On Monday morning between 8 a.m. and 9 a.m. Jap Time, XRP is buying and selling at $2.68, with a market capitalization of $154 billion and a 24‑hour intraday notice range from $2.64 to $2.76. The asset’s modest 24‑hour commerce volume of $3.75 underscores cautious market participation as traders assess its device-time length momentum.

XRP

The 1-hour chart shows instantaneous bearish momentum, with XRP struggling to gain above the serious non permanent make stronger zone of $2.60–$2.65. Declining commerce volume on this timeframe underscores weakening buying ardour, aligning with notice action that has tested the lower bounds of the 24-hour intraday range ($2.64–$2.76). A breakdown beneath $2.60 could per chance crawl up losses toward valuable make stronger at $2.30–$2.40, despite the real fact that a bullish reversal candle paired with volume affirmation could per chance stabilize the asset. Traders could per chance silent video show $2.58 as a first payment end-loss stage for long positions.

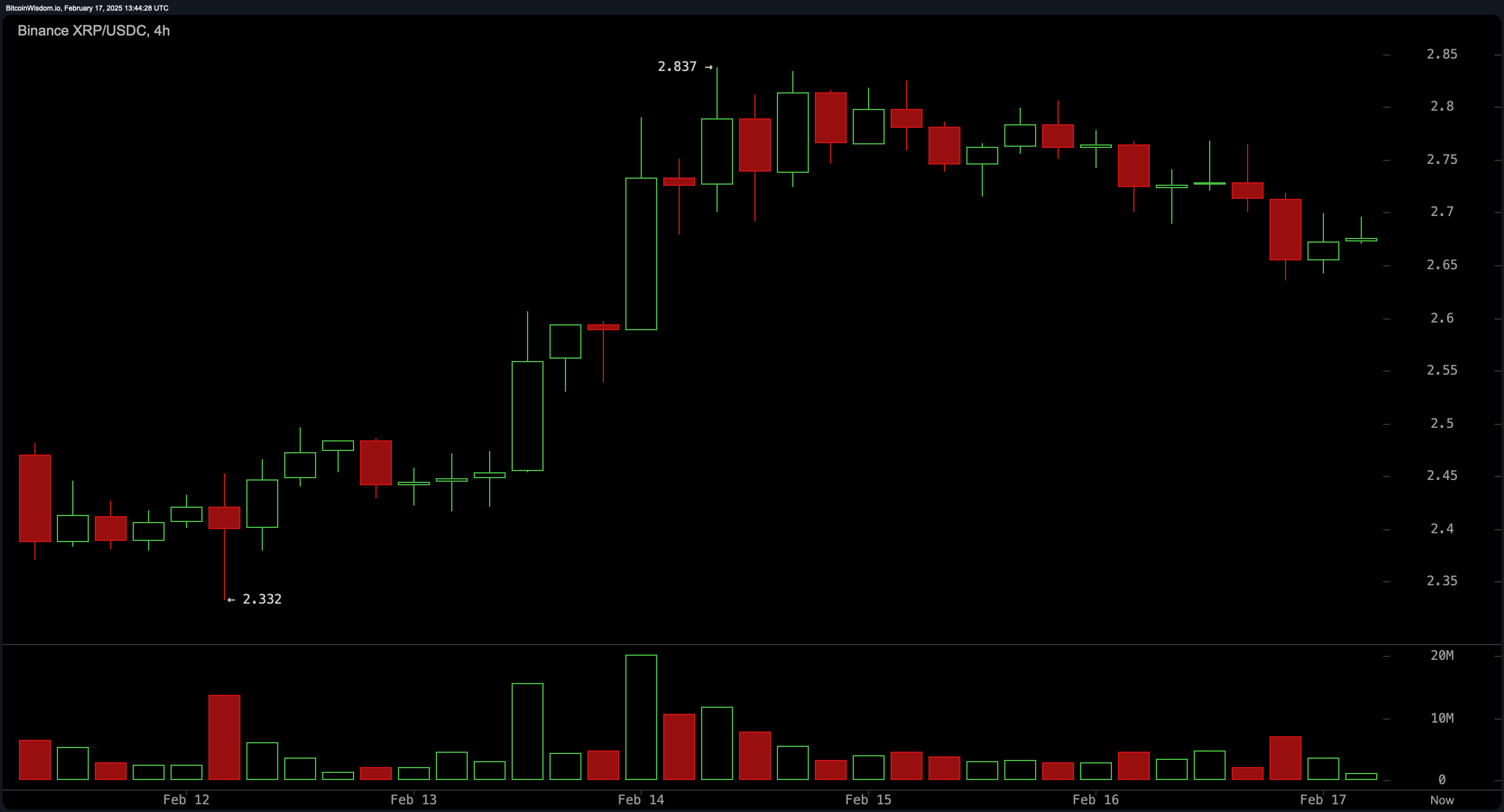

XRP’s 4-hour chart paints a conflicting portray: a nascent uptrend faces stiff resistance device $2.80–$2.85, a zone marked by repeated rejections. While the native restoration suggests bullish makes an attempt, the dearth of volume conviction raises skepticism. A sustained terminate above $2.85 could per chance delivery a direction toward the psychological $3.00 stage, but failure right here risks retesting $2.65 make stronger. This timeframe’s diagnosis advises caution, favoring excessive-volume notice affirmation sooner than directional bets.

