XRP model has been slipping below key toughen phases, and with unusual macroeconomic worries casting a prolonged shadow on the markets, merchants are starting to marvel: Is XRP model headed in the direction of a notable give blueprint in June? A shut perceive at every the hourly and daily charts paints a concerning image, namely when combined with world financial headwinds.

XRP Mark Smash: Why Is XRP Losing All as soon as more?

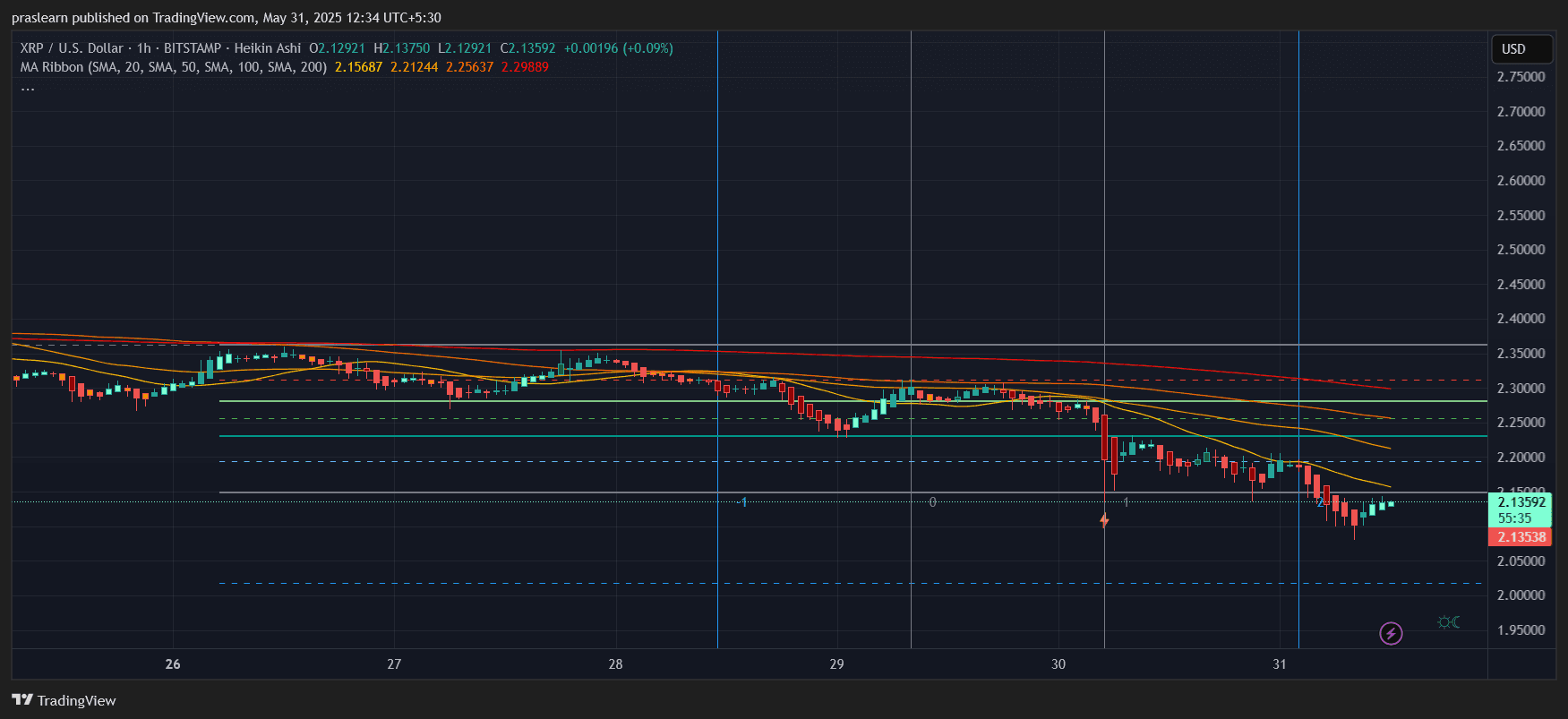

The hourly chart exhibits XRP model procuring and selling around $2.13, well below its 20, 50, 100, and 200-hour shifting averages. Right here’s a textbook bearish signal. Over the final five days, XRP has persistently did not crash above $2.25 — a sturdy resistance line that has now been examined and rejected more than one instances. The charge structure exhibits a clear descending channel, with decrease highs and decrease lows forming many instances.

