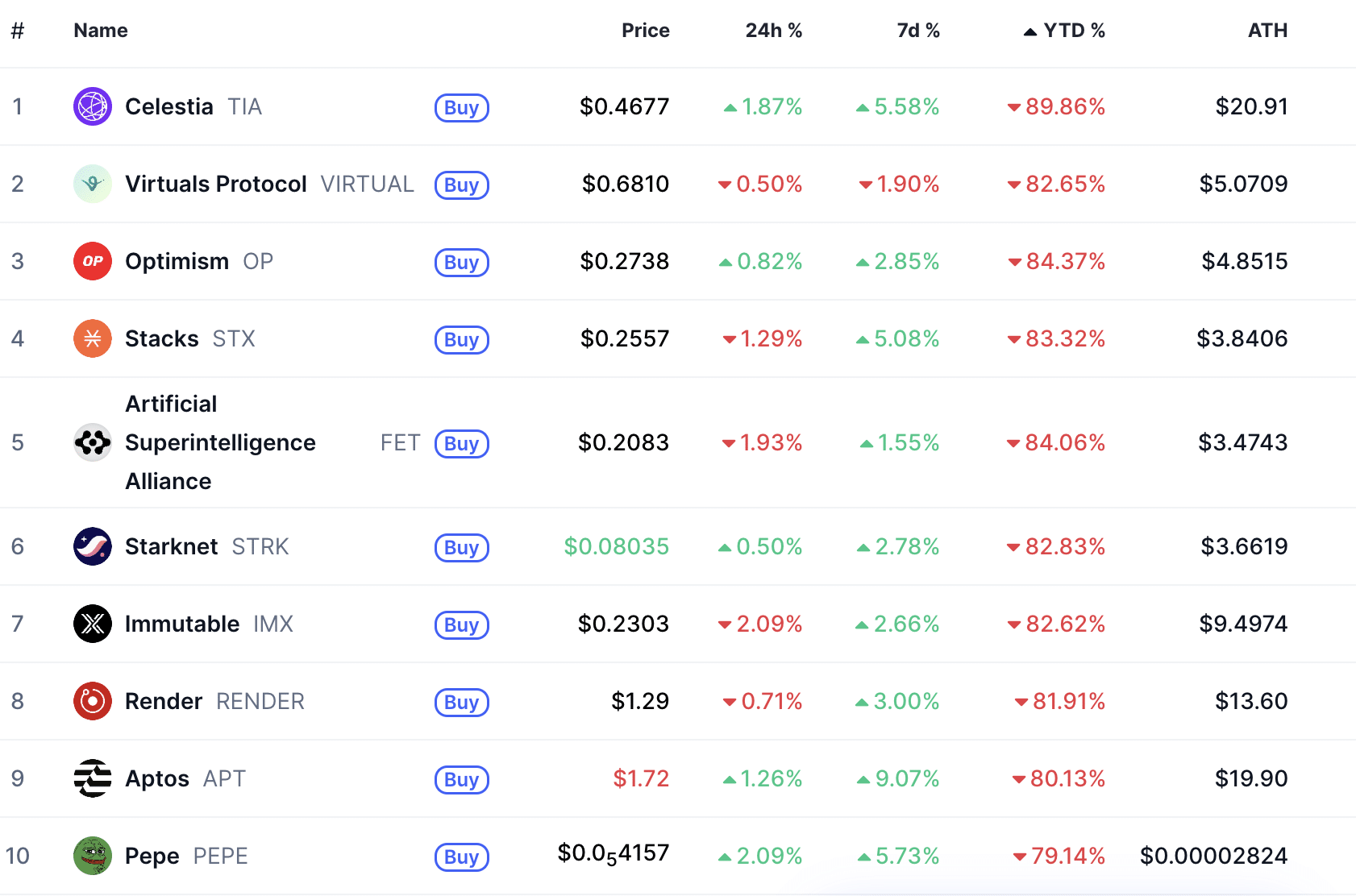

The leisurely-year promote-off became many excessive-beta tokens red, including BTC $88 655 24h volatility: 1.2% Market cap: $1.76 T Vol. 24h: $35.61 B and ETH $2 998 24h volatility: 2.1% Market cap: $359.82 B Vol. 24h: $20.21 B . Wanting at data from aggregators cherish CoinMarketCap or Coingecko, we rely on that most of the sad performers possess misplaced round 80% this year. This entails PEPE $0.000004 24h volatility: 1.7% Market cap: $1.74 B Vol. 24h: $196.34 M , as soon as a meme-coin chief that has since misplaced seventy 9% of its worth, along with loads of excessive-profile altcoins.

