XRP trace upward thrust lengthen is main to investors eyeing a trace surge that will spoil a five-month resistance stage, signaling a foremost bullish momentum.

The final consequence of this pass might maybe make a selection the token’s shut to-term trajectory, influencing market sentiment.

XRP Has a Bullish Setup Amidst Market Volatility

The micro outlook for XRP’s trace remains sure. The token has managed to lead sure of a Dying Inferior, a technical pattern that always indicators a bearish trend. As a replacement, the Golden Inferior that looked at the tip of July continues to imply attainable upward momentum.

This Golden Inferior happens when the 50-day exponential sharp moderate (EMA) crosses above the 200-day EMA, signaling a bullish trend. This pattern has boosted investor self belief, helping preserve the XRP trace above the crucial $0.50 stage.

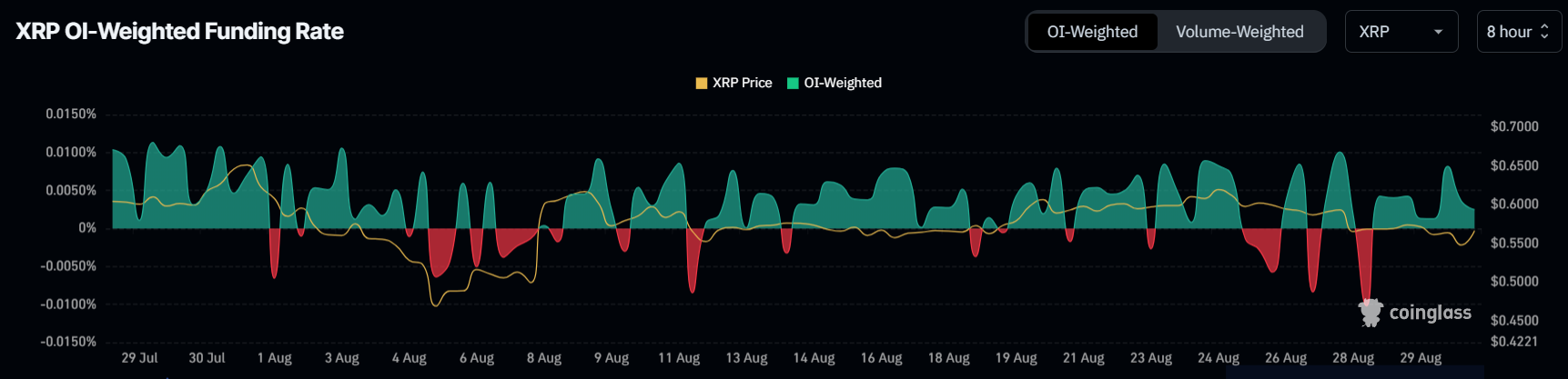

Furthermore, XRP’s funding price has shown constant positivity over the last month, reflecting a bullish sentiment among investors. An even funding price assuredly indicates that merchants are inspiring to pay a top price to assign long positions, making a wager on the price to upward thrust.

With long contracts dominating the market, merchants are looking out ahead to a trace carry and are also actively positioning themselves to earnings from it. This dynamic creates a favorable atmosphere for attainable upward trace actions, making the chance of a breakout more likely if market stipulations remain supportive.

Read more: XRP ETF Explained: What It Is and How It Works

This optimism is foremost as XRP hovers above the 23.6% Fibonacci Retracement line, a key stage that has supplied toughen in most unusual weeks.

The The biggest XRP Mark Barrier

XRP trace’s next indispensable project lies in breaking the $0.64 resistance stage, which aligns with the 50% Fibonacci Retracement line. This barrier has confirmed formidable, conserving the token from advancing since mid-March.

On the opposite hand, XRP would be pleased to breach $0.60 to rep there efficiently. Flipping this stage into toughen would also turn the 38.2% Fib line into a valid toughen zone, potentially paving the capacity for additional features.

If XRP trace can create a 12% trace carry, it can decisively overcome this resistance. This might maybe model a foremost breakout that will consequence in a sustained rally beyond the five-month-aged resistance of $0.64.

Read more: Ripple (XRP) Mark Prediction 2024/2025/2030

Nevertheless, failing to interrupt by $0.64 might maybe consequence in a single more length of consolidation. XRP would quiet preserve above the well-known toughen of the 23.6% Fib line, nonetheless this would invalidate the present bullish thesis, leaving investors expecting restoration and profits.