After a recovery rally from sub-$2.00 ranges earlier this week, XRP label this present day is hovering around $2.18, showing indicators of hesitation shut to a indispensable resistance zone. Regardless of breaking support above the $2.10 psychological level, XRP now faces a convergence of key indicators that will per chance well settle on whether or no longer upside continuation or a reversal plays out on June 30.

What’s Going on With XRP’s Designate?

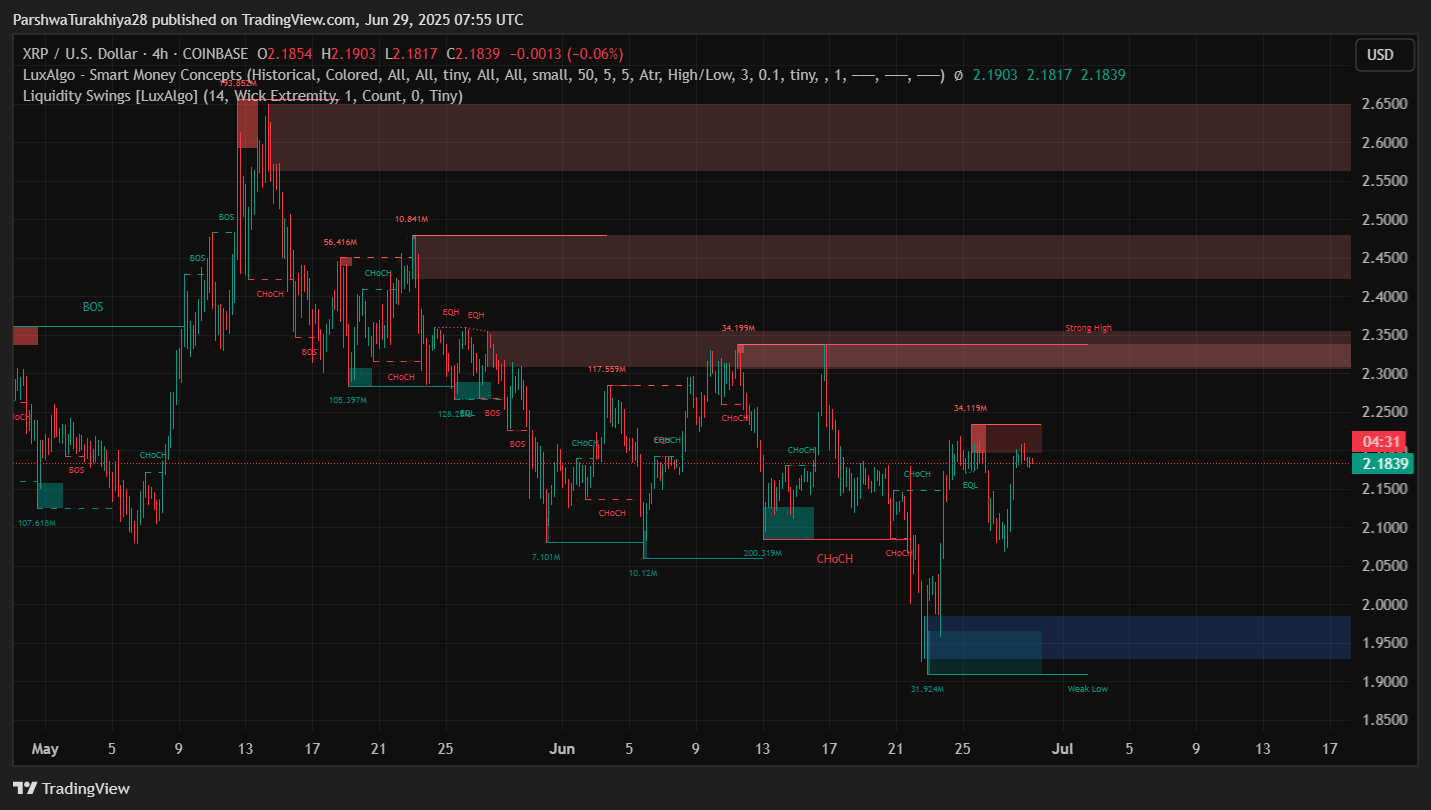

XRP has rebounded into a multi-layered resistance cluster between $2.18 and $2.25, marked by present zones from Orderly Cash Ideas, earlier CHoCH ranges, and multiple failed breakouts. The 4-hour chart unearths label trying to reclaim the descending channel resistance, but rejection from the $2.21–$2.23 zone stays a key barrier.

