3.84.

Targets: $8-$30. Final time we saw this setup, #XRP skyrocketed.

Don’t plod over it. #XRP #XRPArmy pic.twitter.com/aDOuceBQAH

— Armando Pantoja (@_TallGuyTycoon) November 19, 2024

The lengthy-standing lawsuit between the SEC and Ripple, which dampened XRP’s worth capability, has weighed heavily on investor sentiment. Should always Gensler step down, the market might perhaps presumably elaborate it as a shift toward more favorable regulatory stipulations, igniting a wave of optimism and renewed passion within the XRP token.

The analyst parallels a old market cycle the save XRP skilled explosive growth, skyrocketing from mere cents to $3.84. In that scenario, identical macroeconomic and regulatory stipulations map the stage for fleet worth appreciation. Furthermore, Pantoja believes the cryptocurrency might perhaps presumably repeat this historical surge with XRP’s breakout above extreme resistance levels at $1.33 and $1.88.