XRP is procuring and selling at $2.41, with an intraday differ of $2.38 to $2.52, a market cap of $137.70 billion, and a 24-hour procuring and selling volume of $8.77 billion, highlighting a part of consolidation.

XRP

On the 1-hour chart, XRP shows a short-time period downtrend following a retreat from a native high of $2.531 to its present degree advance $2.41. The mark is stabilizing in the $2.38–$2.40 differ, which acts as a key crimson meat up zone, whereas resistance looms at $2.48–$2.50. Diminished procuring and selling volume after a most traditional decline suggests diminished selling tension and doable consolidation. Merchants would possibly per chance well well also simply clutch into fable coming into advance crimson meat up if accompanied by rising volume, focused on the $2.50 degree.

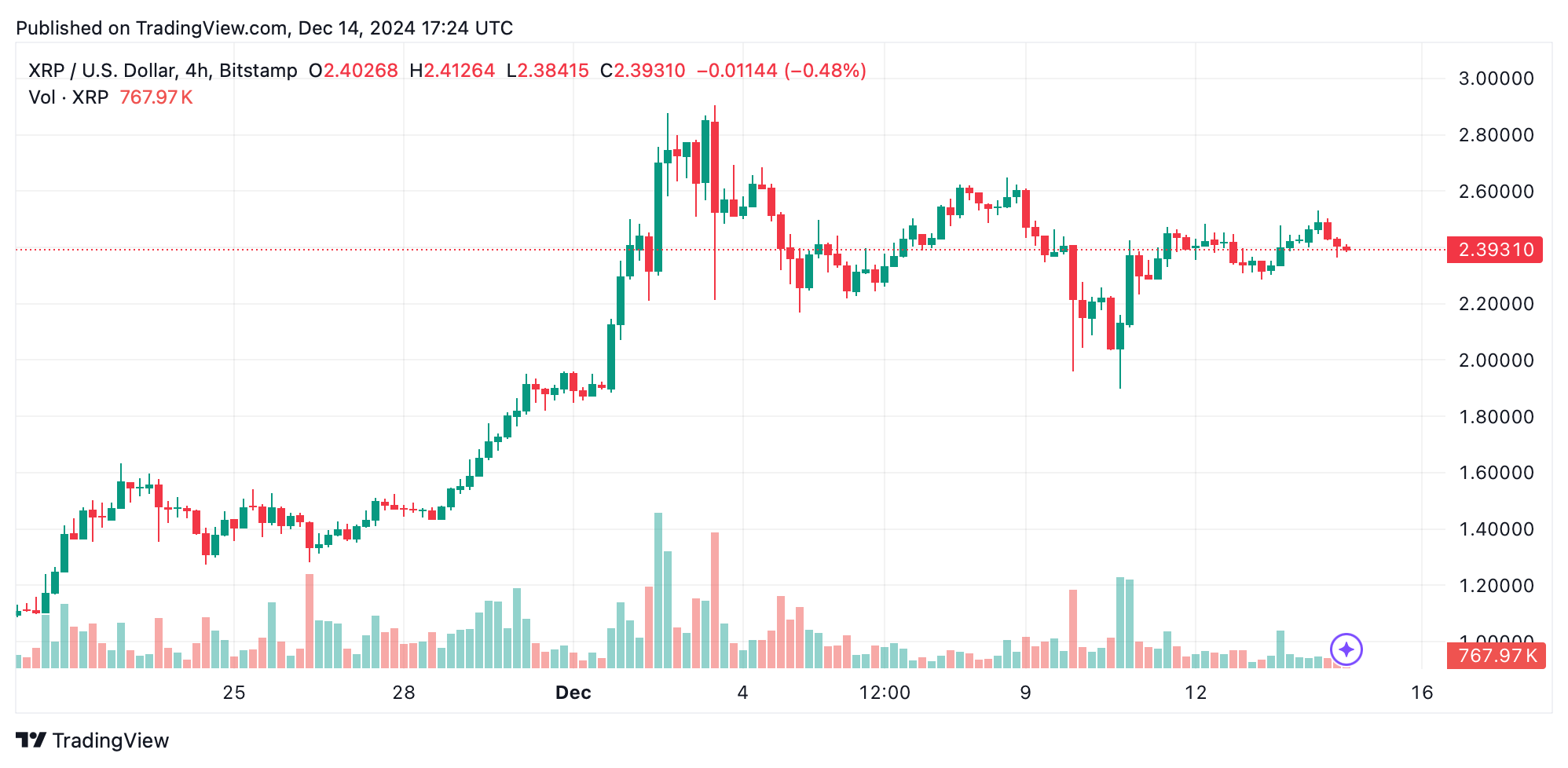

The 4-hour chart unearths XRP consolidating between $2.30 and $2.50 after a pointy recovery from a most traditional low of $1.898. Solid crimson meat up resides advance $2.30, with extra demand zones around $2.10–$2.20. Resistance is evident between $2.50 and $2.60. A breakout above $2.50 would possibly per chance well well teach a bullish continuation, whereas a breach below $2.30 would possibly per chance well well signal extra method back. Merchants eyeing mid-time period positions would possibly per chance well well also simply await confirmed strikes beyond these levels.