Designate is at this time procuring and selling above the 20, 50, and 100 EMA strains (now clustered between $2.15–$2.18), showing momentary bullish construction. On the other hand, it stays below the 200 EMA ($2.1889), which aligns carefully with Keltner Channel midline resistance. The day-to-day chart presentations a descending wedge sample peaceful active, with XRP struggling to decisively shatter above the upper trendline shut to $2.20.

Orderly Cash files moreover displays caution. The most up-to-date CHoCH rejection shut to $2.23–$2.25 coincides with a historical EQH zone that introduced on multiple structural breakdowns in June. Till that ceiling is cleared, upside stays slight.

Why Is the XRP Designate Going Down As of late?

The recent decline from $2.20 is basically attributable to momentum exhaustion and overhead stress from high-quantity liquidity zones. The 30-minute chart presentations the RSI diverging with label, printing a bearish signal shut to forty eight.1. This coincides with a rejection from VWAP resistance at $2.1848, whereas the MACD histogram has flattened and not using a bullish crossover affirmation.

Parabolic SAR dots have flipped above label, extra reinforcing a likely intraday downtrend. The 4-hour Supertrend stays bearish below $2.11, and despite momentary attempts to flip bullish, the signal has no longer but absolutely confirmed an uptrend resumption.

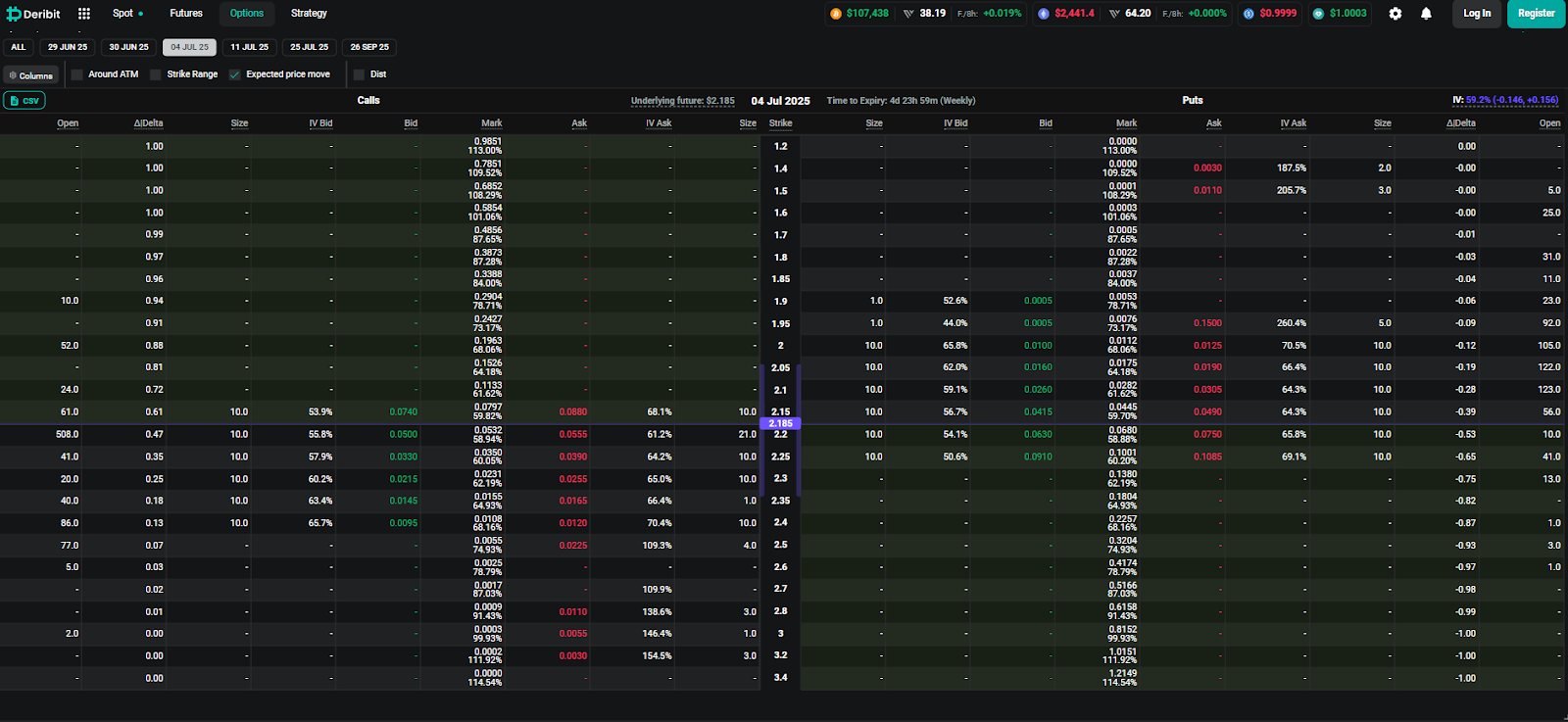

Moreover, risk market files from Deribit indicates heavy name hobby at the $2.20–$2.25 strikes for the July 4 expiry. Implied volatility stays subdued shut to 59%, suggesting that traders are pricing in slight upside except $2.25 is breached with momentum.

On the list walk facet, MFI is hovering at forty eight.6, showing neutral inflows, whereas the RSI on increased timeframes stays below 50 — signaling that bulls peaceful lack conviction.

Key Indicators Signal Compression at Resistance

XRP is procuring and selling internal a narrowing vary between $2.15 and $2.21, with Bollinger Bands tightening and Keltner Channels showing diminished volatility. This veritably precedes a breakout, but path stays dangerous.

