XRP designate is now procuring and selling at $2.ninety nine after falling over 13% in excellent in some unspecified time in the future. This entertaining drop has broken below key relieve stages and is spooking the market.

But if we observe deeper metrics, enjoy liquidation maps and on-balance quantity, there’s a likelihood this downtrend would possibly maybe well be shedding steam.

Derivatives Market Presentations Why XRP Would possibly Hold Crashed, And The Worst Would possibly Be Over

XRP’s 13% smash would possibly maybe well well were triggered by a wave of long liquidations. That intention many merchants who were making a bet on XRP to high-tail up were the exercise of borrowed cash. When the price started falling, their positions hit pause stages and bought automatically sold by exchanges. This forced selling likely brought about the entertaining drop to $2.ninety nine.

For token TA and market updates: Want more token insights enjoy this? Be a part of for Editor Harsh Notariya’s Each day Crypto Publication right here.

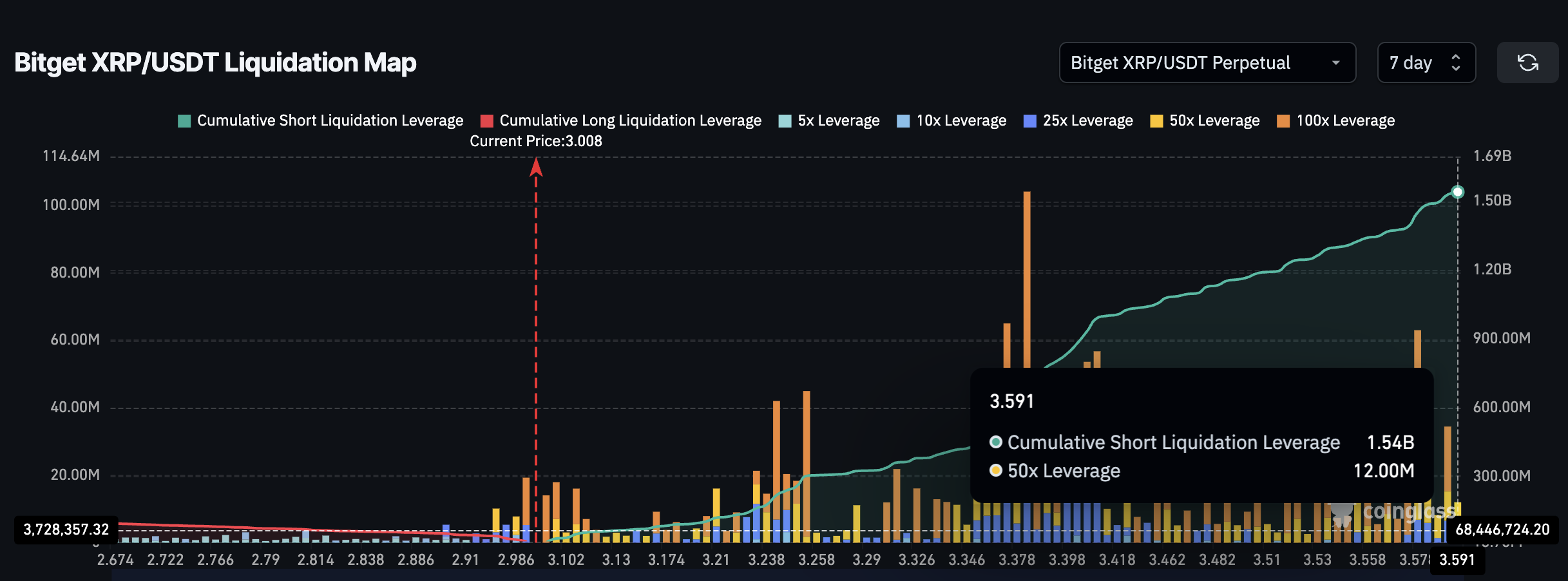

We can undercover agent this on the Bitget XRP-USDT Liquidation Intention (7-day). The chart displays that practically all of these leveraged long positions uncover already been worn out. Sincere now, there’s lower than $100 million price of long liquidations left, which is proscribed when put next with what used to be there earlier. This means many of the leveraged longs are already cleared out.

With fewer long trades left to liquidate, the forced selling strain would possibly maybe well now be easing. In additional practical terms, there’s no longer a ways more shrink back gasoline left from this construct of alarm-promote mechanic. That’s why this freefall would possibly maybe well additionally soon dreary down.

But there’s one more ingredient to undercover agent: a gigantic wall of short liquidation stages building above $3.59. If XRP starts bouncing and pushes elevated, these short positions would possibly maybe well get squeezed next, triggering upside moves.

The liquidation chart is from the derivatives market, and it helps show when crashes would possibly maybe well pause or when bounces would possibly maybe well additionally initiate.

