The XRP impress is up about 2.3% in the previous 24 hours and has trimmed its weekly losses to under 7%. The soar seems to be like healthy before all the pieces look, especially after the bottoming indicators we tracked earlier this week. But the building in the encourage of this soar hasn’t improved ample.

A serious anguish is encourage on the desk — a setup that could perhaps push the XRP impress down by over 13%.

Momentum Improves, however Volume and Provide Stress Compete

XRP’s non eternal energy begins with On-Stability Volume (OBV). OBV presentations whether or no longer genuine volume is coming into or leaving the market. XRP’s OBV has at final moved above its short style line, hinting that customers are returning.

But this switch carries a warning. OBV tried the identical breakout on November 18 and failed. That failure caused a 19% tumble between November 18 and November 21.

The most modern push above the line is simplest marginal, no longer a clear breakout. If it slips again, the identical sample could perhaps repeat.

Need extra token insights adore this? Join Editor Harsh Notariya’s Day-to-day Crypto Publication here.

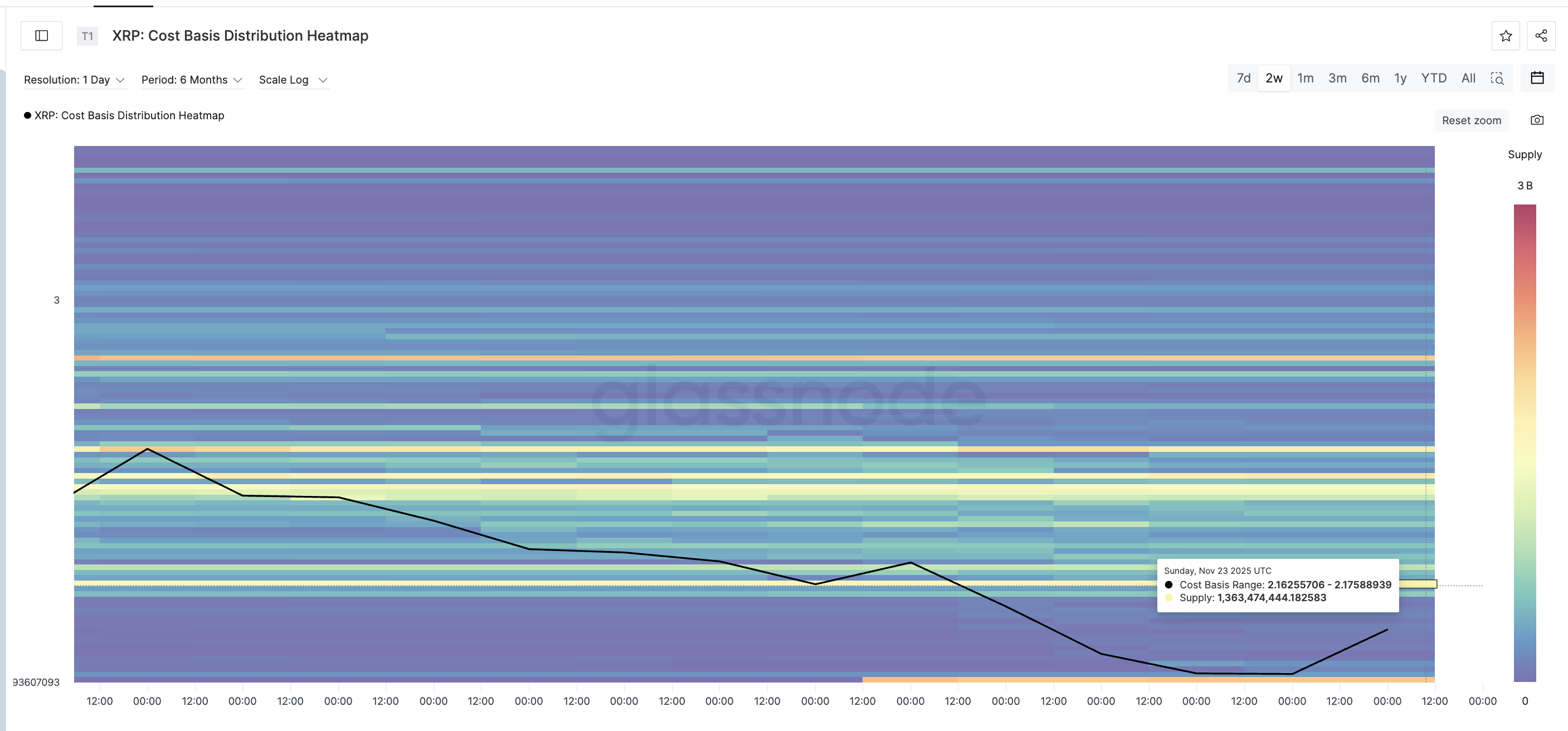

There could be additionally supply strain overhead. The worth-foundation heatmap presentations a dense cluster between $2.16 and $2.17, where roughly 1.36 billion XRP sits, rate nearly $2.86 billion. These holders sit down attain breakeven and continually sell into little recoveries.

If OBV weakens while the XRP impress faces this supply zone, the soar can go like a flash.

Easy, OBV provocative greater is certainly among the few positives for now. A decisive smash above 6.93 billion on the OBV chart would verify stronger volume give a steal to and pork up XRP’s odds of clearing resistance.

XRP Model Movement: The Uncomfortable 13% Threat Easy Hangs Over XRP

Even with a cozy recovery, the XRP impress serene trades under the foremost provocative averages. The 100-day exponential provocative life like (EMA) and the 200-day EMA are both angled down, and the 100-day is now about to terrible under the 200-day.

An exponential provocative life like supplies extra weight to contemporary costs, so it reacts sooner than a straightforward provocative life like. When the 100-day EMA drops under the 200-day EMA, a bearish crossover forms. And it’ll amplify the scheme back.

Here’s the core anguish for XRP moral now. If the crossover completes, the XRP impress could perhaps streak in direction of $1.81, which is the identical bottoming zone the brand new candles bear pointed to. That could perhaps be a 13% dip from the most modern stages. If sellers preserve active while the crossover forms, XRP could perhaps easily revisit that stage. Even the old OBV breakout failure amplifies the anguish of a identical XRP impress tumble.

There could be a technique out, though!

A clear day-to-day shut above $2.25 would weaken the crossover setup. That switch would additionally narrate consumers breaking thru the $2.16–$2.17 supply wall, where about 1.36 billion XRP sit down. Maintaining above $2.25 would allow the 100-day EMA to curve upward again and cleave back the crossover impact.

Unless that happens, the bearish EMA building retains the 13% XRP impress scheme back threat alive, even with OBV turning up.

The put up XRP Model Bounces, But One “Uncomfortable 13″% Threat Easy Lingers regarded first on BeInCrypto.