Here’s a technical evaluation put up by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

XRP: No longer out of the woods yet

XRP

, the payments-focused cryptocurrency, surged 11% on Thursday, reportedly breaking out of a bull flag pattern to counsel renewed upward momentum. Nonetheless, or now no longer it’s now no longer yet clear, as costs dwell effectively below the basic $3.65 stage, the place a bearish “tweezer high” candlestick pattern passed off closing month.

The tweezer high is a bearish reversal pattern, comprising two candles with the same highs that describe a clear rejection point, on this case $3.65. It be as if the market tried to climb to a brand new stage twice and became as soon as met with a brick wall of promoting power at the same space, a mark that the upward momentum has totally stalled.

The bulls, therefore, favor to conquer the numerous provide point at $3.65, a pass that would invalidate the bearish reversal pattern.

Nonetheless, this would maybe well additionally most certainly be easier stated than accomplished, as on-chain knowledge suggests that holders are sitting on immense earnings and like a resounding incentive to sell at contemporary valuations.

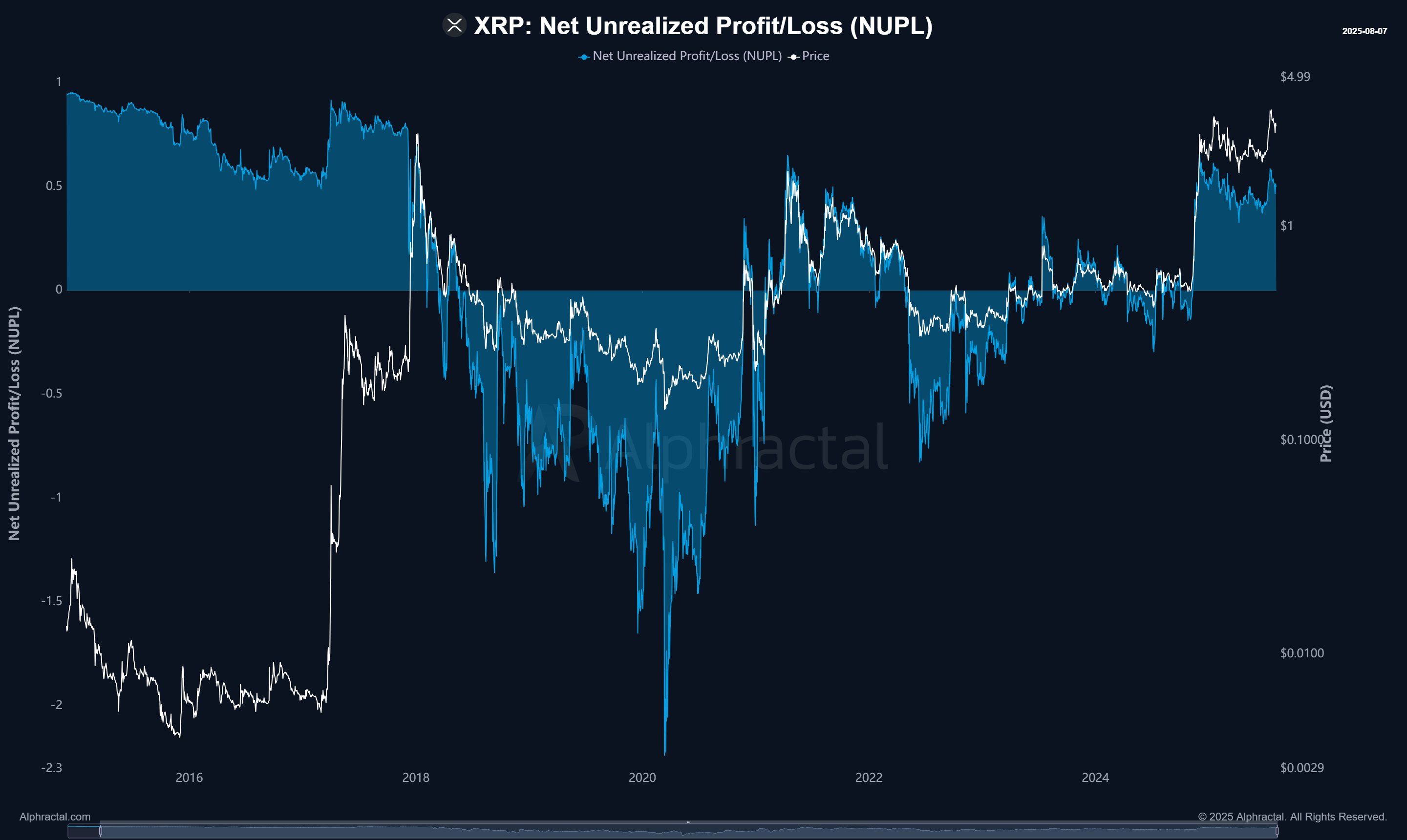

“The [XRP] Rep Unrealized Income/Loss (NUPL) remains at elevated phases now no longer viewed since the 2021 high, reaching connected phases to those noticed in 2018. These excessive values indicate that the market restful carries basic unrealized earnings, which historically represents zones of doable distribution and value correction,” compare agency Alphractal stated on x.

- Resistance: $3.38, $3.65, $4.00.

- Enhance: $2.99, $2.72, $2.65.

Bitcoin: BTC awaits breakout

Bitcoin’s (BTC) contemporary pullback is for the time being taking the form of a descending channel (white traces) interior its basic uptrend (yellow traces). This pattern is a classic “bull breather” that means the market is consolidating its contemporary gains.

The value’s contemporary soar from the 50-day Clear-slit Piquant Moderate (SMA) further reinforces the strength of this consolidation. For traders, this suggests that whereas the transient pattern is restful corrective, the path of least resistance remains to the upside.

A decisive breakout from the descending channel would verify a continuation of the broader uptrend, potentially yielding a pass to sage highs above $123,000. Conversely, a pass below the Could most certainly well excessive of $111,965 would lengthen the possibility of a deeper sell-off to $100,000.

- Resistance: $120,000, $122,056, $123,181.

- Enhance: $111,965, $104,562, $100,000.

Ether: Predominant breakout

Ether has rallied to over $4,200, reaching phases closing viewed four years ago. The cryptocurrency has broken out of a prolonged symmetrical triangle that contained its mark since the all-time excessive in late 2021, which is a basic bullish mark.

The decisive breakout, particularly on a chart with this long a time horizon, implies that the market has officially entered a brand new, extremely effective uptrend, opening the door for a retest of sage highs above $4,800.

- Resistance: $4,400, $4,875, $5,000.

- Enhance: $4,000, $3,941, $3,737.