XRP has fluctuated between $2.forty eight and $2.52 within the past hour, supported by a $144 billion market capitalization. Inside the identical period, it recorded a 24-hour alternate quantity of $7.57 billion and an intraday designate differ spanning $2.38 to $2.59.

XRP

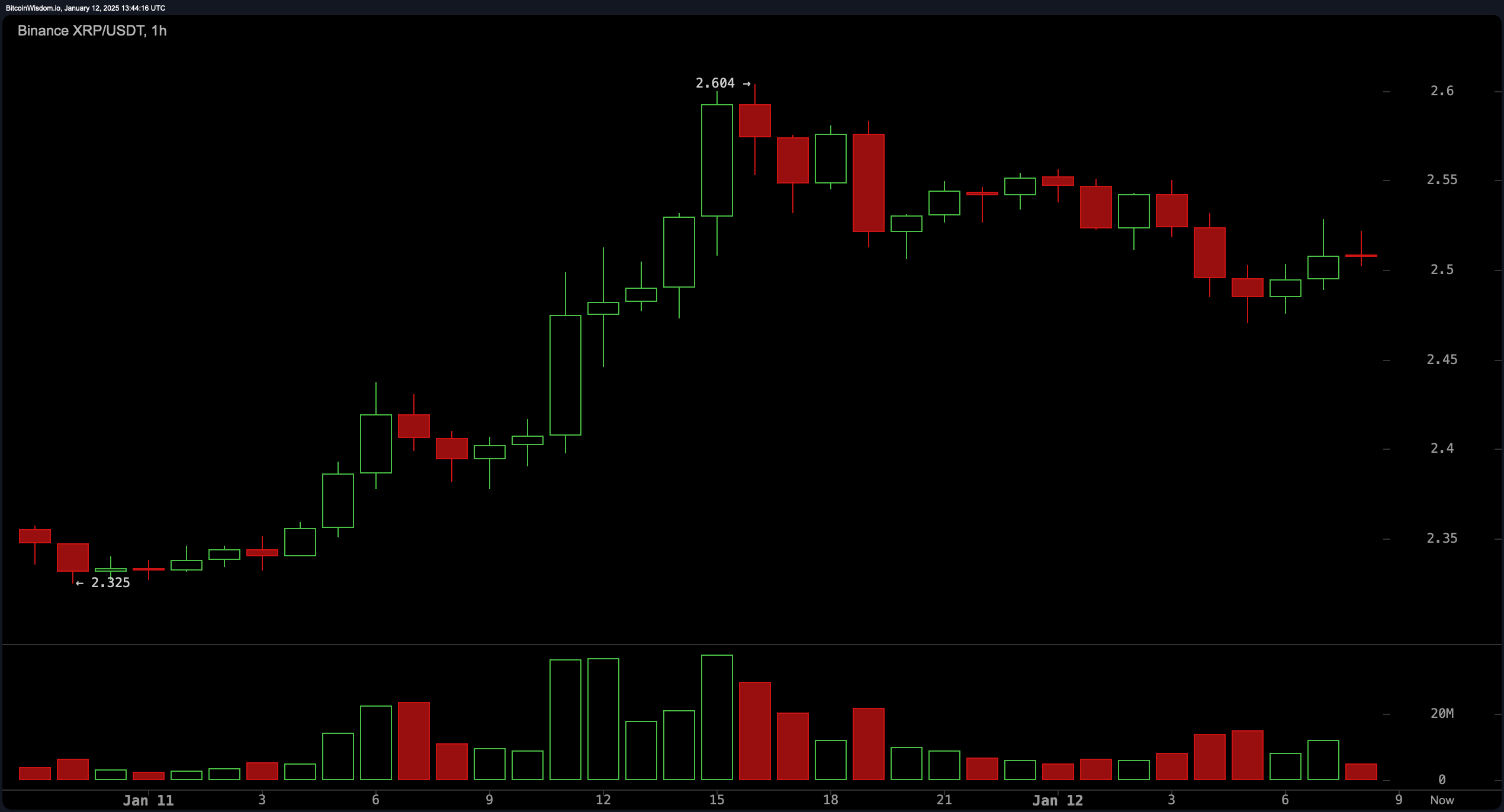

On the hourly chart, XRP looks to be in a little bit of micro-consolidation, discovering equilibrium shut to $2.50 after reaching a native high of $2.604. Resistance emerges between $2.55 and $2.60, with enhance anchored at $2.forty five. This a part of declining quantity suggests a measured correction moderately than a bearish shift, presenting merchants with likely momentary entry parts shut to enhance ranges, targeting exits between $2.60 and $2.65.

