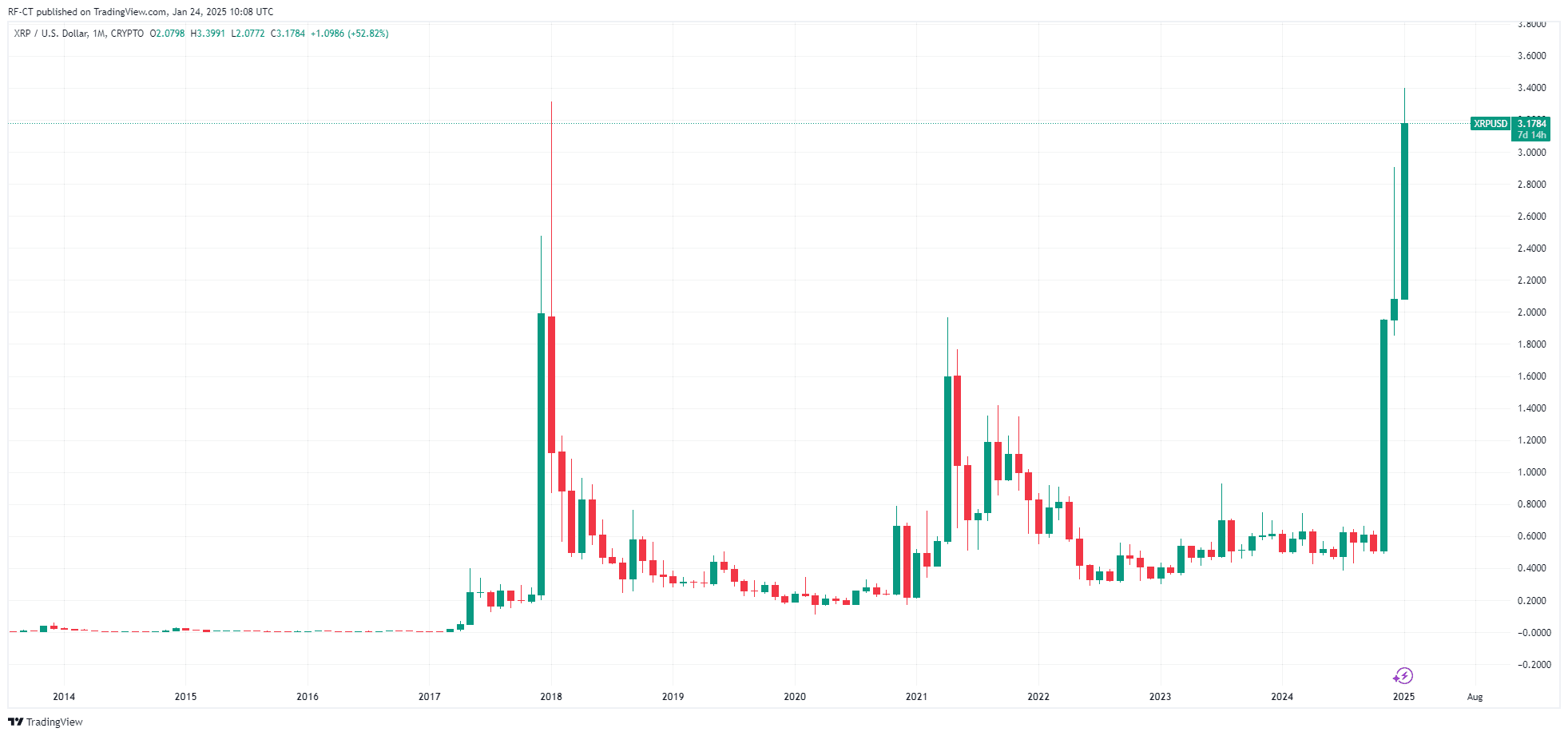

XRP remains on the forefront of the cryptocurrency market, facing both alternatives and uncertainties. However, will the SEC silence on Ripple’s allure, Trump’s crypto executive uncover selling know-how innovation -with a essential honest of making The US the capital of AI and crypto- fuel an XRP label rally? And with Ripple’s increasing honest in global debt transactions, XRP’s future has buyers and analysts staring at closely. This text examines the most up-to-date XRP files and dispositions impacting its market outlook.

