XRP, priced at $2.52 with a market cap of $145 billion and 24-hour trading quantity of $9.35 billion, has shown a label vary between $2.33 and $2.56 on January 13, 2025, as technical indicators imply a mix of consolidation and potential bullish momentum.

XRP

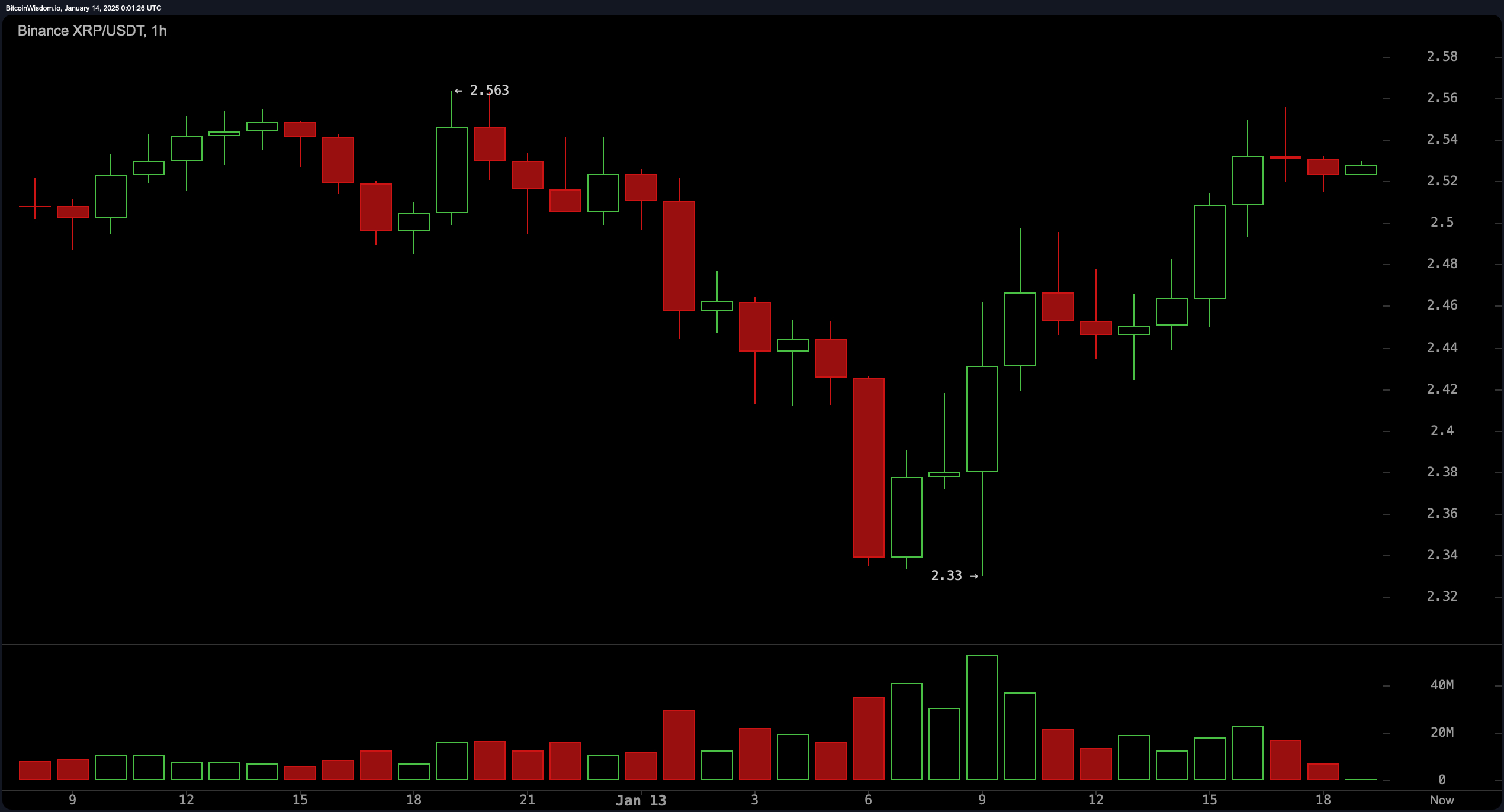

XRP’s 1-hour chart displays a interval of consolidation arrive $2.50-$2.55 after a recent recovery, with oscillators such because the gripping reasonable convergence divergence (MACD) indicator in a aquire zone at 0.08662, indicating upward momentum. Within the meantime, declining quantity highlights seller warning because the market evaluates the energy of this gallop. Entry opportunities arrive $2.forty eight-$2.50 with a pause-loss under $2.forty five might perhaps also offer favorable setups for intraday programs, while resistance at $2.55-$2.60 affords a doable exit zone.