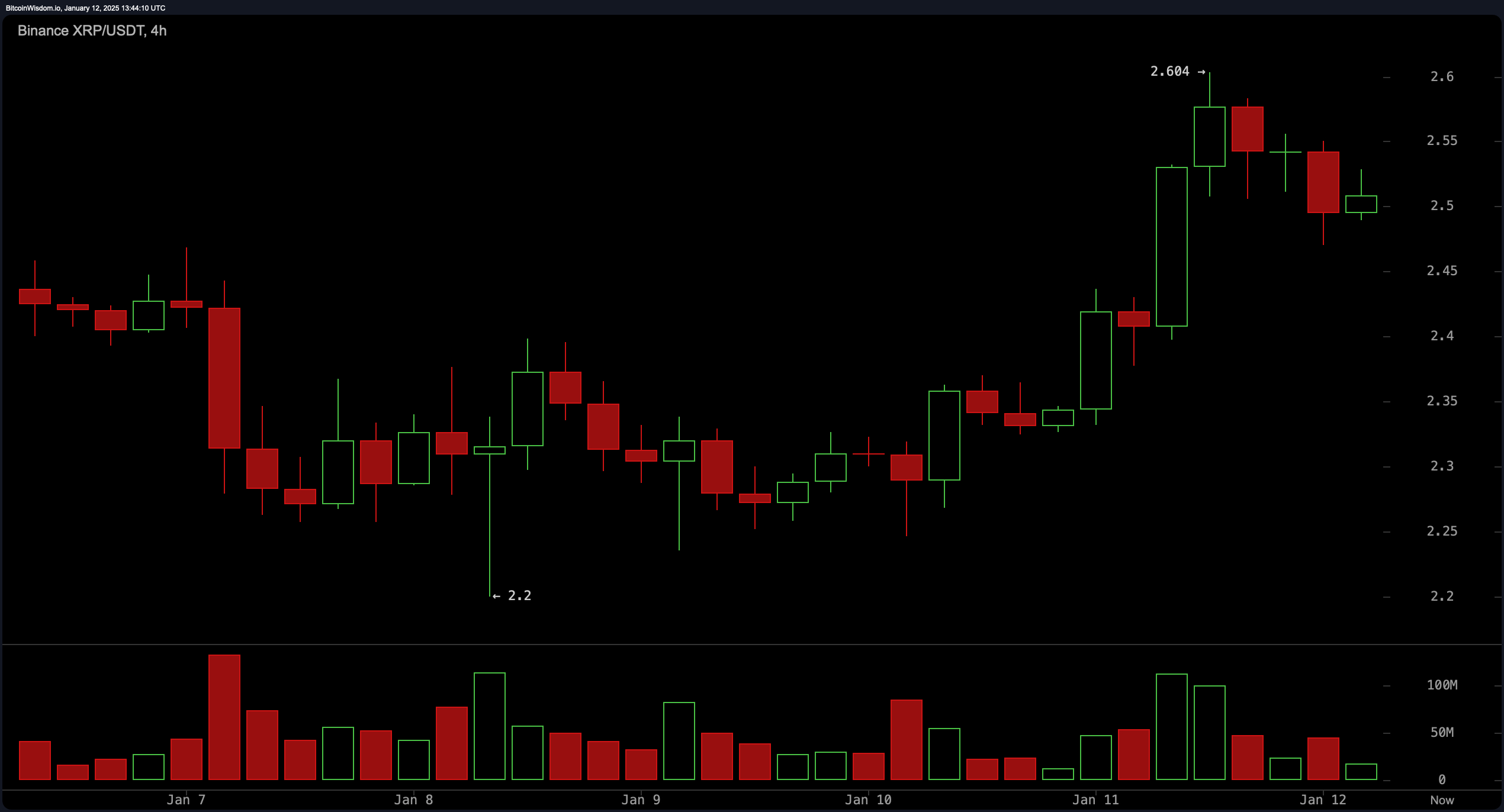

Zooming out to the 4-hour chart, XRP retains its upward trajectory following a with out a doubt intensive designate rally earlier within the week, stabilizing shut to $2.50. Resistance zones lie at $2.60 and $2.70, with enhance reliably holding between $2.forty five and $2.50. Strategically, merchants would perhaps perhaps have faith entry opportunities on a confirmed breakout above $2.60 or a retracement to $2.forty five, surroundings profit targets within the $2.60 to $2.70 differ.

