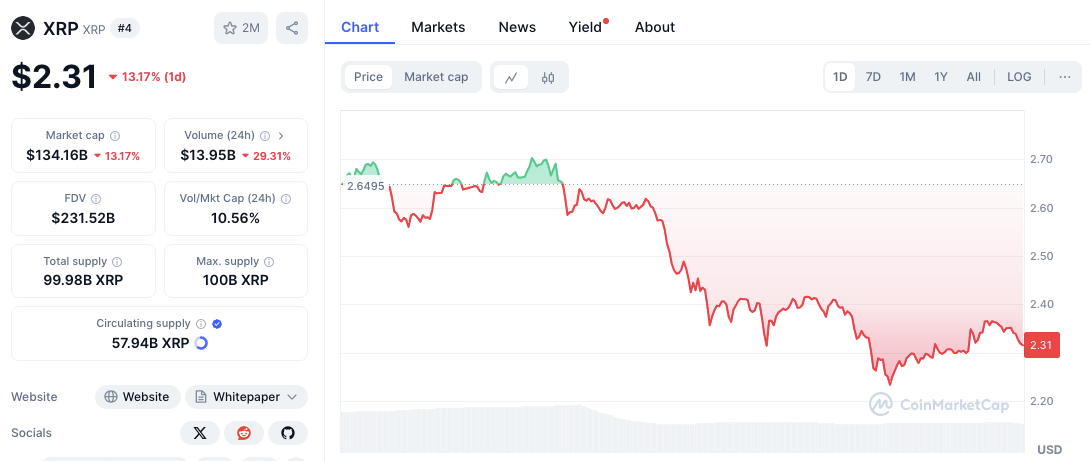

XRP has seen a pointy charge decline, losing 12.47% in the last 24 hours. The cryptocurrency is now buying and selling at $2.32 after falling from a in vogue excessive of $2.6495. The downward fashion is clear, with decrease highs and decrease lows forming on the chart.

Moreover, market volume has fallen by 27.96%, showing less buying and selling exercise. So then, merchants are watching key enhance and resistance stages to resolve out the next charge movement.

Key Enhance Ranges for XRP in Focal level

XRP is currently trying out the $2.30 enhance level, which holds psychological significance. If this level fails to support, the charge would perchance well perchance also descend to $2.20, a potential enhance zone.

Furthermore, $2.00 remains a sturdy enhance space the achieve merchants would perchance well perchance also step in to forestall additional decline. On the other hand, if XRP rebounds from $2.30, it’d also attempt a recovery in direction of better resistance stages.

Resistance Ranges Forward for XRP Recovery

XRP faces resistance at $2.50, the achieve selling stress seemed sooner than the most fresh descend. Previous this, the charge must ruin through $2.65, the most fresh top, to open an uptrend.

Technical Indicators Counsel Bearish Momentum

Files from CoinMarketCap reveals that $2.75 remains a sturdy resistance level, historically stopping additional gains.

A successful movement past these stages would perchance well perchance also sign renewed bullish momentum, drawing more merchants into the market.

RSI Exhibits Fair to Bearish Momentum

The Relative Energy Index (RSI) is at 45.49, suggesting neutral to bearish momentum. An RSI below 50 indicates outdated seeking stress, with probably enhance around 43.55, the achieve outdated rebounds took place.

Furthermore, the Appealing Moderate Convergence Divergence (MACD) indicator confirms a bearish fashion. The MACD line (-0.07409) is below the sign line (-0.07797), signaling downward momentum. The harmful histogram additional helps the bearish outlook.

Combined Signals from Derivatives Market

In step with Coinglass files, XRP futures buying and selling volume has dropped significantly, reducing by 32.32% to $21.65 billion.

Also, open passion has decreased by 22.76% to $3.15 billion, showing diminished speculative passion. On the other hand, the alternatives market paints a gallop listing. Alternate strategies volume surged by 464.44% to $32.18K, whereas open passion elevated by 296.88% to $2.97 million.

Disclaimer: The records provided listed right here is for informational and tutorial capabilities handiest. The article does no longer constitute financial advice or advice of any form. Coin Edition is now not any longer liable for any losses incurred as a outcomes of the utilization of remark material, products, or companies and products talked about. Readers are advised to exercise caution sooner than taking any action linked to the corporate.