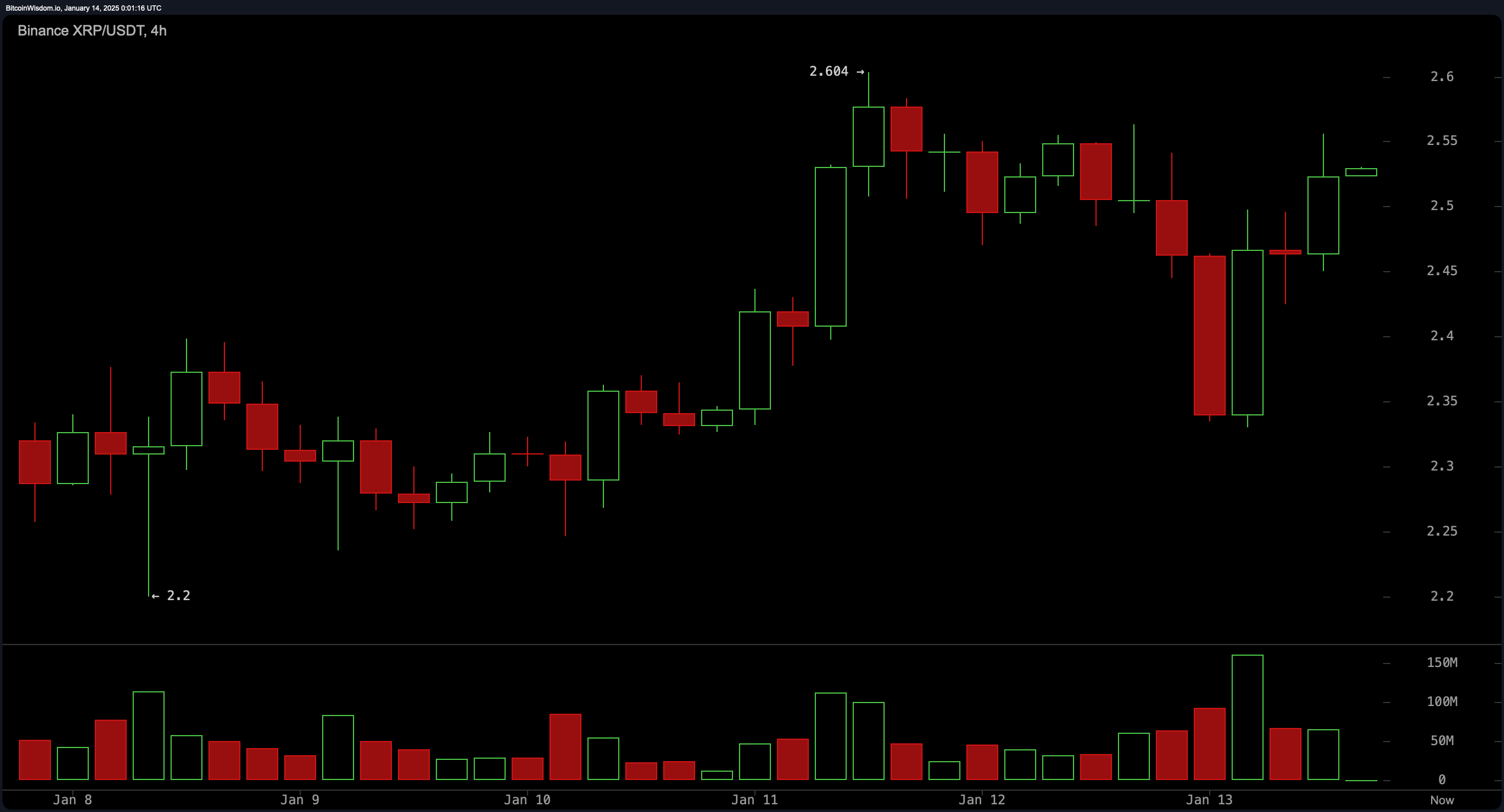

On the 4-hour chart, XRP has established increased lows, signaling an uptrend no matter resistance arrive the $2.60 vary. Key gripping averages, along with the exponential gripping reasonable (EMA) at $2.43729 and the straightforward gripping reasonable (SMA) at $2.42029, beef up the bullish outlook. Nonetheless, quantity has begun to diminish arrive resistance, emphasizing the necessity for affirmation sooner than looking forward to a breakout. Retests of $2.forty five-$2.50 might perhaps also present ideal entry strategies, with stops positioned conservatively under $2.40.

