REX-Osprey’s newly launched XRP replace-traded fund (ETF), XRPP, made debut the day earlier to this, breaking earlier data for XRP-linked merchandise.

Alternatively, no matter the historic originate, the fervour has but to clutch XRP’s characteristic designate. The token has slipped by 1% within the previous 24 hours, whereas the relaxation of the broader crypto market data positive factors. This implies that whereas XRPP’s strong birth highlights appetite for XRP-linked funding merchandise, bearish bias dominates.

XRP ETF Shatters Records; Traders Unimpressed

In an earlier file, BeInCrypto illustrious that inner 90 minutes of trading, the newly launched XRPP ETF logged volumes 5 times better than earlier XRP-basically based mostly futures contracts, signaling surging institutional hobby.

Alternatively, no matter the ETF debut, XRP’s designate performance has remained muted, slipping by 1% real during the last day. This divergence stems largely from a rising bearish bias among each and each characteristic and derivatives merchants, who appear reluctant to gallop the ETF momentum.

Whereas institutional quiz for XRPP is undeniable, non eternal market contributors proceed to favor caution, with many betting against the token’s end to-time period upside means.

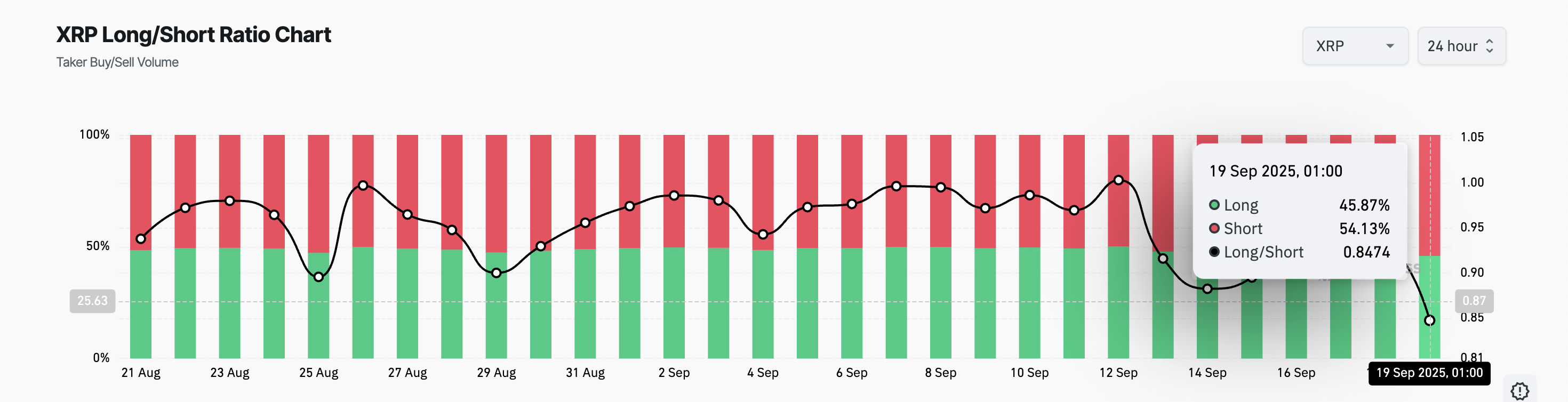

Here’s mirrored by its plummeting prolonged/short ratio, which straight away sits at a 30-day low of 0.84, confirming the strengthening quiz for shorts.

For token TA and market updates: Need extra token insights love this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

The prolonged/short ratio compares the selection of prolonged and short positions in a market. When an asset’s prolonged/short ratio is above one, there are extra prolonged than short positions.

On the different hand, when the ratio falls below one, it implies that short positions dominate the market. This reflects a definite tilt toward bearish sentiment.

With XRP’s ratio slipping to a 30-day low, its futures merchants are an increasing number of betting on additional declines even as the XRPP ETF continues to experience institutional patronage.