10 worst-performing altcoins in 2025 | Supply: CoinMarketCap

Listed here, we will protect conclude a conclude witness at Celestia (TIA), Optimism (OP), and Synthetic Superintelligence Alliance (FET/ASI). Under is a overview of how a long way each altcoin fell in 2025, what drove the strikes, and the contrivance in which the market spoke back.

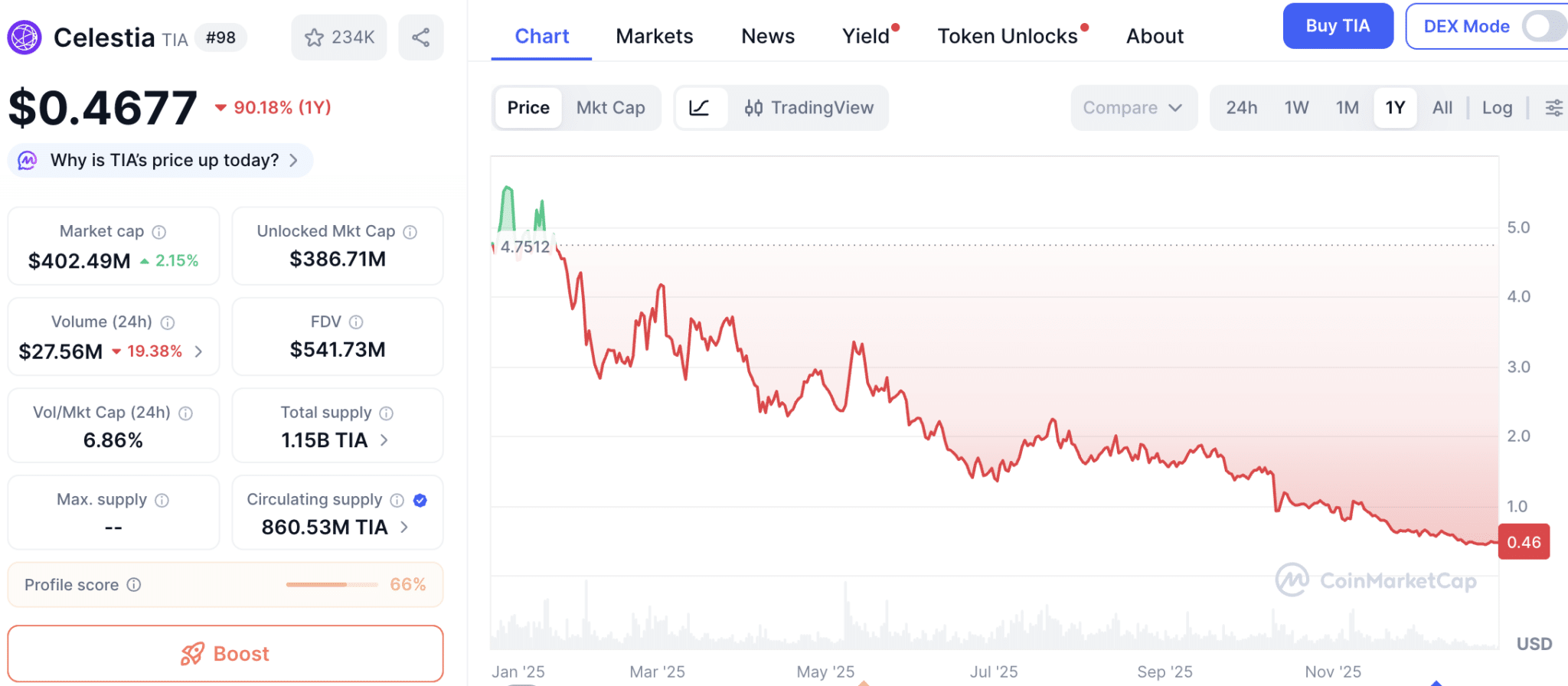

Celestia (TIA): -90%

TIA $0.46 24h volatility: 0.1% Market cap: $396.47 M Vol. 24h: $31.27 M , a proof-of-stake L1 blockchain optimized for app creation, misplaced virtually 90% year-to-date. In conserving with CMC, it fell from about $5.5 before everything of 2025 to $0.46 advance year-pause.

Celestia (TIA) label in 2025 | Supply: CoinMarketCap

Mostly, the descend became as a result of free up and overhang dynamics. Celestia’s vesting and 2024–26 free up cadence saved selling tension contemporary in 2025. By summer, TIA became primarily viewed as a textbook put up-airdrop unwind. CoinDesk analysts tied its continuing emissions to skinny liquidity.

Furthermore, in August, Celestia Foundation disclosed it bought serve 43.forty five million TIA from Polychain (round $62.5 million on the time). The pass became meant to contemporary the token present, nonetheless as but any other spotlighted investor selling. The put up on X rapid provoked a reaction from the crypto neighborhood.

