- WLFI stalls below the $0.14 Moving Averages and drifts toward the $0.11–$0.10 give a enhance to pocket.

- Long liquidations dominate as on-chain stress fuels shut to-time-frame bearish stress.

- RSI nears oversold, hinting at that you simply might perhaps well perchance perhaps take into consideration give a enhance to-driven stabilization forward.

After hitting a three-week low round $0.1215 space on Thursday last week, the WLFI token witnessed a 12% designate rebound to a top of $0.1371, where it met a non everlasting resistance as soon as over again. Per the chart prognosis, a ruin above the 20-day and 50-day MAs at $0.14 might perhaps perchance be the most necessary signal of a decisive bullish reversal signal.

Then over again, the token was as soon as unable to entire these constructions and thus witnessed further setbacks. As of press time, the token hovers all the draw in which by draw of the $0.1312 space, recording a 2% decline in the previous 24 hours. This adds to its broader year-on-year forty eight% ebb since its September top across the $0.25 zone.

WLFI’s Tag Jog: Bears Target the $0.11 Key Make stronger

As reported in the outdated week’s prognosis by CryptoTale, WLFI’s bearish sentiment is eyeing the $0.11-$0.10 key give a enhance to differ because the following ability downside target. Historically, this give a enhance to differ has generated rebounds twice this year, and WLFI is inching support toward it over again.

The zone traces up with the 23.60% Fibonacci degree, which adds a little bit of of structure for merchants buying for any impress of stabilization. Besides, market-profile records give a enhance to the identical differ. WLFI has traveled from its Rate Reveal Excessive, by draw of the Point of Retain an eye on, and eyes the Rate Reveal Low, positioned lawful interior that $0.11–$0.10 pocket, creating a stack of overlapping give a enhance to indicators.

Offer: TradingView

Momentum records further adds credence to this market structure. In the in the intervening time hovering at the 38 space, WLFI’s Relative Energy Index signifies that the stock is drawing near oversold territory, most certainly signaling a reversal in the shut to future. With but further put left before oversold territory is officially reached, WLFI is poised to manner the give a enhance to differ in the shut to future.

Key Ranges to Query

With all these overlapping indicators pointing to the identical zone, the WLFI altcoin appears to secure a solid foundation at the $0.11-$0.10 differ, making it a doable space for patrons to step in and power prices greater. On such times, the WLFI token is anticipated to revisit the 20-day and 50-day MAs, coinciding with the 38.20% Fib degree across the $0.14 degree.

Diverse key targets encompass the 50% Fib retracement round $0.1640 and the $0.1666-$0.1760 key resistance zones. Meanwhile, a breach below the $0.11-$0.10 give a enhance to differ might perhaps well perchance moreover space WLFI designate on a path in direction of testing its all-time low round $0.07, last viewed in October.

Connected: Why CRV Is Surging As we speak: Key Factors In the support of the Tag Bounce

On-Chain Indicators Deepen Market Weak point

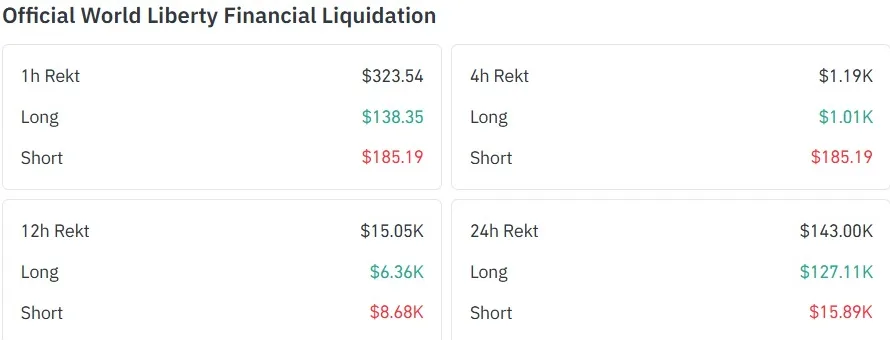

From an on-chain standpoint, the WLFI goes by draw of a noticeable uptick in liquidations, with roughly $143,000 worn out in the previous day. Most of that stress landed on the prolonged facet. About $127.11 in bullish positions had been knocked out, compared with simplest $15.89 in shorts.

Offer: CoinGlass

The imbalance isn’t dramatic in scale, nonetheless it hints at a prolonged squeeze forming below the surface. In consequence, merchants who had been leaning greater are being pushed out of their positions and, in some instances, turning defensive by shifting into shorts. That model of rotation in overall drags prices decrease before the market finds its footing over again.

Birth interest, alternatively, is barely shifting. It for the time being sits shut to $213 million, retaining a sideways shape that means merchants haven’t misplaced interest nonetheless aren’t in a position to decide to any direction either.

Offer: CoinGlass

In consequence, volatility has thinned, leaving a market that feels watchful in preference to alive to. Most are looking ahead to a clearer catalyst before making bigger moves. Unless that arrives, WLFI’s designate is probably going to drift with liquidations and whatever broader cues the market throws at it next.

Disclaimer: The records equipped by CryptoTale is for educational and informational purposes simplest and can fair now not be regarded as monetary advice. Always behavior your secure learn and search the advice of with a talented before making any funding decisions. CryptoTale is now not accountable for any monetary losses as a result of usage of the voice material.