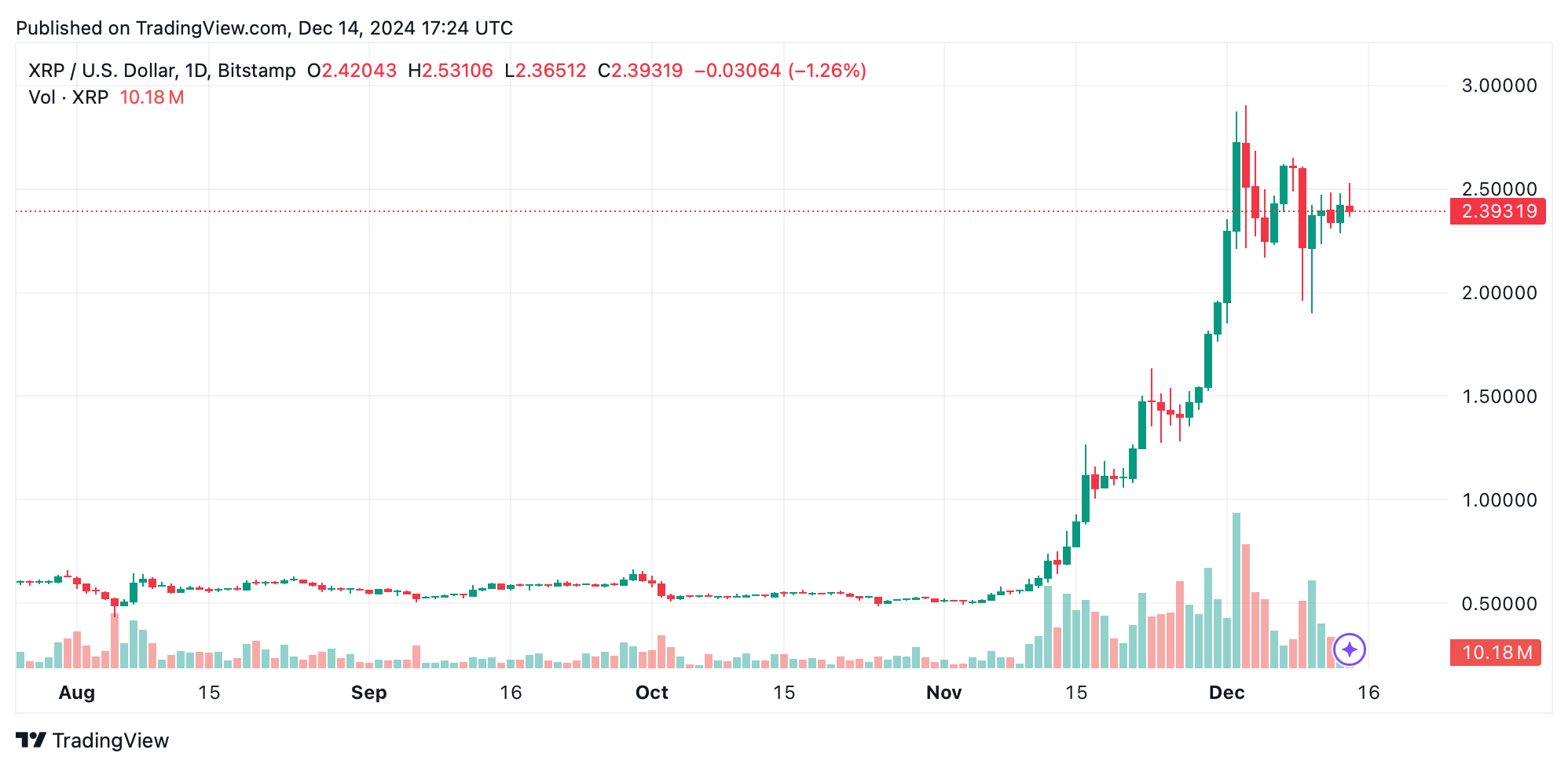

XRP’s daily chart portrays a broader rally from $0.5441 to a height of $2.909, followed by a pullback into the $2.40–$2.50 consolidation zone. Key crimson meat up levels are seen at $2.20 and $2.00, whereas resistance ranges from $2.60 to $2.90. The reduced procuring and selling volume in the midst of consolidation suggests waning momentum but affords a capacity procuring opportunity if $2.20 holds firm. A breakout above $2.60 would possibly per chance well well lead XRP in direction of retesting its most traditional highs.

XRP’s oscillators present fair to bullish signals, with the relative strength index (RSI) at 64.15, Stochastic at 56.37, and momentum at 0.04736 indicating optimism. On the opposite hand, the transferring lifelike convergence divergence (MACD) degree at 0.31878 signals detrimental action. Transferring averages (MAs) point out a solid bullish type, as exponential transferring averages (EMAs) for 10, 20, and 50 classes and straight forward transferring averages (SMAs) for the identical classes all deem definite signals.

Bull Verdict:

XRP’s consolidation advance $2.40, blended with solid crimson meat up levels and bullish transferring averages, suggests the aptitude for a breakout above $2.50. If procuring volume increases and the broader market sentiment stays definite, XRP would possibly per chance well well retest $2.60 and doubtlessly aim for its most traditional high advance $2.90, reaffirming its bullish momentum.

Endure Verdict:

A failure to set apart crimson meat up at $2.38, coupled with the promote signal from the transferring lifelike convergence divergence (MACD), would possibly per chance well well consequence in a deeper retracement in direction of $2.20 or even $2.00. Lower procuring and selling volumes in the midst of consolidation would possibly per chance well well moreover teach waning bullish strength, atmosphere the stage for bearish momentum to dominate.