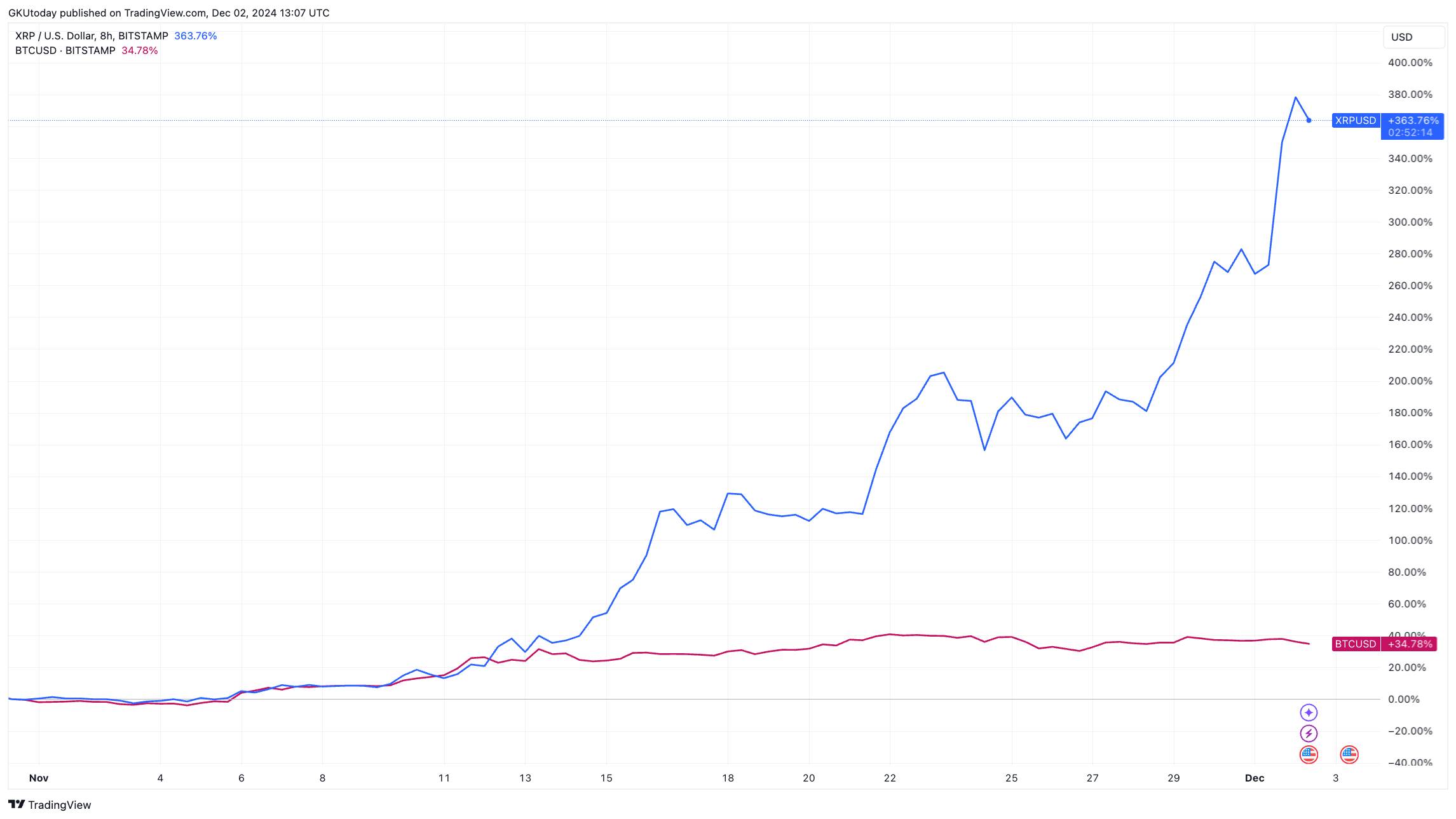

For weeks, XRP’s imprint performance has been on the middle of consideration on the crypto market. Hitting $2.50 on the commence of December and posting a staggering, nearly 400%, succeed in for the reason that U.S. election closing month, the token has climbed into a dominant station. Now valued at over $135 billion in market capitalization, XRP stands as the third-greatest digital asset, in the help of most effective Bitcoin (BTC) and Ethereum (ETH).

Within the middle of this, an surprising but engaging quiz emerges – whether XRP can sooner or later overthrow Bitcoin NEXT? A seller-skilled known in the crypto dwelling beneath the nickname “DonAlt” stood as a lot as acknowledge to that quiz.

Noting that XRP’s fully diluted valuation (FDV) is now double that of Solana and drawing near Ethereum, DonAlt has drawn parallels to 2017, when XRP briefly overtook Bitcoin.

Came about in 2017 for a brief 2nd, then your entire market nuked to zero

— DonAlt (@CryptoDonAlt) December 2, 2024

Nonetheless, he cautions that while such growth could additionally excite optimists, going too some distance could additionally destabilize the market because it did then. DonAlt suggests that even a real looking upside scenario, corresponding to a 1,000% elevate, could additionally consequence in catastrophic corrections if the market fails to defend up steadiness.

Watch out what you will have for

Adding one more angle to the discussion, famend seller Peter Brandt not too long ago shared a more bullish point of view. Brandt thinks XRP could additionally sooner or later attain $24 per token, which would elevate its market cap to $1.37 trillion. This figure, while aloof trailing Bitcoin’s unusual $1.89 trillion, places XRP interior shut attain of unprecedented the market chief’s dominance.

However there is aloof moderately of skepticism available. what has took station previously and what’s taking place available in the market upright now, it is evident that growth fancy this wishes to be managed carefully. There are loads of dangers concerned, and the 2017 market atomize is a ethical example of what can happen if issues accumulate uncontrolled.