VWAP, SAR, and 200 EMA are all coiling around the $2.18 zone. This convergence makes $2.18–$2.20 a pivotal level for bulls to reclaim with quantity if a breakout in the direction of $2.25–$2.30 is to be carried out.

Failure to assign out so would delivery the door for a revisit to the $2.05–$2.00 enhance band — a liquidity-prosperous role confirmed by multiple CHoCH and BOS formations on the Orderly Cash chart.

XRP Designate Prediction: Rapid-Term Outlook (24h)

If XRP label closes above $2.21 with sturdy quantity and RSI pushes support above 50, a rally in the direction of $2.25 and potentially $2.30 turns into seemingly. This would align with the 1D wedge breakout scenario and guarantee a broader bullish reversal.

On the flip facet, rejection below $2.18 may maybe well well gallop label in the direction of $2.12 and $2.05, where bullish OB and high-quantity enhance exist. A breakdown below $2.00 would bid the momentary bullish case and reintroduce downside risk in the direction of $1.91.

Given the present convergence of main indicators, the following 24 hours are serious. XRP label volatility is anticipated to rise as compression reaches its tipping point.

XRP Designate Forecast Desk: June 30, 2025

| Indicator/Zone | Diploma (USD) | Signal |

| Resistance 1 | 2.21 | VWAP + better trendline |

| Resistance 2 | 2.25 | Option wall & EQH zone |

| Increase 1 | 2.15 | EMA20/50/100 confluence |

| Increase 2 | 2.05 | Orderly Cash bullish OB zone |

| RSI (30-min) | forty eight.16 | Bearish divergence |

| MACD (30-min) | Flat | No certain signal |

| VWAP | 2.1848 | Instantaneous resistance |

| Parabolic SAR | 2.1788 (above) | Bearish intraday |

| Supertrend (4H) | Bearish below 2.11 | Yet to flip bullish |

| Option Strike Wall | 2.25 | Implied cap |

| MFI (4H) | forty eight.68 | Neutral capital walk |

Disclaimer: The facts presented in this article is for informational and academic functions perfect. The article doesn’t constitute financial advice or advice of any kind. Coin Model will not be any longer accountable for any losses incurred because the utilization of assert, merchandise, or companies talked about. Readers are informed to notify caution earlier than taking any motion connected to the firm.