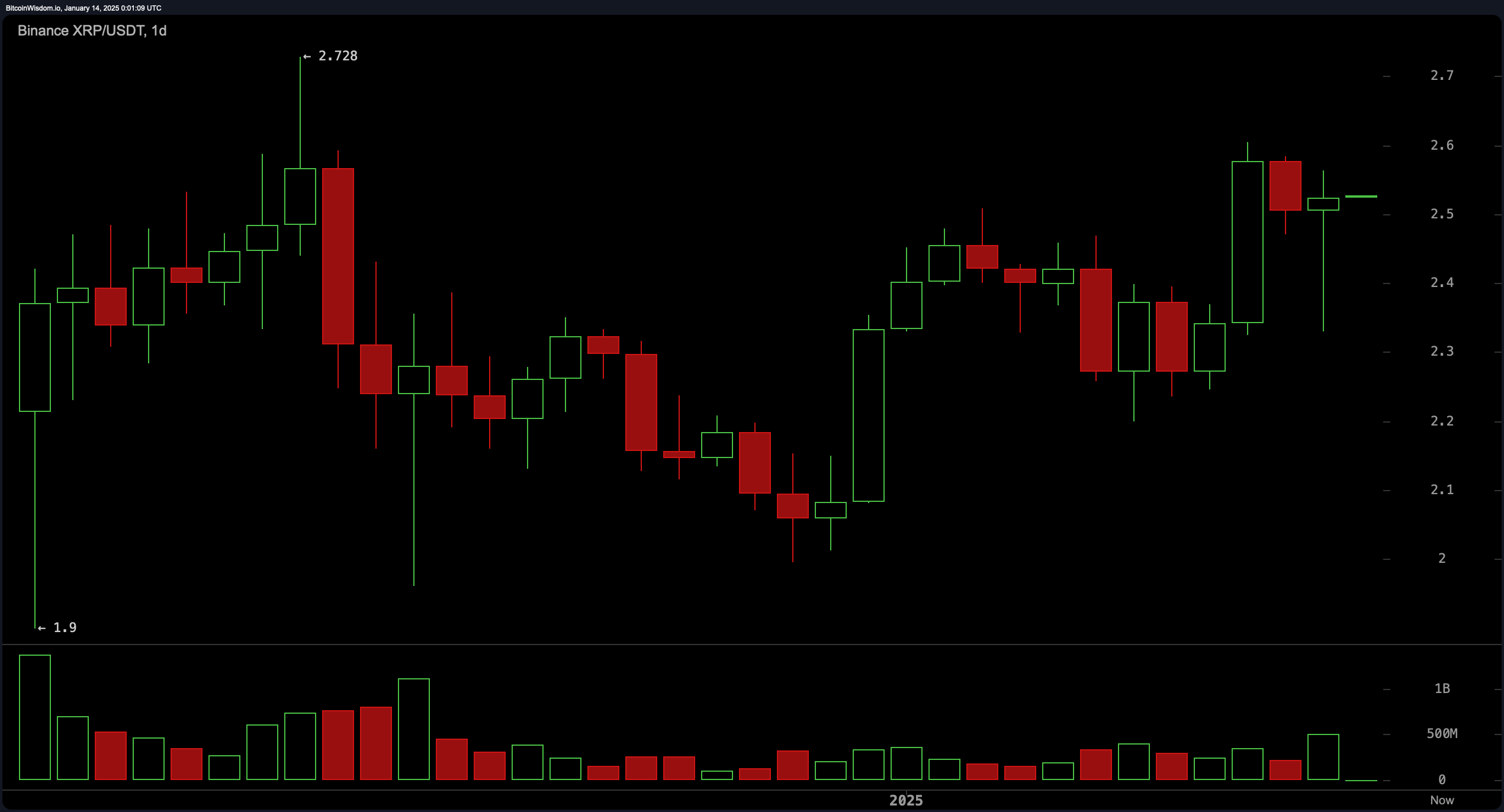

XRP, the third-largest cryptocurrency by market cap, exhibits a clearer image on its day-to-day chart, revealing a solid rebound after a recent dip. All gripping averages (MAs)—starting from the EMA (20) at $2.37322 to the SMA (200) at $1.02419—are signaling a aquire. The relative energy index (RSI) at 59.39 stays neutral, suggesting room for additonal upside if momentum builds. Resistance at $2.70 might perhaps also act as a barrier except sustained quantity drives the cost increased.

Oscillator indicators across timeframes latest a mixed but on the entire optimistic image, with the Stochastic oscillator signaling a promote at 85.07, while the momentum indicator stays firmly in aquire territory at 0.10585. These divergences underline the significance of quantity as a confirming component for directional strikes on the second.

XRP’s MAs reveal solid bullish momentum, with all key indicators in aquire territory. The exponential gripping reasonable (EMA 10-day) is at $2.43729, while the straightforward gripping reasonable (SMA 10-day) is at $2.42029, reflecting non permanent energy. Longer-interval of time indicators, along with the EMA (200-day) at $1.28300 and the SMA (200-day) at $1.02419, verify a worthy upward trend across timeframes.

Bull Verdict:

XRP’s fixed aquire indicators across all gripping averages and the bullish alignment of key indicators, such because the gripping reasonable convergence divergence (MACD) and momentum, imply solid potential for upward hotfoot. A breakout above $2.60 on increasing quantity might perhaps also solidify a persisted bullish trend, making it searching asset for traders seeking prolonged opportunities.

Comprise Verdict:

Irrespective of the bullish indicators, declining quantity arrive resistance levels and the stochastic oscillator (%Okay) indicating overbought prerequisites elevate warning. Failure to interrupt above $2.60 or a tumble under $2.50 might perhaps also result in retests of decrease beef up levels, potentially signaling a reversal or extended consolidation for XRP.