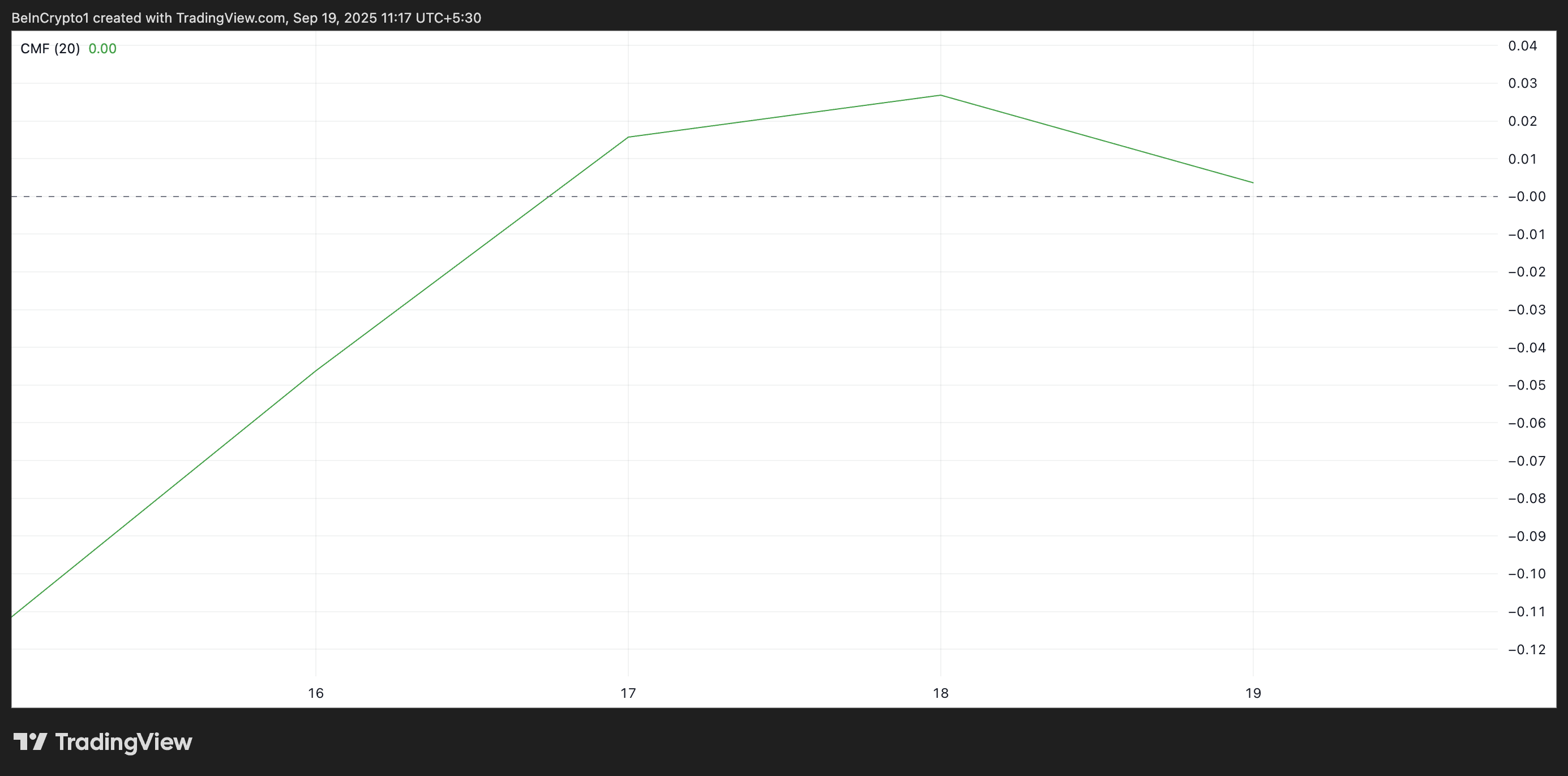

Furthermore, on the each day chart, XRP’s Chaikin Money Go with the circulation (CMF) is trending downward and poised to interrupt below the zero line. This means the descend in aquire-aspect stress, which places the token at probability of a end to-time period decline.

The CMF indicator measures the shuffle with the circulation of capital into or out of an asset by tracking designate and volume. A rising CMF suggests stronger aquire-aspect stress, whereas a falling CMF signals rising promote-aspect stress and means distribution.

For XRP, the downward trajectory of its CMF means that, no matter the surge in institutional quiz during the XRPP ETF, characteristic market contributors are progressively pulling liquidity out of the token.

XRP Tag at a Crossroads: $2.87 Breakdown or $3.22 Breakout?

This building highlights the probability dealing with XRP within the end to time period. Unless characteristic purchasing for stress strengthens and sentiment shifts positively across markets, the token’s designate would possibly furthermore building sideways or even fall toward $2.87.

Alternatively, if fresh quiz enters the market, this can make stronger XRP and push its designate upward to $3.22.

The put up XRP ETF Originate Breaks Records, But Tag Lags Gradual Market Rally regarded first on BeInCrypto.