The XRP Ledger (XRPL) is seeing a necessary surge in utility and on-chain activity, pushed by the commencement of stablecoin checking out by global monetary giants.

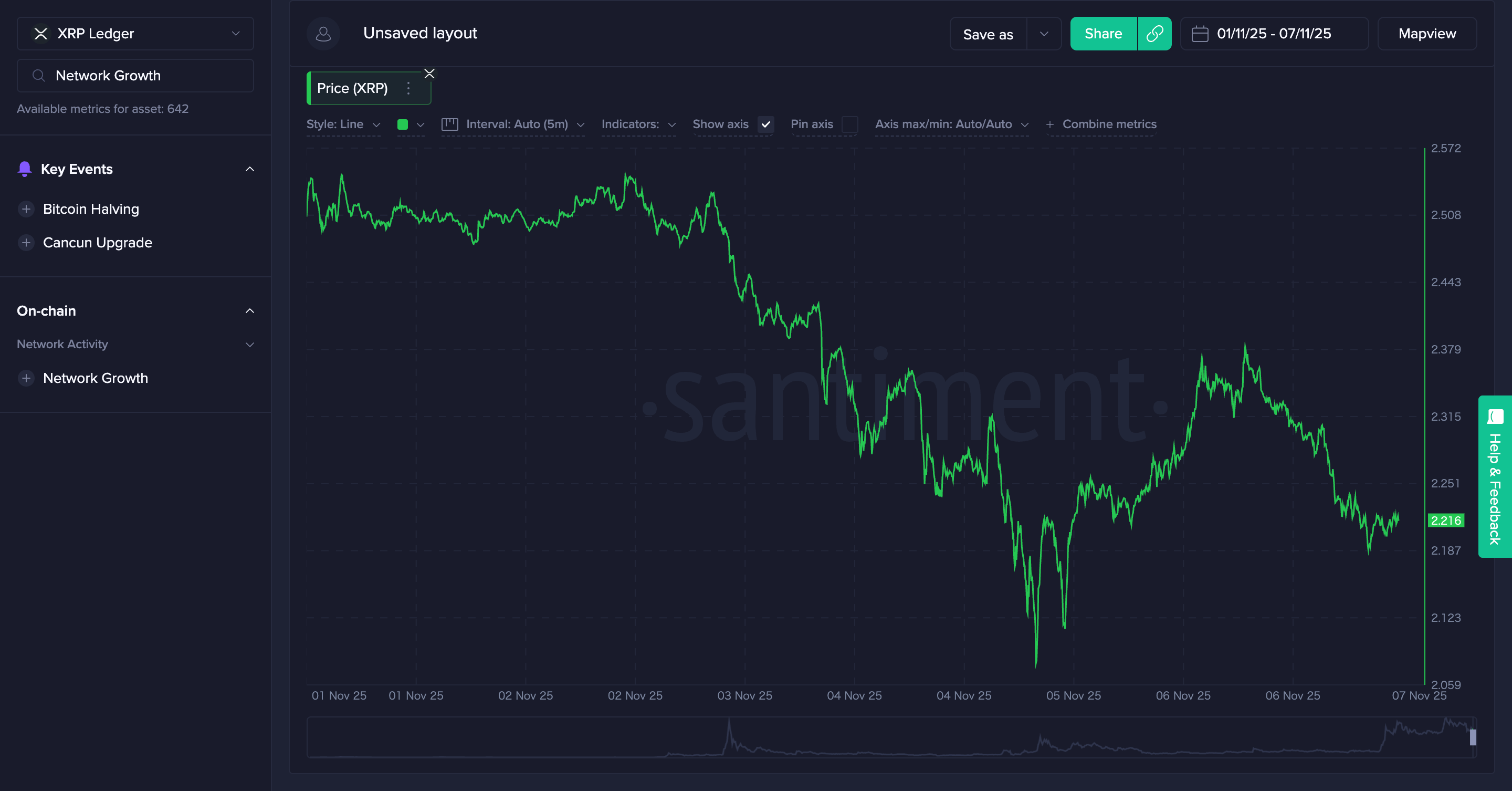

No topic these extremely effective elementary signals—including a 12% mark kill and a file alternative of fresh wallets—XRP’s market fee continues to decline. This creates a inviting divergence. It separates the quick institutional adoption of the XRPL infrastructure and XRP’s mark action. This raises questions: are macro headwinds overshadowing technical development?