Plight Market Quantity Hints at Merchants Stepping Lend a hand In

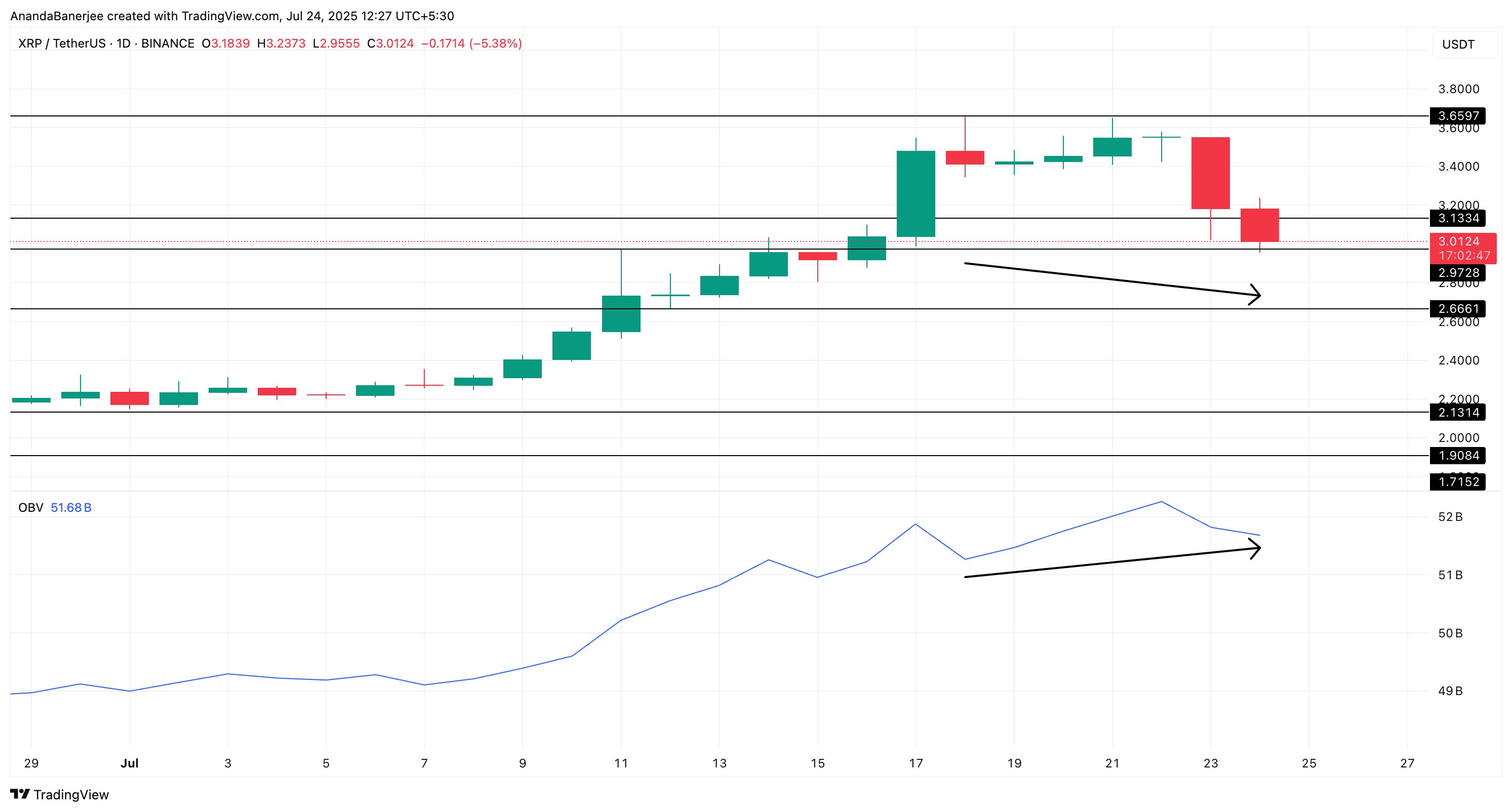

Whereas the derivatives market displays that forced selling is maybe cooling off, the instruct market is additionally flashing one thing attention-grabbing. The OBV (On-Balance Quantity), a metric that tracks whether or no longer quantity is flowing in or out of a coin, is basically rising, despite the proven reality that the XRP designate has been shedding.

That’s a bullish divergence. It intention folks are easy procuring XRP on trouble exchanges, even whereas the price is falling. OBV going up intention more quantity is going on on inexperienced candles than red ones. So despite the proven reality that XRP is down at $2.ninety nine, the underlying quantity circulate is no longer confirming the bearish pattern.

This ties effectively with the derivative files: the forced selling is maybe ending, and valid investors is maybe stepping in quietly. In past cases, this construct of OBV divergence most continuously displays up excellent sooner than a designate reversal or in any case a short-term jump.

This makes OBV an spectacular trouble-market signal. It doesn’t verify a paunchy XRP designate restoration yet, however it does indicate that selling strain is being absorbed and that the downtrend is maybe shedding energy.

