Worldcoin (WLD) stamp sits at $1.85, up forty five% within the past 24 hours and over 110% this week. Three-month features now stand at 50%, lifting yearly returns by 26% after a lengthy stretch of unfavorable efficiency.

Such posthaste features most incessantly ever attain with out a give up. The indicators suggest a pullback is drawing near near, but various indicators video show it being a wholesome breather rather than a pattern reversal.

Profit-Taking Locations Stress on the Rally

One red flag comes from the proportion of offer in profit. Between September 7 and eight, the part of WLD in profit jumped from 62.3% to Seventy 9.3%. This procedure practically 80% of holders are sitting on features — a setup that most incessantly invites profit-taking.

Alternate flows verify this: retail and immediate-timeframe wallets hold despatched tokens to exchanges, pushing swap balances up by 2.23%. At $1.83 per token, that upward push represents roughly $11 million in capacity sell pressure.

Meanwhile, whales had been including. Their holdings climbed from 7.30 million to 7.93 million WLD, a gather lengthen worth about $1.15million.

When as compared, the inflows to exchanges exceeded the whale accumulation, ensuing in a gather promoting pressure of over $9.5 million. And that too with out taking orderly money and high 100 addresses into consideration, as each these cohorts hold also dumped over the final 24 hours.

This imbalance explains why the WLD stamp may perhaps perhaps well perhaps stall within the immediate timeframe.

Desire extra token insights admire this? Signal up for Editor Harsh Notariya’s Each day Crypto Publication right here.

The Relative Strength Index (RSI) adds weight to this stare. RSI, which measures whether an asset is overbought or oversold, is now the most overheated since early 2024. That makes a correction seemingly, though we’ll explore the RSI implications extra within the rate section below.

Dip Shopping Reveals Why This Would possibly perhaps well perhaps also Be a Healthy Correction

