- POL helps zkEVM and app-relate blockchains.

- The present assign is advance $0.23, down from $1.29 in March 2024.

- 2025 forecast ranges between $0.11795 and $0.47181.

Polygon (MATIC) is undergoing a significant transformation with the introduction of its upgraded token, POL, as piece of the wider Polygon 2.0 roadmap.

This cross marks a shift to a nil-records Ethereum Virtual Machine (zkEVM) system and helps a network of application-relate blockchains.

The fortify is geared toward boosting scalability, utility, and decentralisation, doubtlessly influencing long-time frame valuation.

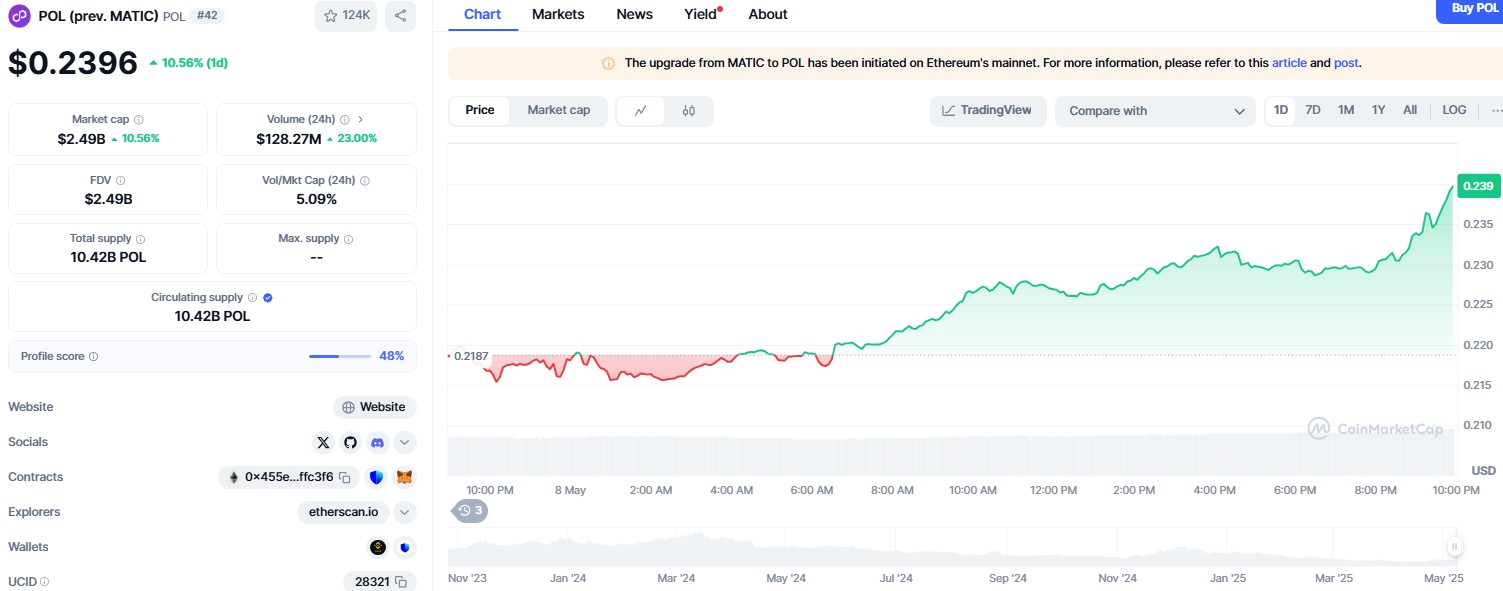

As of early Also can 2025, POL trades advance $0.23, removed from its March 2024 top of $1.29.

Provide: CoinMarketCap

With assign volatility high and unusual utility being constructed in, merchants for the time being are weighing whether or no longer the token can realistically attain $1 all all over again interior the twelve months.

The protocol’s success could presumably additionally have broader implications for Layer 2 scaling solutions proper during the Ethereum network.

POL migration sparks unusual ardour

The migration from MATIC to POL is a key piece of Polygon’s fortify, allowing the network to adapt through zkEVM chains and decentralised governance.

POL will enable staking, neighborhood resolution-making, and validation activities proper through Polygon’s ecosystem.

POL’s present performance exhibits a modest rebound, up 2.88% to $0.23.

The token seen its all-time high of $1.29 in March 2024 and a low of $0.1533 in April 2025.

The present assign fluctuate signifies substantial uncertainty, with upcoming adoption metrics prone to form the worth direction.

2025 assign targets

Polygon’s 2025 forecast incorporates a capacity high of $0.47181, a projected low of $0.11795, and an average estimate of $0.29488.

Analysts counsel the token’s success in reaching the upper spoil will rely on how speedily the unusual ecosystem beneficial properties traction.

The shift to zkEVM architecture, alongside developer participation, can even be a key improve driver.

Forecasts for 2026 show a capacity high of $0.75490 and a low of $0.18872.

In 2027, the token could presumably additionally upward push to $1.20784, and by 2028, it could presumably additionally hit $1.93254.

Polygon’s 2030 estimates top at $4.94731, in accordance with long-time frame adoption and scaling growth.

Funding case remains combined

Polygon’s 2.0 transition strengthens its technical capabilities, nonetheless the present shopping and selling assign suggests there are nonetheless adoption hurdles to clear.

With zkEVM deployment and token migration underway, POL could presumably additionally entice ardour from developers constructing scalable dApps.

POL’s race to $1 in 2025 will largely rely on the traction won in its upgraded ecosystem and one of the best procedure it competes with other Layer 2 solutions.

Discontinuance monitoring of gas price financial savings, validator participation, and mainnet job will likely be significant in assessing future performance.