XRP Stamp Holds Key Ranges Amid Crash

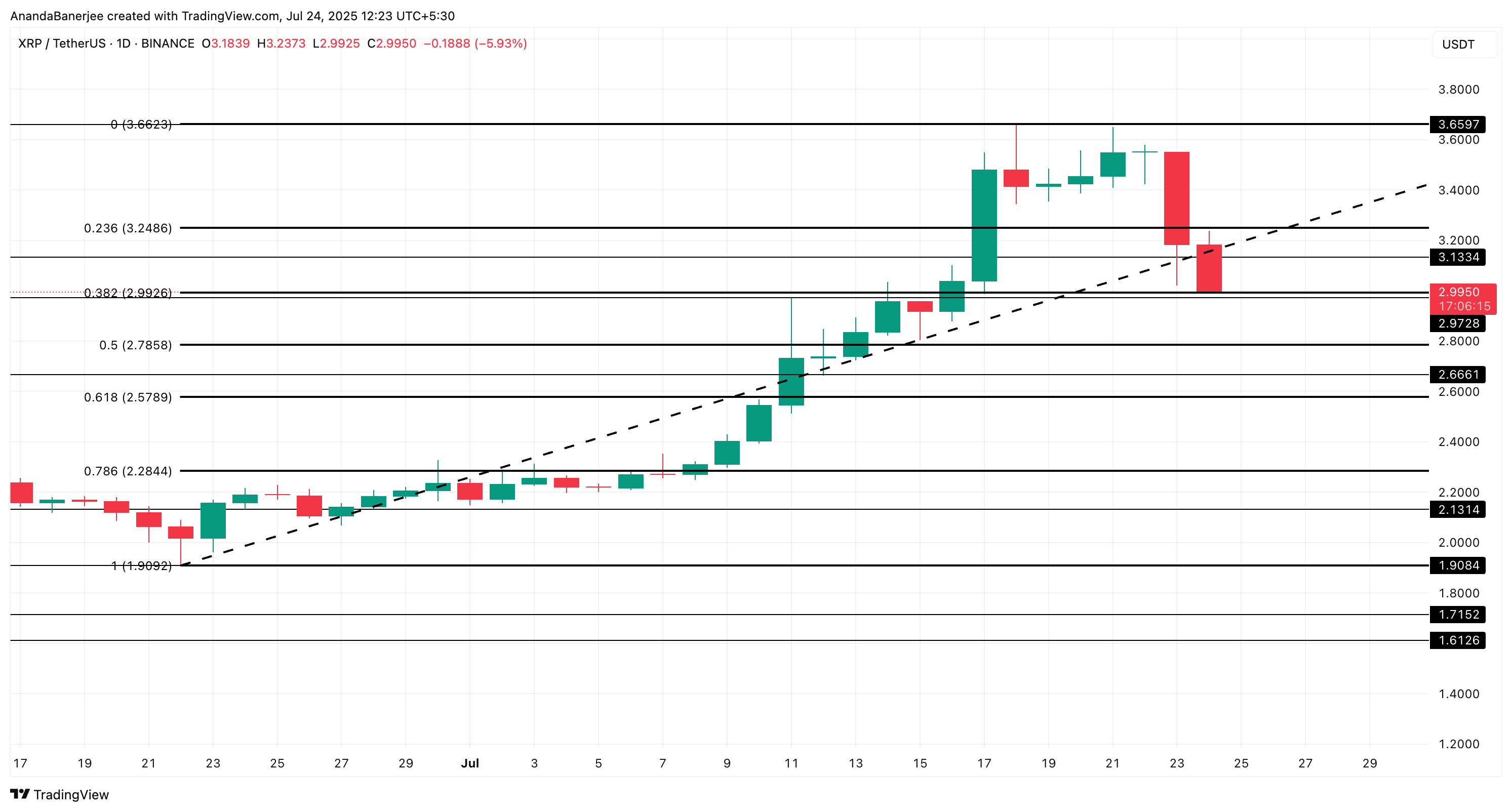

XRP designate is now procuring and selling excellent below $3.00, after falling almost 13% in a single day. That drop sliced thru the well-known $3.13 relieve, and now designate is hovering around $2.ninety nine; a level that lines up with the 0.382 Fibonacci retracement.

This level is key. If XRP holds above it, a short-term jump would possibly maybe well additionally play out, especially with OBV showing energy and long liquidations mostly exhausted. But if $2.ninety nine fails, the following important level sits at $2.78: the 0.5 Fibonacci retracement. That turns into the produce-or-ruin zone.

The Fibonacci retracement indicator used to be used right here, connecting the last most predominant swing low of $1.90 to the swing excessive or the all-time excessive of $3.65. This construct of retracement charts key relieve stages if the asset starts shedding.

Below $2.78? Issues get dicey and the jump expecation gets thrown out of the window. A fall to $2.66 or even $2.28 would possibly maybe well additionally happen like a flash, especially if sellers receive momentum. But straight away, the indicators indicate the correction would possibly maybe well be slowing.

For any jump to stick, XRP needs to reclaim $3.13. If it must’t, merchants must easy undercover agent for more shrink back.