Recently, there’s been a noticeable stagnation in the growth of active addresses the use of MATIC, unlike the true amplify noticed factual a few weeks earlier. Whales possess often reduced their MATIC holdings in the closing two weeks, contributing to probably market volatility.

This field, coupled with the presence of weak strengthen ranges, might perchance perchance exacerbate the downward tension on MATIC’s impress, perchance leading to an further decline.

Day-to-day Active Addresses Slowing in Growth

From February 13 to March 7, the count of Day-to-day Active Addresses horny with MATIC witnessed a critical leap, escalating from 2,468 to a couple,275. This shift signifies a basic growth rate of 32.70% within a span of factual three weeks.

Nevertheless, the momentum of this growth began to wane after March 7, as evidenced by the declining fashion in the 7-day Inspiring Average depicted in the accompanying chart.

It’s particularly tantalizing to hunt the ancient correlation between the amplify in each day active addresses and the payment actions of MATIC.

Given the present plateau in the growth of each day active addresses, it hints at a drawing end duration the keep MATIC’s impress might perchance perchance experience a allotment of stabilization. This kind of fashion suggests that, after a duration of critical activity, the payment of MATIC can be gearing up for a extra settled allotment, doubtlessly hinting at reduced volatility in the near future.

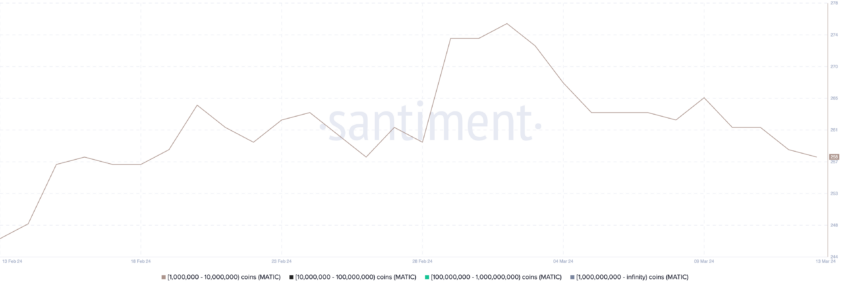

Whales Have Been Offloading Their Holdings

The decision of addresses conserving as a minimum 1,000,000 MATIC is furthermore reducing. On March 2, it reached its all-time excessive, with 276 MATIC whales. Nevertheless, since that day, the decision of whales has reduced to 258 on March 14.

In that identical duration, MATIC’s impress fully grew 10%, manner decrease than various cash. This implies that perchance these whales are leaving MATIC to focal level on various cash they agree with can operate greater.

Evaluating the 300 and sixty five days-to-date (YTD) growth of one of the most ultimate crypto in the market this day – other than stablecoins and memecoins, MATIC used to be outperformed by 18 out of 20. It fully outperformed the YTD features of XRP and ICP.

With the market booming correct now, traders can be transferring their money and picking various cash to wager, pondering they are going to operate bigger returns on their investment when in contrast with MATIC, especially after it rose from $1.18 to $1.27 in fair ultimately.

MATIC Model Prediction: Will MATIC Sustain Its Give a boost to?

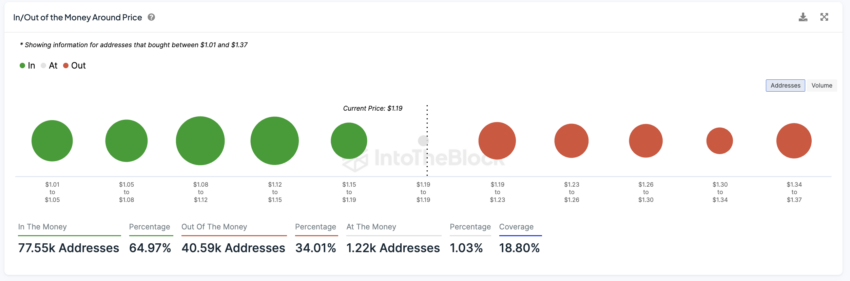

When examining the In/Out of the Money Around Model (IOMAP) chart for MATIC, it’s evident that the cryptocurrency finds broad strengthen at the $1.15 stage. Nevertheless, might perchance perchance peaceful it fail to possess this stage, there’s a risk of a decline to as puny as $1.12 or even $1.08. When MATIC embarks on a sustained downtrend, it is a long way going to even plummet to the $1.01 impress fluctuate.

The In/Out of the Money Around Model (IOMAP) chart is an analytical utility used to visualize clusters of investor positions relative to the current impress of an asset. It identifies the payment ranges at which broad amounts of buy or promote orders are concentrated, effectively mapping out critical strengthen and resistance ranges essentially based mostly on exact investor holdings.

By inspecting the distribution of those positions, the IOMAP can expose the keep traders might perchance perchance experience losses (out of the money) or features (in the money) if the asset’s impress moves to various ranges.

The IOMAP gives a snapshot of market sentiment and probably future impress behavior by highlighting key ranges the keep impress action might perchance perchance stall or reverse because of the collective investor behavior.

Conversely, if MATIC efficiently overcomes the resistance ranges at $1.19 and $1.23, there’s probably for an upward trajectory in direction of $1.34 in the drawing end days. This kind of whisk would stamp its very most realistic valuation since April 2022, showcasing a critical recovery and bullish momentum for the coin.

This diagnosis highlights the critical impress aspects that will per chance resolve MATIC’s rapid-term market actions, reflecting the hazards and opportunities ahead.