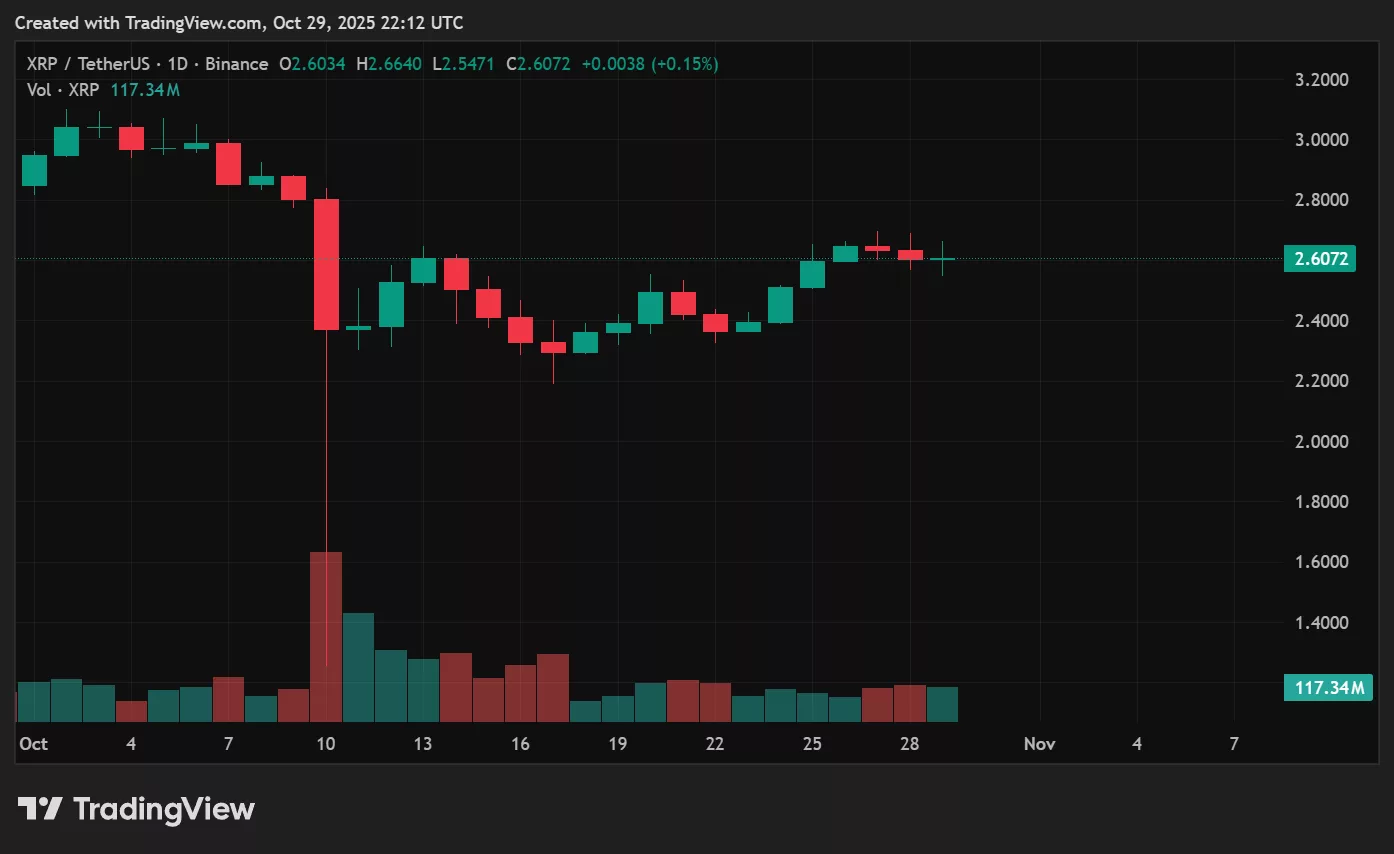

- XRP trace trades discontinuance to $2.63 after the Fed’s 25 bps price decrease, consolidating below key resistance.

- A breakout above $2.80–$3.00 also can lengthen features against $3.20 if distress sentiment improves.

- Failure to protect $2.50 also can merely trigger downside against $2.30–$2.40 as markets digest the Fed’s cautious tone.

The Federal Reserve’s most recent price decrease has trigger off a blended response all over distress assets. XRP is hovering discontinuance to $2.63, holding regular as traders weigh whether or no longer more straightforward protection will reignite crypto inflows — or if cautious Fed steerage will blunt the impact.

Desk of Contents

XRP trace following Fed price cuts

XRP trades around $2.63, down slightly of by 1.2% all around the final 24 hours but mild up nearly 10% on the week. The token stays in a stunning $2.58–$2.68 differ, consolidating merely under resistance at $2.70–$2.80.

The Fed’s 25 bps decrease to 3.75–4.00% delivered what markets anticipated, but Chair Powell’s feedback about “recordsdata-dependent” future strikes tempered enthusiasm. While Bitcoin and Solana temporarily spiked post-announcement, most astronomical-cap altcoins, along side XRP, procure paused as liquidity prerequisites and macro cues recalibrate.

Merchants now peek the price decrease as a doable medium-term tailwind — especially if distress appetite returns and stablecoin inflows rep.

Bullish XRP trace components

A decisive discontinuance above $2.80 also can verify bullish continuation, opening room against $3.00–$3.20. With the Fed signaling a doable easing cycle and global yields trending decrease, XRP also can procure the benefit of renewed inflows into excessive-beta assets.

Technical constructing stays optimistic: XRP is buying and selling above its 200-day transferring moderate, and most recent whale accumulation recordsdata presentations strengthening long-term positioning.

Bearish trace components

If macro sentiment turns distress-off. To illustrate, if the Fed’s dovishness sparks fears of enterprise slowdown, speculative flows also can dry up. A smash below $2.50 dangers pullback against $2.30–$2.40.

Moreover, lowered volatility and falling buying and selling volumes all over altcoins also can scuttle away XRP struggling to diagram immediate-term momentum.

XRP trace prediction in response to original ranges

With XRP at $2.63, traders face a balanced setup: a dovish macro backdrop favors tiring upside, but discontinuance to-term resistance around $2.80–$3.00 have to obvious for momentum to lengthen. The broader XRP outlook hinges on whether or no longer decrease charges reignite crypto distress-taking, or if capital continues to consolidate in Bitcoin and fundamental Layer-1 performs.

Disclosure: This text does no longer signify funding advice. The disclose material and materials featured on this internet page are for educational capabilities handiest.