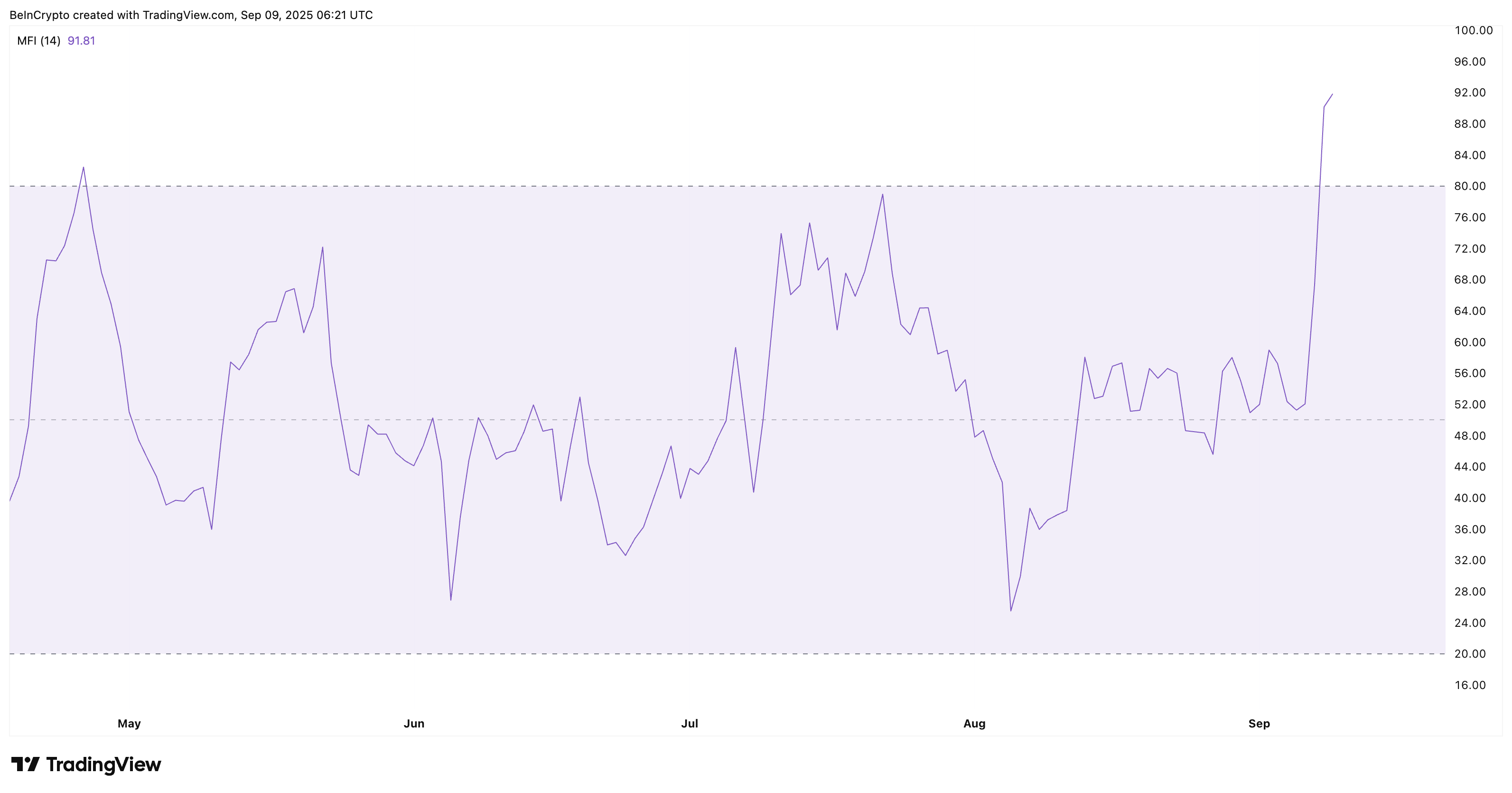

Despite the promoting pressure, question is now no longer absent. The Money Waft Index (MFI), which tracks whether inflows outweigh outflows, has surged to its best doubtless level since early 2024. A rising MFI whereas stamp consolidates suggests that investors — notably whales — are engrossing every minute dip.

Here’s distinguished because MFI strength most incessantly indicators that corrections are shallow. When profit-taking sparks a pullback, dip investors most incessantly step in posthaste to limit downside.

In WLD’s case, this loyal inflow manner that although the rate cools after its unworldly rally, the correction may perhaps perhaps well now no longer deepen right into a give procedure. As an various, it appears to be like extra admire a give up sooner than testing higher ranges.

WLD Ticket Chart Validates a Healthy Pullback

The WLD stamp chart supports this balanced outlook. As neatly-known earlier, RSI is stretched (within the overbought territory), confirming that a near-timeframe dip is due. Nonetheless, WLD continues to trade in a bullish setup, as its animated averages are flashing strength.

The 50-day Exponential Transferring Sensible (EMA) or the orange line, which reacts sooner to fee changes, is closing in on the slower 100-day EMA (sky blue line). If the 50-day crosses above, it may perhaps well perhaps well perhaps in finding a “golden wicked” — a signal most incessantly tied to prolonged bullish trends. Multiple golden crosses in past rallies hold preceded days of upside, making this a key structure to understanding.

The expectations of the bullish crossover forming all the procedure in which thru the pullback may perhaps perhaps well perhaps add to the “wholesome correction” yarn.

For ranges, $1.38 stays the closest strong pork up. If that breaks, the correction may perhaps perhaps well perhaps deepen to $1.06. On the upside, a tidy day-to-day cessation above $1.94 would atomize the pullback scenario altogether, seemingly pushing the WLD stamp towards novel highs.

The put up World’s ( WLD) Unworldly Ticket Rally Risks A Pullback, Here Is Why It Would possibly perhaps well perhaps also Be A Healthy One seemed first on BeInCrypto.