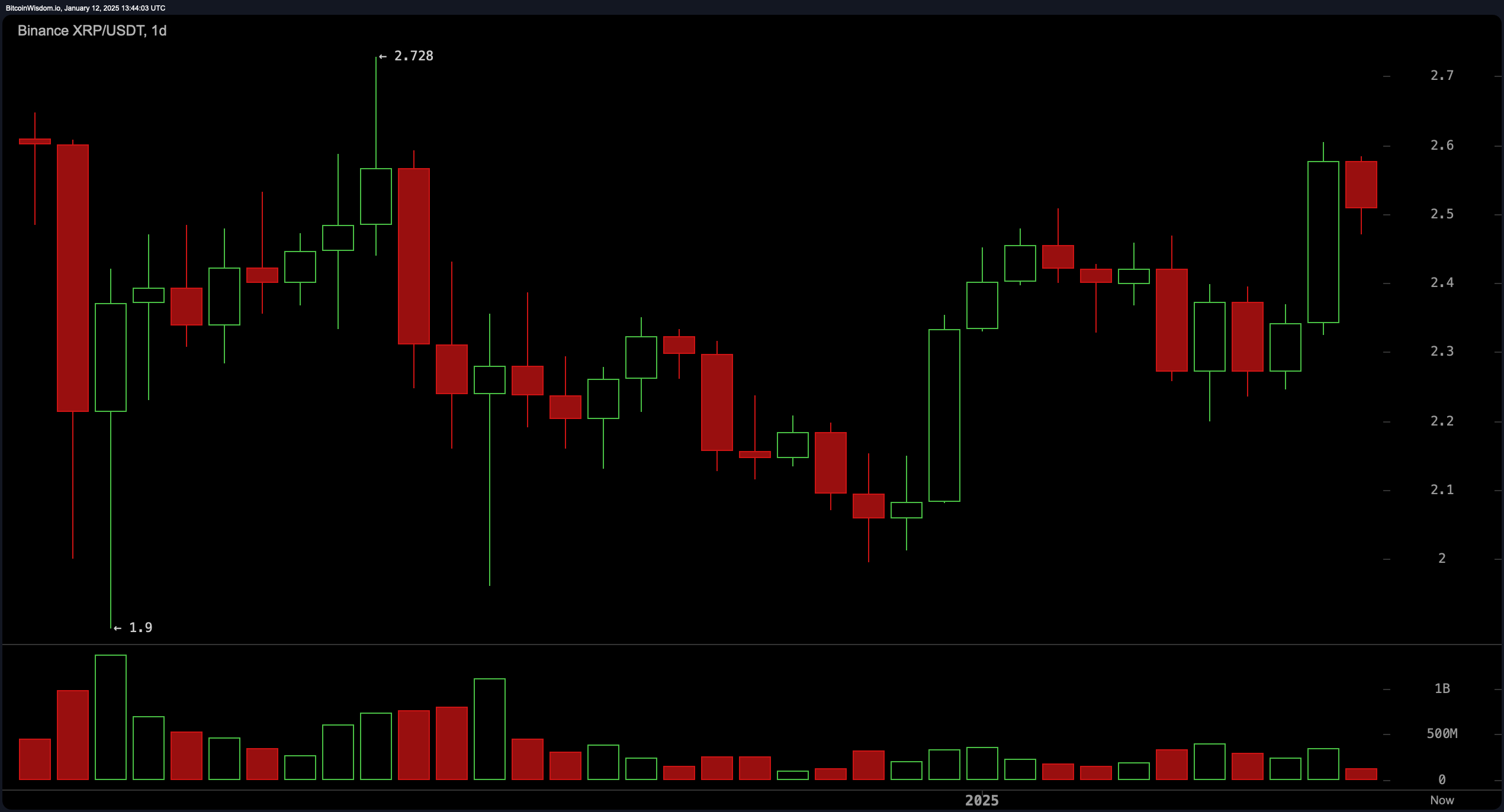

On the day-to-day timeframe, XRP displays a broader restoration pattern, climbing from a most modern low shut to $2.20 to an intraday high of $2.72 sooner than rather retracing. Seriously, elevated buying quantity on bullish candles reflects renewed market interest. Resistance at $2.72 and enhance at $2.40 define key ranges to verify for added designate circulate.

Technical oscillators repeat a nuanced outlook. The relative energy index (RSI) reads 58.Ninety 9, signaling neutrality, whereas the Stochastic oscillator, at 82.71, leans toward overbought conditions. Meanwhile, the enthralling sensible convergence divergence (MACD) signifies a explicit signal at 0.07805, counterbalanced by selling stress in point of fact helpful by the momentum oscillator at 0.10760 and the commodity channel index (CCI) at 137.10.

Across all timeframes, enthralling averages dwell bullish. Both exponential and straightforward enthralling averages all the arrangement by 10, 20, 50, 100, and 200 sessions align to repeat favorable buy conditions. This alignment signals that market sentiment for XRP remains optimistic, contingent on the asset surpassing serious resistance thresholds.

Bull Verdict:

XRP’s most modern technical setup paints a report of optimism, with bullish signals from enthralling averages all the arrangement by all timeframes and buying interest reflected in most modern quantity patterns. A a hit breakout above $2.6, accompanied by sturdy quantity, would perhaps perhaps pave the technique for added gains toward $2.7 and beyond. The broader restoration fashion means that XRP is well-positioned for likely upside if resistance ranges are decisively breached.

Endure Verdict:

Despite the upward momentum, XRP faces well-known hurdles at resistance zones between $2.6 and $2.7, whereas oscillators signal caution with overbought conditions and selling stress creeping in. A failure to preserve enhance at $2.forty five would perhaps perhaps lead to extra downside, attempting out ranges under $2.4. Merchants must always remain vigilant for indicators of a deeper correction if buying momentum falters.