-

BTC, ETH, SOL, and DOGE believe skilled designate declines of 1.95%, 1.85%, 2.10%, and 2.35%, respectively, within the past hour.

-

Bitcoin would possibly perhaps presumably perhaps descend to $54,000 or lower if the bearish pattern continues.

-

53.14% of high Bitcoin merchants preserve brief positions, whereas 46.86% preserve prolonged positions.

After a transient restoration on September 10, 2024, the final crypto market once again seems for a extensive decline. Following the open of the United States User Heed Index (CPI) and the outlet bell of the US market, fundamental cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and others, believe fallen vastly.

Crypto Market Big Contemporary Decline

In accordance with the coinmarketcap, within the past hours BTC, ETH, SOL, and DOGE believe skilled designate declines of 1.95%, 1.85%, 2.10%, and 2.35%, respectively.

This designate decline suggests that merchants and crypto lovers aren’t chuffed with the most fresh CPI document. Despite the reality that CPI has dropped to 2.5%, vastly lower than the earlier month’s 3.0%, it indicates that inflation is cooling down.

The Ability Reason for Bitcoin Heed Decline

Nonetheless, the functionality reason within the lend a hand of the market promote-off is the distinguished Bitcoin dump by transient holders and miners.

A famed crypto analyst made a put up on X (beforehand Twitter) pointing out that Bitcoin transient holders seized the new designate soar on September 10, and offloaded nearly 14,816 BTC rate $850 million. In one more put up, the analyst famend that Bitcoin miners believe furthermore sold off a foremost 30,000 BTC rate $1.71 billion within the past 72 hours.

In accordance with the historical designate momentum, if BTC closes a day-to-day candle below the $56,000 level, there is a excessive possibility that it would possibly perhaps presumably perhaps descend to $54,000 or lower if the bearish pattern continues.

Bearish On-chain Metrics

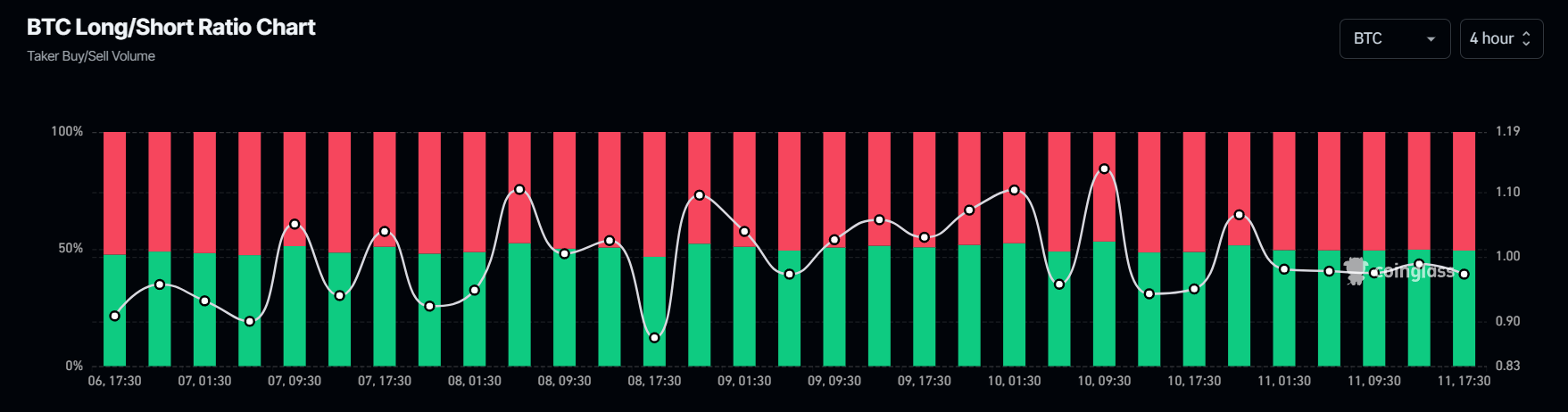

Nonetheless, this bearish outlook is further supported by on-chain metrics. Coinglass’s BTC Lengthy/Brief ratio at demonstrate stands at 0.881 (the rate below 1 indicates bearish market sentiment). Moreover, BTC’s future commence hobby has furthermore dropped by 1.5% and continues to decline.

Within the intervening time, 53.14% of high Bitcoin merchants preserve brief positions, whereas 46.86% preserve prolonged positions, highlighting that bears are at demonstrate dominating the asset and believe the functionality to abolish extra selling stress.