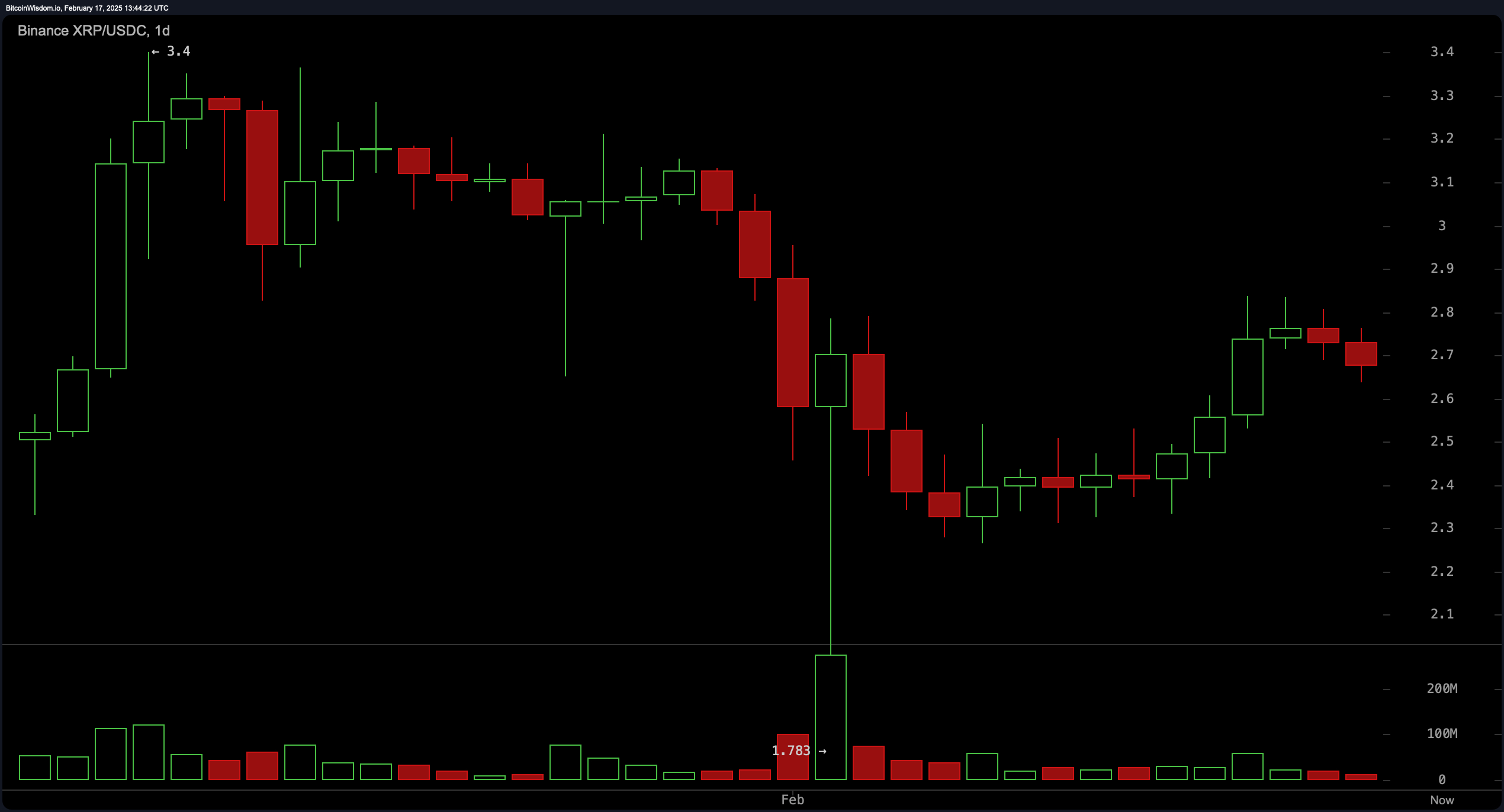

The on a typical foundation chart confirms a broader downtrend, despite the real fact that XRP has clawed lend a hand from fresh lows device $1.78. The restoration remains fragile, with resistance device $2.80–$2.85 acting as a to find-or-atomize threshold. Volume diagnosis reveals capitulation at some level of the prior drop but muted participation at some level of the rebound, signaling skepticism among traders. A atomize above $2.85 would danger medium-time length bearish sentiment, whereas rejection right here could per chance validate the overarching downtrend’s persistence.

XRP’s oscillators show cloak a neutral bias overall. The relative energy index (RSI) at 50.74 and Stochastic at 81.66 counsel equilibrium between traders and sellers. On the other hand, the transferring moderate convergence divergence (MACD) flashes a aquire signal at -0.03172, contrasting with the momentum indicator’s sell call at 0.27468. This divergence implies fragmented momentum, urging traders to prioritize notice action over oscillator signals until clearer alignment emerges.

Transferring averages skew bullish, with 10-, 20-, 30-, 50-, 100-, and 200-day exponential averages (EMA) all signaling buys. The 30-day straightforward transferring moderate (SMA 30) at 2.78278 and 50-day SMA at 2.69015, alternatively, counsel sells, hinting at device-time length overhead offer. The 200-day SMA (1.41642) and EMA (1.72464) underscore long-time length bullish seemingly but stay a ways-off from fresh prices. Traders could per chance silent weigh shorter-time length EMA-pushed optimism in opposition to SMA resistance ranges.

Bull Verdict:

XRP’s fresh buying and selling stage at $2.68, backed by a strong market cap of $154 billion, suggests the opportunity of an upward transfer if buying ardour surges. A sustained terminate above the intraday excessive of $2.76 could per chance catalyze extra positive aspects, potentially driving the asset toward the $3.00 mark; traders could per chance silent look for elevated volume and a breakout from fresh resistance as affirmation of a bullish reversal.

Possess Verdict:

Despite XRP’s proper market capitalization, the reasonably low 24‑hour commerce volume of $3.75 and its confined intraday notice range between $2.64 and $2.76 expose an absence of sturdy momentum. A breakdown beneath the the biggest make stronger zone at $2.60 could per chance expose XRP to accelerated selling stress, making it prone to extra declines; cautious traders could per chance silent be wary of those technical pressures and the opportunity of a deeper bearish glide.