Mastercard and the Institutional Validation of XRPL

The most fresh institutional validation for the XRPL arrived as Mastercard joined Ripple and Gemini to birth up checking out the RLUSD (Ripple USD) stablecoin straight on the ledger. This institutional adoption straight translated into a surge in on-chain activity: the alternative of fresh XRP wallets hit a file excessive, reflecting elevated person engagement and interest in the ecosystem. Furthermore, a 12% mark kill between November 5 and 6 underscored the market’s clear immediate-time period reaction to the news.

This quick develop in utility suggests that the XRPL is succeeding in attracting regulated, sincere-world monetary entities. Alternatively, the subsequent mark decline reveals a clear strive in opposition to. Even main adoption news struggles in opposition to prevailing market sentiment. This sentiment will likely be pushed by broader threat-off attitudes or profit-taking.

The Redefinition of XRPL and Tokenomic Debate

Ripple’s CEO has explicitly emphasised the continuing need to conform the XRPL’s public image previous its initial heart of attention utterly on contaminated-border funds.

🚨“What Amazon became to books, Ripple is to contaminated-border funds” – Brad Garlinghouse💪🚀

Don’t underestimate #XRP ‼️#Ripple isn’t competing 🥇 It’s redefining the system 🌐💸 pic.twitter.com/rGvR2Zpe3N

— ToniTheRippler (@thatgirl_chichi) July 13, 2025

The platform is now looking out out for to redefine its designate. It aims to become a flexible foundation for decentralized finance (DeFi) and controlled asset tokenization. This permits it to compete with networks like Solana and Ethereum.

This branding method has intensified the interior debate over XRP’s tokenomics. Analysts are undoubtedly actively predicting XRP’s long-time period fee. This prediction is fueled by the likelihood that the XRPL can also introduce a price-burning mechanism related to Ethereum’s EIP-1559. This sort of circulation would transform XRP into a doubtlessly deflationary asset.

To illustrate, analysts have assessed the functionality mark trajectory of XRP by 2035. This prognosis assumes the XRPL introduces price burning. This sort of tokenomic swap can also fundamentally alter its long-time period market perception. This technical evolution is severe to maximizing the fee of the institutional adoption currently underway.