1. SEC Silence Fuels Market Uncertainty

Ripple’s correct victory against the SEC in 2023 was a pivotal second for the crypto alternate. However, the SEC has but to allure the ruling, leaving XRP in a deliver of limbo. The absence of regulatory readability has resulted in hypothesis regarding the lengthy traipse trajectory of XRP’s label and adoption. Analysts warn that the prolonged uncertainty can also trigger transient volatility, particularly as buyers anticipate decisive action from the SEC.

2. Trump’s Crypto Govt Deliver: Favorable for Ripple and XRP Adoption?

President Donald Trump’s Crypto Govt Deliver banning the pattern of a U.S. Central Bank Digital Forex (CBDC) and overturning the controversial SAB 121 has been a sport-changer for the crypto sector. Right here’s how the uncover supports Ripple and XRP:

- Prohibition of CBDCs: The uncover’s ban on CBDCs reinforces the dominance of non-public-sector solutions admire Ripple’s blockchain know-how. This coverage aligns with Ripple’s honest of streamlining putrid-border funds with out counting on authorities-issued digital currencies.

- Repeal of SAB 121: By eliminating burdensome accounting requirements for cryptocurrency custodians, the executive uncover reduces barriers for institutions retaining XRP, fostering increased market participation and liquidity.

These moves signal an very good coverage shift for blockchain innovation, with Ripple positioned as a key beneficiary.

3. Will the SEC Silence and Trump Govt Deliver Gas an XRP Label Rally?

The intersection of the most up-to-date XRP files and dispositions, from market dynamics, institutional hobby, regulatory shifts, and geopolitical influences makes the doubtless for an XRP label rally a arena of intense hypothesis. Right here’s how the most up-to-date dispositions can also shape XRP’s trajectory.

Market Dynamics and Institutional Hobby: A Bullish Basis

XRP’s allure amongst institutional buyers and crypto whales has been on the upward push. Coinbase’s most up-to-date accumulation of over 300 million XRP highlights the increasing self assurance within the token’s utility and capability. The sustained hobby from main gamers underscores XRP’s resilience, even amid market uncertainty.

Furthermore, Ripple’s upcoming RLUSD innovation is determined to reinforce liquidity and scalability, additional strengthening XRP’s location as a market chief. Irrespective of the transient surge in trading volume from the $TRUMP token, XRP’s consistent query reaffirms its site as a high-tier cryptocurrency. These components collectively imply a robust foundation for future label growth.

XRP Alternatives for Progress: Ripple Improvements and Policy Enhance

The daring Ripple global debt transaction initiatives non-public ignited optimism about XRP’s lengthy-term possibilities. By redefining putrid-border funds and debt decision, Ripple positions XRP as a first-rate instrument within the worldwide monetary landscape. Analysts non-public projected an XRP label rally to $9, reflecting the increasing XRP adoption in global markets.

At the side of to this momentum is the doubtless affect of Trump’s Govt Deliver, which prohibits the pattern of a U.S. Central Bank Digital Forex (CBDC) and repeals the restrictive SAB 121. These coverage shifts desire non-public-sector innovation, no longer straight away benefiting Ripple and XRP by lowering regulatory burdens on crypto infrastructure and encouraging broader adoption.