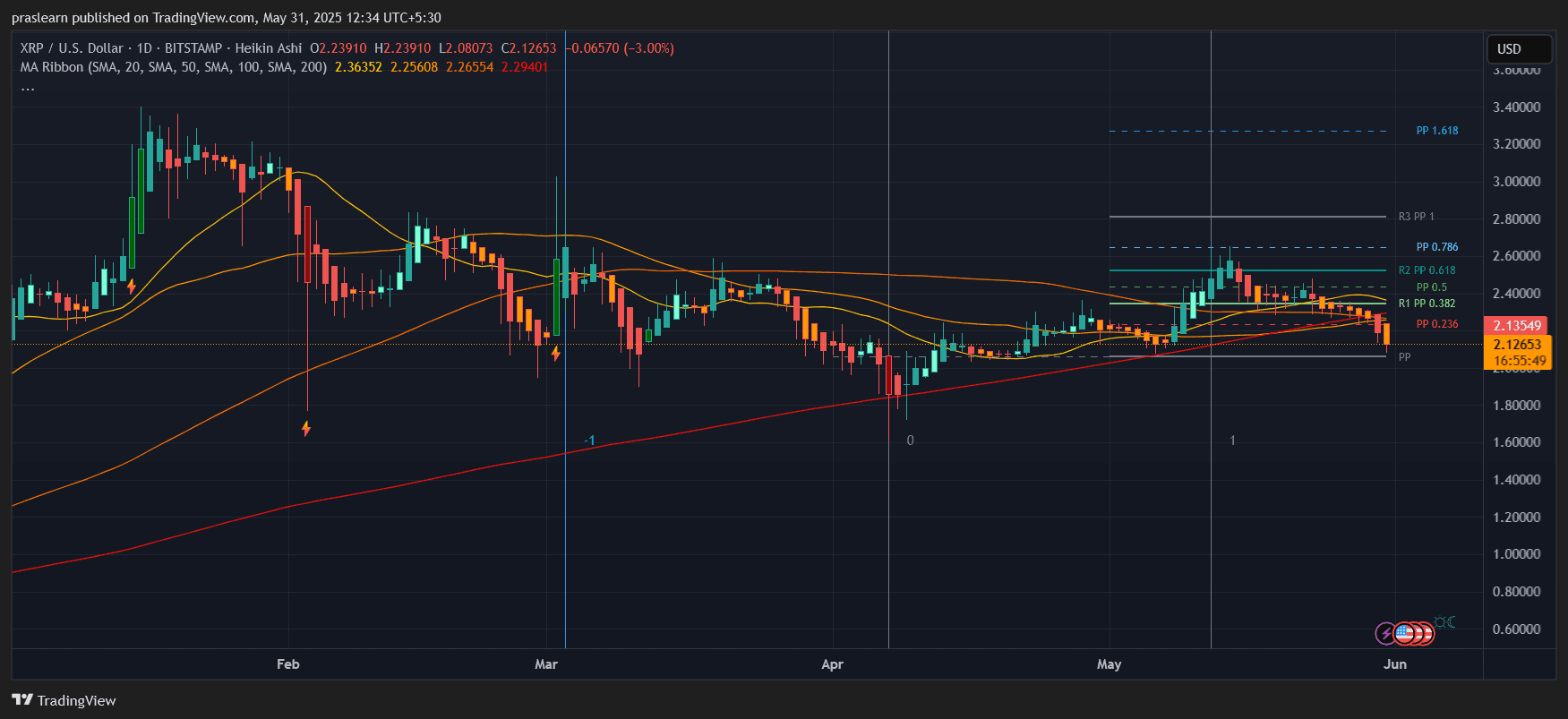

The daily chart adds to this pessimism. XRP model has now fallen below the 200-day SMA (~$2.29), a level that had previously supplied prolonged-time duration toughen. Breaking below this line customarily shifts the vogue from recovery to recession. The Heikin Ashi candles are printing prolonged purple our bodies with little or no greater wicks, suggesting sturdy bearish momentum.