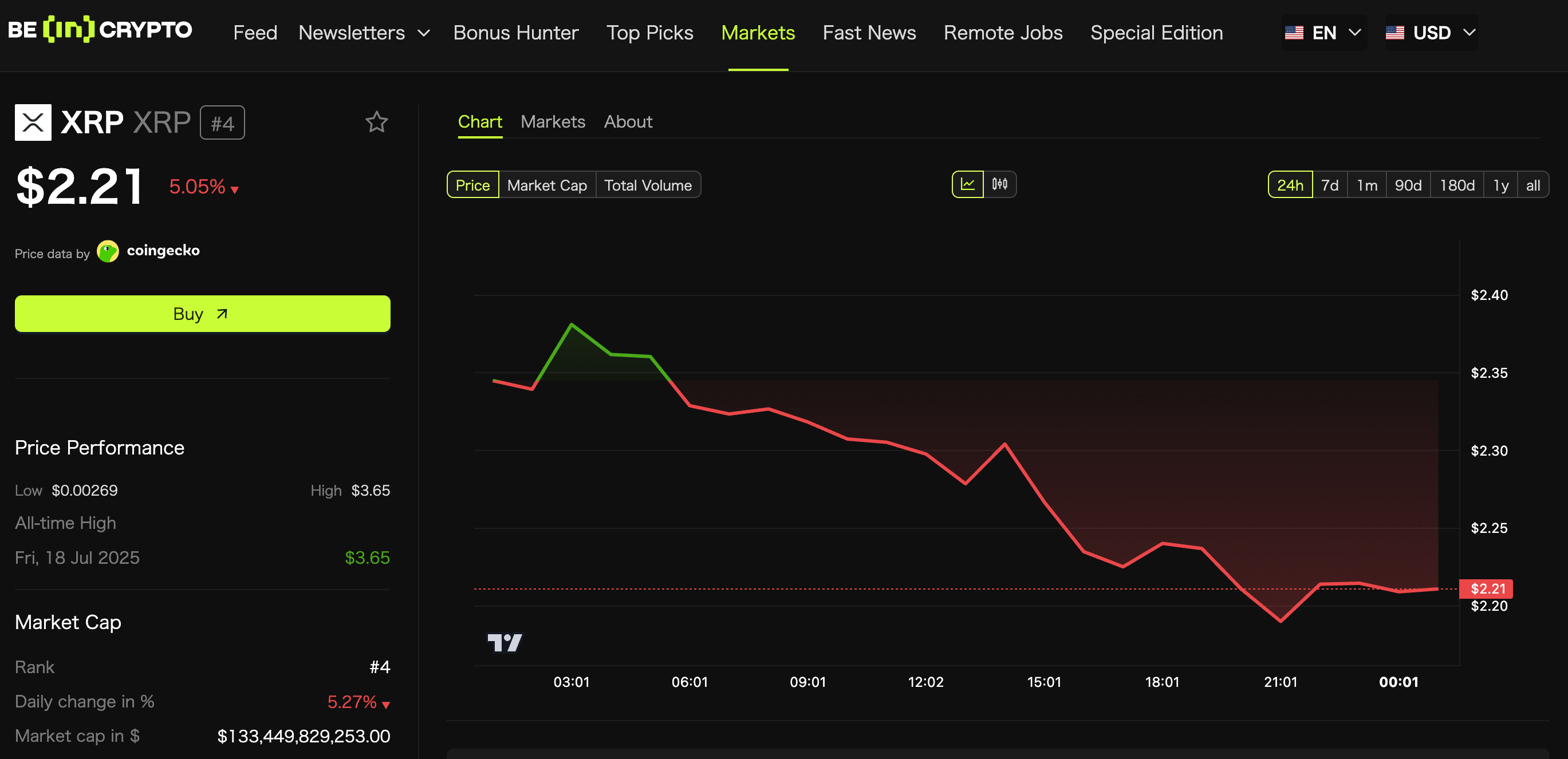

Stamp vs. Fundamentals: The Unresolved Regulatory Shadow

No topic these extremely effective elementary traits—file pockets explain, stablecoin adoption, and promising tokenomic adjustments—XRP’s market mark has been trading in a downtrend. This disconnect suggests that the market continues to grapple with external uncertainties. At the time of writing, XRP is trading at $2.21, reflecting a 5.05% tumble over the final 24 hours.

XRP completed readability regarding its non-security space for programmatic gross sales. Alternatively, residual appropriate uncertainty from the SEC litigation continues to weigh on the asset. Macroeconomic headwinds and broader market threat aversion moreover forestall necessary gains from holding.

Eventually, the a hit deployment of RLUSD and the establishment of price burning are necessary steps for XRP. Alternatively, the value indicates that the market requires now not most efficient utility, but moreover the closing decision of all well-known regulatory risks sooner than utterly reflecting the clear long-time period fundamentals.

The put up XRP Adoption Explodes — So Why Is the Stamp Crashing? The Hidden Threat No One Sees appeared first on BeInCrypto.