The XRP mark at present sits at $3.05 after a unstable week marked by keen rejections shut to $3.30 and rapid bounces from $2.90. The pair is coiling inner a symmetrical triangle on the day-to-day chart, with mark action converging toward an inflection point. Merchants for the time being are watching whether XRP breaks better toward $3.30 or slips aid toward the $2.80 liquidity zone.

What’s Occurring With XRP’s Worth?

XRP is trading in a tightening differ on the day-to-day timeframe, with $3.30 acting as resistance and $2.90 acting as enhance. After the July rally toward $3.66 stalled and precipitated waves of earnings-taking, this triangle pattern shaped.

The Honest trusty Strength Index (TSI) exhibits a minute bearish crossover, which implies that momentum is slowing down. At the the same time, Truthful Money Concepts (CHoCH indicators) ascertain that there are liquidity sweeps within the $3.20–$3.30 differ. Peaceful, the fact that the lows grasp been better since July means that traders are serene drawn to the $2.80–$2.90 differ.

On the 4-hour chart, the price has gotten aid above the 20 EMA at $3.00 and is now shut to the 50 EMA at $3.02. The Bollinger Bands grasp gotten a lot tighter, and the mid-band enhance is now spherical $2.97, which strengthens the temporary honest bias.

Why XRP Worth Going Down At the novel time?

The main reason XRP’s mark goes down at present is on epic of it has been rejected more than one cases at Fibonacci retracement stages. The day-to-day chart exhibits that the price couldn’t cease above the 0.382 Fib at $3.08 and is now happening toward $3.04. Sellers grasp repeatedly protected the 0.5 Fib at $3.19 and the 0.618 Fib at $3.30, which has stopped bullish continuation.

Parabolic SAR dots stay above candles, showing design back bias, whereas the VWAP on the 30-minute chart highlights resistance between $3.05–$3.07. RSI currently sits spherical 55, honest however fading from overbought cases.

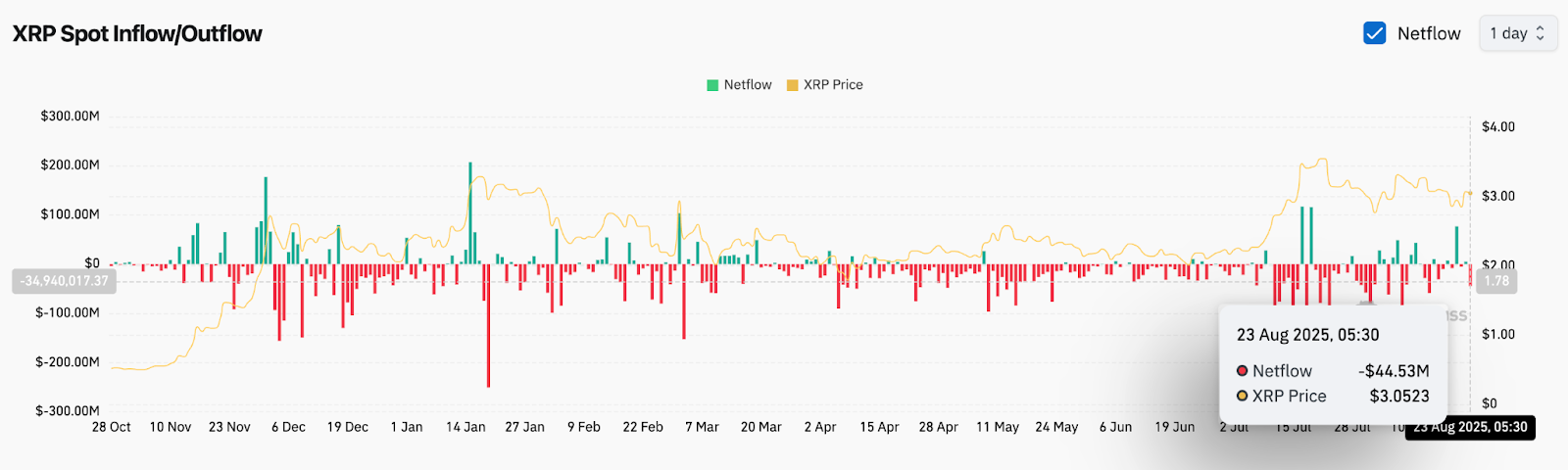

Jam waft files adds additional context. On August 23, accumulate outflows of $44.fifty three million had been recorded, suggesting temporary selling rigidity as traders locked in beneficial properties.

XRP Worth Indicators Veil Impartial Bias

XRP is balancing between bullish structural enhance and power overhead resistance. The day-to-day Bollinger Bands grasp compressed, reflecting low volatility before a ability breakout. EMAs (20/50/100/200) cluster tightly spherical $3.00–$3.04, reinforcing the significance of this pivot zone.

The RSI on the 30-minute chart is preserving above 50, suggesting bulls may perhaps perhaps objective serene serene protect intraday dips. Then again, momentum indicators lean moderately bearish, and without a deliver spoil above $3.10, upside conviction remains restricted.

XRP Worth Prediction: Rapid-Term Outlook (24h)

For the next 24 hours, XRP mark action is at hassle of stay differ-plug inner $2.95–$3.10. A tidy breakout above $3.10 would open the door to $3.19 and $3.30, with quantity affirmation required to set aside up the creep.

On the design back, if mark slips below $2.95, the next key enhance lies at $2.80, adopted by $2.62. The symmetrical triangle is approaching its apex, suggesting that volatility growth is coming near near. Till a breakout occurs, traders may perhaps perhaps objective serene question uneven sideways movement.

XRP Worth Forecast Desk: August 24, 2025

| Indicator/Zone | Level / Signal |

| XRP mark at present | $3.05 |

| Resistance 1 | $3.10 (temporary pivot) |

| Resistance 2 | $3.19 / $3.30 (Fib retracements) |

| Strengthen 1 | $2.95 (EMA/VWAP cluster) |

| Strengthen 2 | $2.80 (triangle pass / liquidity) |

| RSI (30-min) | 55.5 (honest to gentle bullish) |

| TSI (1D) | Bearish crossover |

| Bollinger Bands (4H) | Tight compression |

| Parabolic SAR (1D) | Bearish bias below $3.10 |

| Jam Flows (Aug 23) | -$44.53M outflows |

Disclaimer: The guidelines offered listed here is for informational and tutorial applications handiest. The article does now not constitute financial advice or advice of any kind. Coin Edition is now not any longer accountable for any losses incurred on epic of the utilization of scream material, merchandise, or companies and products mentioned. Readers are told to exercise caution sooner than taking any action related to the firm.