“That is a fresh stage of grift tbh. Translation: We can now protect conclude $TIA tokens from one investor who became dumping and presents it to 1 other investor who will dump afterward,” wrote particular person nicknamed Mirza.

The Celestia Foundation has labored with Polychain Capital to place Polychain’s total remaining TIA holdings to fresh merchants.

This month, the Foundation bought 43,451,616.09 TIA from Polychain Capital for $62.5m. Polychain will quickly be undelegating their total staked…

— Celestia (@celestia) July 24, 2025

One other predominant roar became faded fee capture and utilization optics. Self reliant on-chain analyses steadily highlighted very low data utilization and fee earnings (circa $60/day earlier in 2025). This reinforced a valuation vs. usage hole. In conserving with Chain Catcher, the network could well presumably generate about $5.2 million in annual fee earnings if used accurately.

Optimism (OP): -84%

OP $0.27 24h volatility: 0.1% Market cap: $528.68 M Vol. 24h: $54.94 M , a favored layer-2 blockchain on top of Ethereum, misplaced 84.5% year-to-date. It fell from $2.06 before everything of 2025 to $0.27 in leisurely December, per CMC.

Optimism (OP) label in 2025 | Supply: CoinMarketCap

As with Celestia, chronic unlocks labored poorly for Optimism. OP confronted routine token unlocks all year long: leisurely-Would possibly maybe, leisurely-April, and a scheduled Dec. 31 tranche of round $8.6 million. Every of these steadily added token present for the duration of faded put a query to.

In conserving with Tokenomist, expansive cliff unlocks (single unlocks exceeding $5 million) scheduled over the following 7 days encompass HYPE, SUI, EIGEN, KMNO, OP, ENA, ZORA, and SVL. Huge linear unlocks (each day unlocks exceeding $1 million) over the same interval encompass RAIN, SOL, TRUMP, WLD,… pic.twitter.com/ZBllI1K6lq

— Wu Blockchain (@WuBlockchain) December 29, 2025

L2 competitors became a essential headwind, too. Even as Optimism shipped fault-proofs and stepped forward on the Stage 1 decentralization course in 2024 and 2025, trading silent reflected L2 sector fatigue and rotating liquidity. By September, media coverage framed OP as one among the L2 laggards. The spin deepened into Q4.

Synthetic Superintelligence Alliance (FET): -84%

ASI Alliance is a collaboration between three predominant blockchain-primarily based fully mostly AI projects: SingularityNET, Gain.ai, and Ocean Protocol. In 2024, when it became founded, it became on the wave of AI hype. Alternatively, in 2025, it misplaced round 84% of its worth, from $1.6 to about $0.2.

Optimism (OP) label in 2025 | Supply: CoinMarketCap

The dear problems started in 2024. The multi-token ASI merger (FET, AGIX, OCEAN) did no longer trail effortlessly, rising operational noise. Several exchanges supported auto-conversions while Coinbase declined to facilitate migrations, adding uncertainty round flows.

In October 2025, Ocean Protocol exited the ASI Alliance, prompting governance disputes, appropriate threats, and a descend in the FET label around the time. The ASI board temporarily suspended the conversion bridge while looking for appropriate advice.

Alignment is key in any evolving partnership. Transitions are natural.

Ocean Protocol’s exit from the Alliance does no longer affect the core skills stack – momentum and pattern stays undiminished contained in the founding teams. The ASI Alliance stays fully aligned in its… https://t.co/q6FJCWhwax

— Synthetic Superintelligence Alliance (@ASI_Alliance) October 9, 2025

Moreover, leisurely-2025 anxiety-off spilled over into AI tokens. In conserving with the most fresh Coingecko portray, AI is no longer primarily the most winning crypto narrative anymore. If truth be told, the crypto AI coins possess misplaced round 50% in label in 2025. What became primarily the most winning narrative, that chances are high you’ll put a query to? Nicely, we’re serve to the honest-world property (RWA): round +180% in features.

The Bigger Altcoins Backdrop

Slack-2025 macro and contaminated-market stress (tariff shocks, tight liquidity, tech-led anxiety aversion) broadly hit crypto, compounding token-particular present overhangs. Finish-of-year reports documented the wholesale anxiety-off turn and involving liquidations across digital property.

Alternatively, if you occur to’re drawn to more optimistic forecasts, be taught our summary of crypto moguls’ predictions for 2026.

Disclaimer: Coinspeaker is committed to offering fair and clear reporting. This text goals to negate faithful and smartly timed recordsdata nonetheless must no longer be taken as monetary or funding advice. Since market stipulations can switch , we abet you to study recordsdata for your find and seek the advice of with a talented sooner than making any choices primarily based fully mostly on this dispute material.