Because the market witnesses a extensive bull bustle in Bitcoin, the Arena ETFs are promoting the assumption of BTC as a retailer of worth. As shoppers stumble on the Bitcoin impress crossing above the $57,000 impress, the realm Bitcoin ETFs impress a foremost milestone. These innovative funding autos enjoy garnered foremost consideration, and as much as the moment exercise has been nothing rapid of unheard of.

On twenty sixth February, a blended on daily basis trading quantity of $2.4 billion used to be witnessed at some stage in the nine Bitcoin ETFs, underscoring the market’s voracious appetite for Bitcoin-linked products.

Blackrock’s Bitcoin ETF Takes A Pre-Market Surge

Amongst the nine ETFs, BlackRock’s iShares Bitcoin Belief (IBIT) has taken heart stage with mighty pre-market actions. Eric Balchunas, senior analyst at Bloomberg, shared in regards to the $80 million traded in IBIT sooner than the market even opened.

Any other thing about $IBIT quantity that is important is the amt of pre-market exercise.. test this out, or no longer it is already viewed $80m traded.. supreme 5 ETFs enjoy viewed extra exercise sooner than mkt open. Unparalleled for 2mo-ragged ETF. $BITO in Ninth build makes me enjoy lot of arb quantity occurring. pic.twitter.com/cqa6ocbN0b

— Eric Balchunas (@EricBalchunas) February 27, 2024

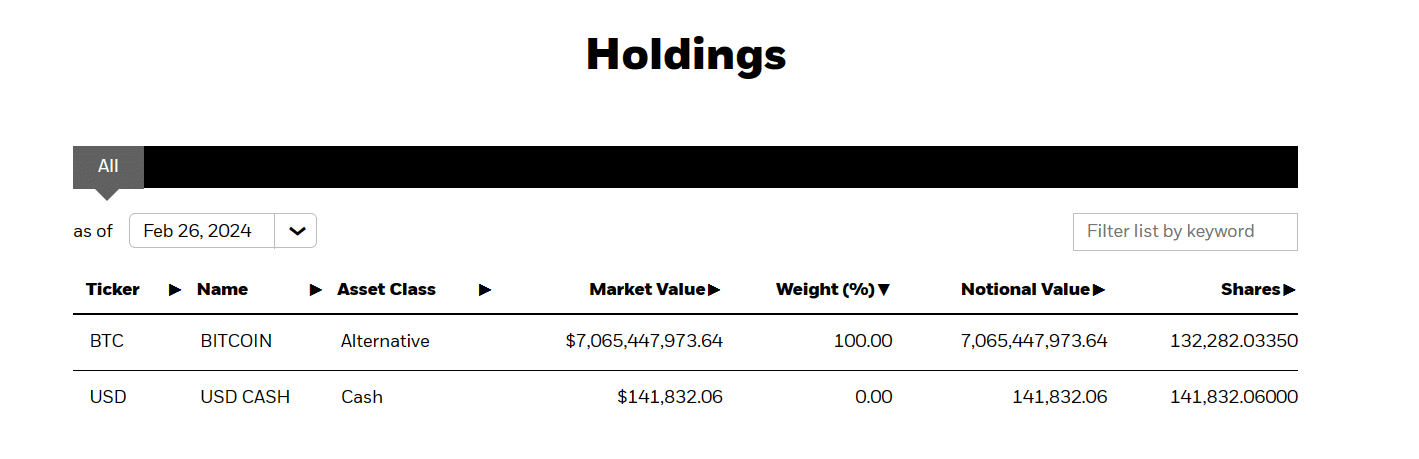

IBIT stands out, no longer factual for the sheer quantity of trading nevertheless for the unparalleled stage of exercise it represents for an ETF barely two months into its begin. With this surge, the bulls enjoy propelled IBIT to surpass a whopping $7 billion in whole worth, a testament to the trust’s burgeoning dominance in the Bitcoin ETF build.

Source: Blackrock

IBIT showcases a foremost amplify in Bitcoin holdings, indicating a bullish stance from shoppers and market watchers alike. The ETF’s skill to plot such excessive pre-market exercise suggests sturdy confidence and a alive to investor curiosity that would very correctly redefine the ETF panorama.

Grayscale’s Terrorized Outflows

Amidst the bullish frenzy in the ETF sector, a lowering outflow used to be seen in Grayscale’s area Bitcoin ETF. The Grayscale Bitcoin Belief (GBTC) has viewed its catch outflows taper for three consecutive trading days, culminating in a chronicle-low outflow of $22.4 million. Such diminishing outflows hint at a reversal of sentiment, potentially marking the beginnings of a bullish phase.

The realm with Grayscale is great. Salvage outflows enjoy been lowering vastly. Ultimate closing week, we saw a on daily basis catch outflow of $44.2 million. By the twenty sixth, this had halved. It’s a clear signal of altering investor sentiment. The kind of shift would perchance perchance affect Bitcoin’s market impress. It would perchance perchance also enjoy an label on its status as a sustainable funding.

What’s Next?

The market dynamics are attention-grabbing. On one side, original area Bitcoin ETFs are seeing a upward push in trading volumes. They are attracting foremost inflows. On the opposite side, the decrease in outflows from established funds like GBTC is obvious. This means that investor attitudes toward cryptocurrency ETFs are maturing. As trust in Bitcoin’s worth grows, its bullish impact on the market appears to be promising.