May presumably Macroeconomics Smash XRP Mark Extra?

The broader financial outlook isn’t any longer helping. A chain of setbacks is rattling investor self belief correct thru the financial markets:

- US GDP contraction: The US economy shrank by 0.2% in Q1 2025. That’s an dread bell for all threat-on sources, along side crypto.

- Jobless claims spike: Impulsively high unemployment numbers signal a weakening labor market. Historically, this drives merchants away from speculative sources cherish XRP.

- US-China replace talks stall: Renewed replace tensions, along with a US court blocking key tariffs, hang introduced support memories of the 2018-2019 replace struggle — a duration when crypto struggled to entice serious capital inflows.

Set apart together, this macroeconomic fog is pressuring liquidity in the crypto markets, and XRP is taking the hit.

XRP Mark Prediction: What Enact the Technical Indicators Order?

On the hourly chart, XRP model is caught underneath key brief averages:

- SMA 20: $2.156

- SMA 50: $2.212

- SMA 100: $2.256

- SMA 200: $2.298

These averages are layered tightly above the associated fee, forming a resistance ribbon that XRP model has many instances did not crash. The closest psychological toughen sits around $2.00. If that fails, the next house of curiosity is $1.85 — a level final examined in April.

On the daily chart, XRP model correct broke below the Fibonacci pivot at 0.236, around $2.13. The following notable level lies approach $1.60 — a model that would erase almost 40% from XRP’s most modern local high of $2.60.

Let’s enact the mathematics:

Mark loss from high:

$2.60 (most modern swing high) – $2.13 (recent) = $0.47 loss

Proportion fall: ($0.47 / $2.60) × 100 ≈ 18.07% down

If XRP model continues falling to $1.60:

$2.60 – $1.60 = $1.00 loss

Proportion fall: ($1.00 / $2.60) × 100 ≈ 38.46% fall

And if terror promoting items in?

A breakdown below $1.50 could presumably perhaps trigger a rapid fall to $1.00, namely if Bitcoin also retraces or if XRP model faces unusual SEC-linked rigidity.

XRP Mark Smash: May presumably XRP If truth be told Smash to Zero?

Let’s be particular — a rupture to zero is extremely no longer going unless XRP is legally or essentially invalidated. However in instances of terror, even irrational phases cherish sub-$1 can get examined.

XRP’s market structure is fragile, and if broader market liquidity dries up, altcoins cherish XRP customarily face the steepest declines. The threat is compounded by XRP’s previous volatility and its reliance on speculative flows.

What Wants to Occur for a Reversal?

For XRP model to handbook particular of a deeper descend, it must reclaim no much less than the $2.25–$2.30 zone and retain above it. That can presumably perhaps space the associated fee support above key shifting averages and could presumably perhaps signal vogue stabilization. Moreover, macroeconomic files must flip — perhaps a shock replace deal between the US and China or stronger-than-expected US job files could presumably perhaps inject optimism support into markets.

Till then, demand volatility, appealing moves, and bearish sentiment to dominate.

XRP Mark Prediction: Prepare for June Volatility

XRP model is on shaky floor, every technically and essentially. With macroeconomic pressures mounting — from GDP slumps to interchange struggle echoes — and worth motion turning decisively bearish, June could presumably perhaps carry more wretchedness for XRP holders.

Whereas a total rupture to zero isn’t forthcoming, a deep correction in the direction of the $1.60–$1.85 vary isn’t any longer correct conceivable — it’s an increasing selection of most likely unless momentum flips quick.

Merchants must peaceful discontinue cautious, behold for quantity spikes, and show screen macro headlines carefully. Because if sentiment breaks entirely, XRP’s fall could presumably perhaps speed sooner than expected.

$XRP