XRP Challenges and Risks: Bearish Patterns and Market Sentiment

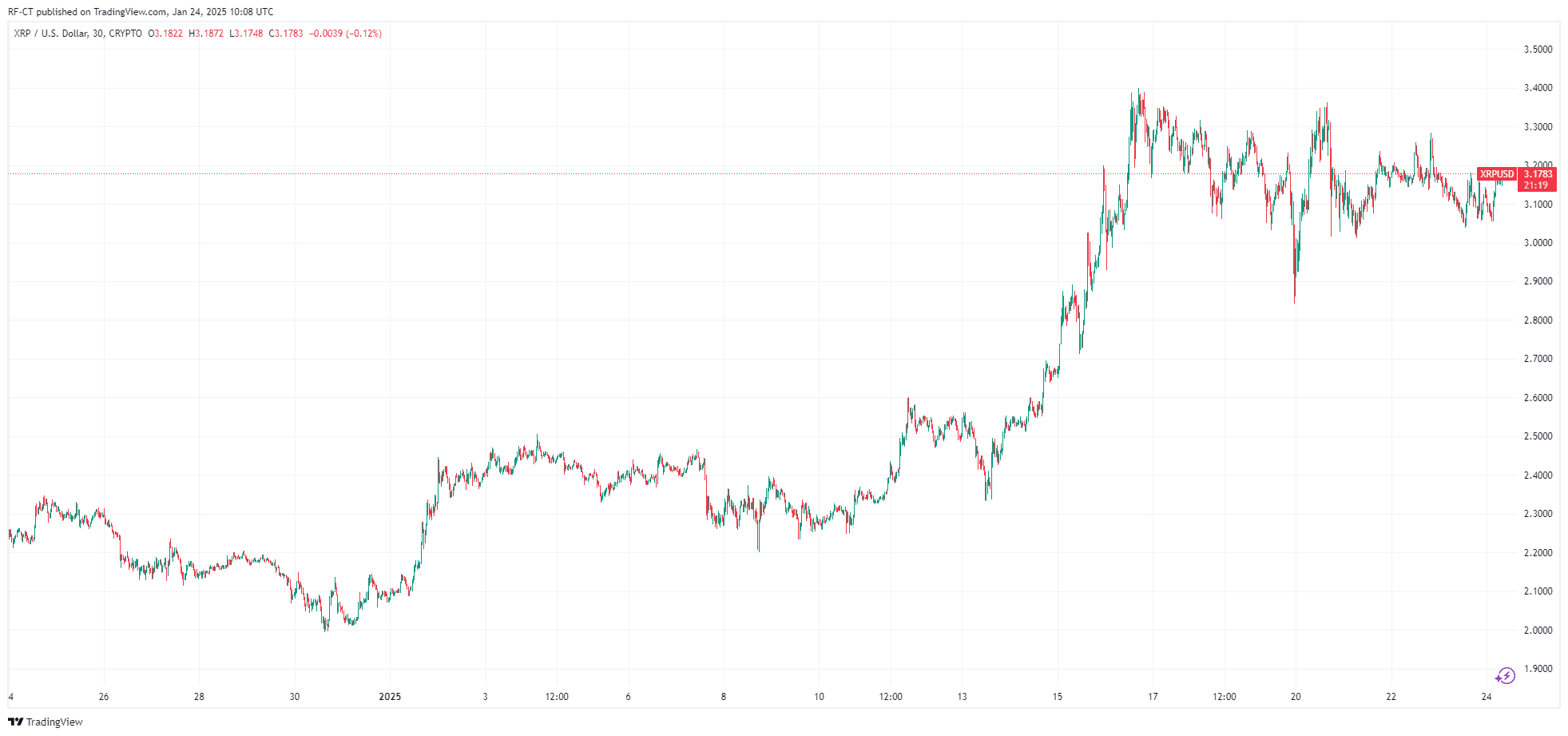

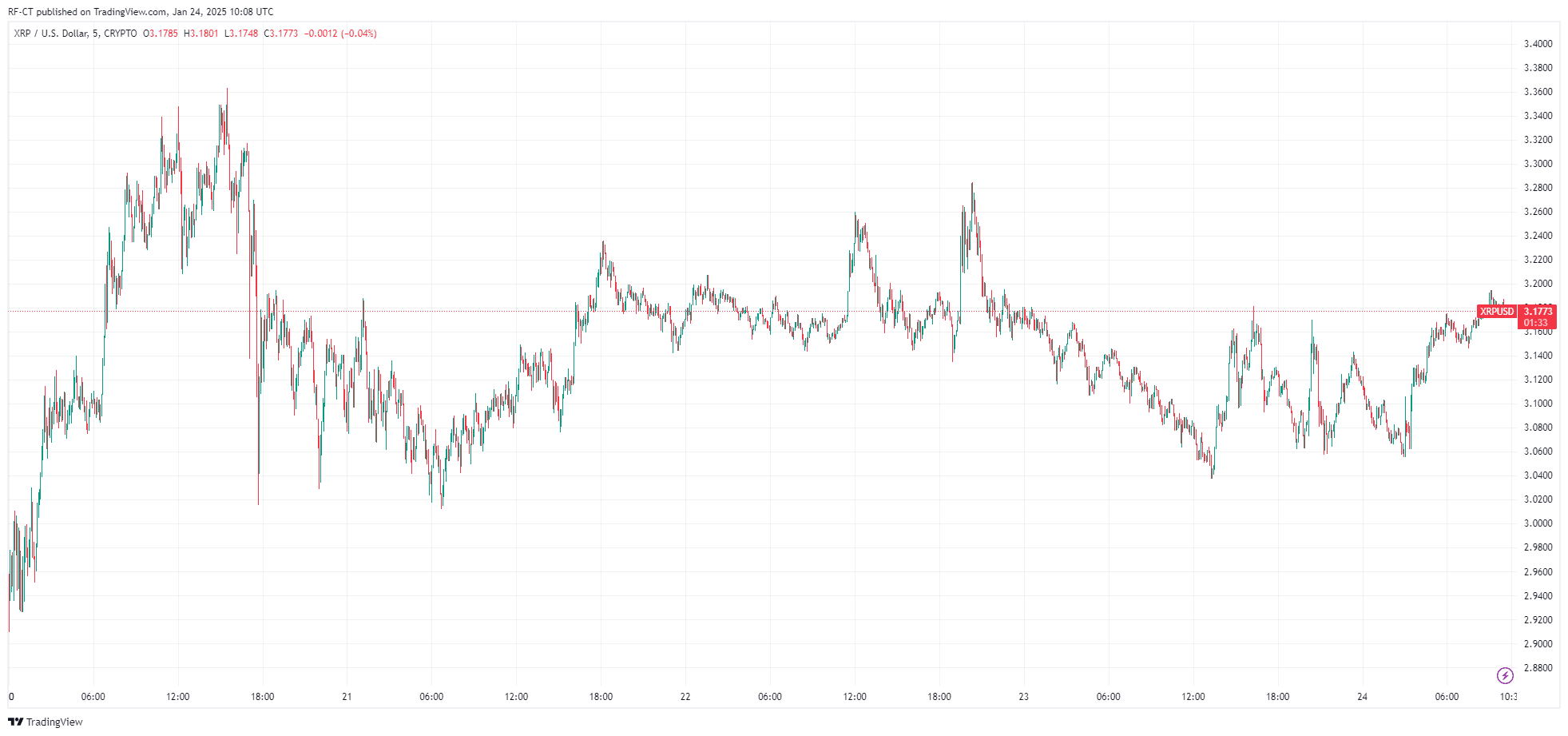

Whereas the basics appear sturdy, XRP is no longer with out risks. Bearish patterns non-public emerged, signaling a doable 20% label decline if key pork up ranges are breached. Market sentiment remains volatile, partly as a end result of geopolitical components and uncertainty surrounding regulatory readability because the SEC remains silent on its allure against Ripple. This silence has fueled hypothesis nonetheless also left a cloud of unpredictability over the transient XRP label actions.

Conclusion: A Rally within the Making?

The most up-to-date landscape means that the XRP label is poised for growth, pushed by institutional hobby, Ripple’s innovative initiatives, and supportive coverage shifts underneath Trump’s executive uncover. However, the lingering risks of market sentiment and technical challenges warrant cautious optimism. Merchants and buyers will non-public to unexcited video show serious pork up ranges and key dispositions closely.

Whereas a important XRP label rally is no longer assured within the immediate term, the groundwork for sustained growth appears great, with the XRP label properly-positioned to capitalize on the evolving digital monetary ecosystem.