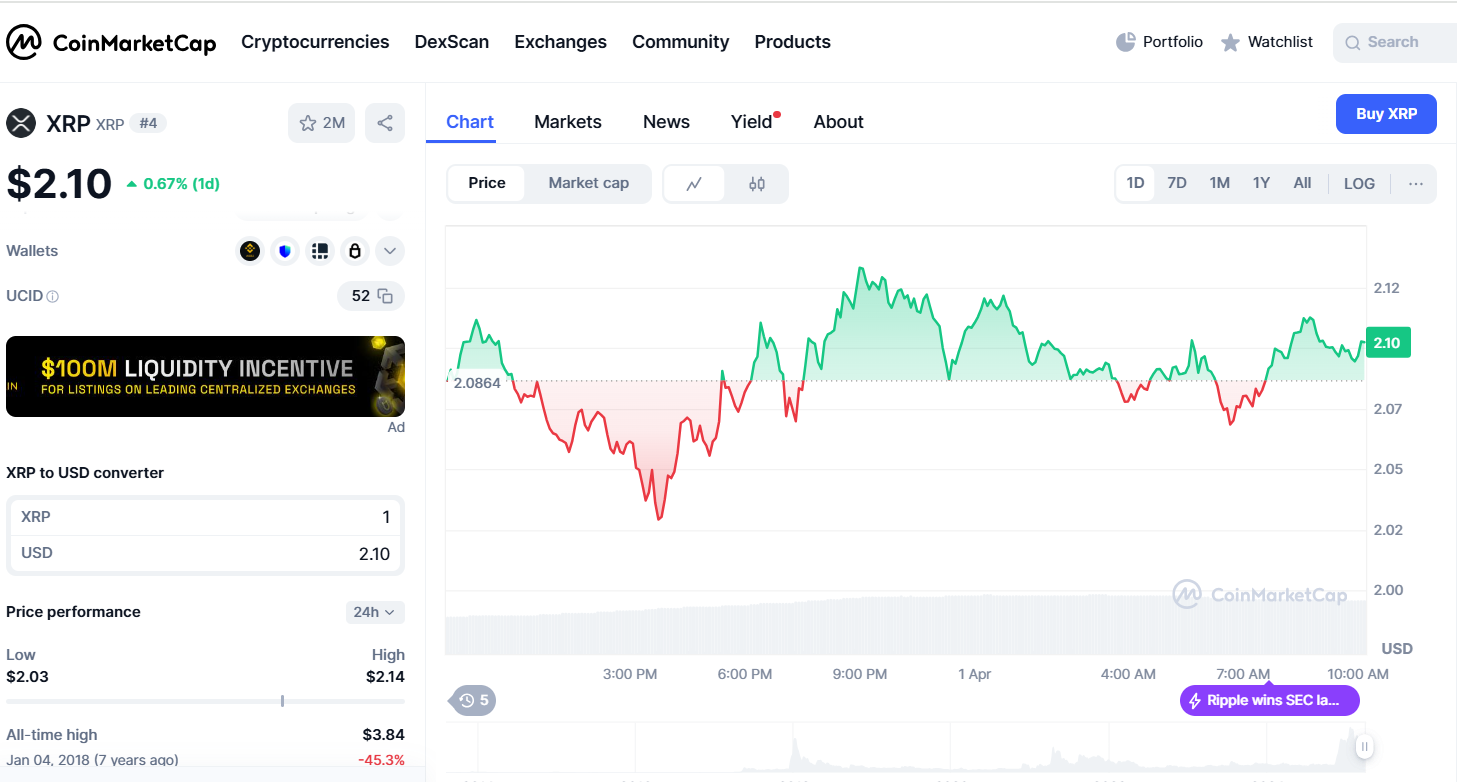

After hitting a low of $2.03, XRP has within the raze bounced relieve to the $2.10 level, exhibiting a produce of more than 1%. Then every other time, the cryptocurrency has struggled correct by the last week, closing within the crimson within the midst of six of the closing seven day-to-day buying and selling classes. This weakness comes amid a broader slump within the crypto market, where falling costs and investor uncertainty indulge in keep rigidity on most digital assets.

Currently, XRP’s mark chart displays a tug-of-warfare between bearish and bullish signals across varied timeframes. On the three-day chart, a sturdy bearish divergence remains packed with life. This reveals that even supposing XRP’s mark has been transferring, the momentum within the relieve of these moves isn’t any longer as sturdy as it appears to be like. The sphere has no longer modified vastly within the day prior to this, suggesting that bearish rigidity is calm prevalent.

Bullish Divergence Emerging on the 8-Hour Chart

In inequity, the 8-hour chart reveals indicators of a bullish divergence. Whereas XRP’s mark has been posting decrease lows, the Relative Energy Index (RSI)—a key momentum indicator—has been forming elevated lows. This pattern suggests that no topic the mark declines, underlying momentum is strengthening. A stronger soar within the RSI over the following day would present extra affirmation of this probably reversal.

For the quick timeframe, sideways mark motion is expected, with a minute bullish bias. Historical patterns counsel that such setups generally lead to either modest upward moves followed by consolidation or, in favorable conditions, more fundamental bullish rallies.

XRP’s mark actions remain carefully tied to Bitcoin and the broader cryptocurrency market. Except Bitcoin experiences a appreciable bullish breakout, XRP’s probably for a serious mark surge appears to be like restricted within the shut to timeframe. Key enhance stages are identified between $1.95 and $2.05, where taking a gaze for curiosity is more doubtless to emerge if the mark dips. Resistance is expected between $2.24 and $2.30, a zone where selling rigidity tends to intensify.